We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

- Account and Investment Services

- Access to Human Advisors

- Vanguard Personal Advisor Fees and Pricing

- Account Types and Services

- User Experience & Mobile App

- Onboarding Process

- Vanguard Digital Advisor vs. Personal Advisor

- Who Is Vanguard Personal Advisor Best For?

- The Bottom Line

- Our Favorite Hybrid Robo Advisors

Vanguard is a giant in the investment world, with millions of customers and a variety of financial services. In 2015, Vanguard added Personal Advisor (PAS) to its offerings.

Vanguard Personal Advisor combines the power of robo-advising with access to a team of human financial advisors. This is called a hybrid robo advisor.

| Annual Fee | 0.30% |

| AUM (Assets Under Management) | $186.5 billion* |

| Minimum Investment | $50,000 |

| Free Version | No |

| Headquarters | P.O. Box 1110 Valley Forge, PA 19482 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | Yes |

| Cash Management Account | No |

| Customer Service | Live support via email and phone |

| Access to Human Advisor | Yes |

| Phone | 800-462-5999 |

Paid non-client promotion. Rating as of 04/06/2023 based on a review of services offered in 2022.

Account and Investment Services

Vanguard Personal Advisor offers a unique combination of robo-advising and financial planning services.

Vanguard launched this service as robo advisors started rising in popularity. Robo advisors typically involve minimal human intervention, and computer algorithms are designed to manage your investments without the hassle or costs of in-person meetings.

The downside is that sometimes you need some advice from a real person. Vanguard PAS stands out because every investor can access human financial advisors whenever they need help.

Access to Human Advisors

Accounts with a balance between $50,000 and $500,000 have access to a team of financial advisors. Accounts over $500,000 get upgraded to Personal Advisor Select, which comes with a dedicated financial advisor and personal trust services. You can access their Wealth Management services if you have over $5 million in your account.

You won’t be able to meet face-to-face with your financial advisor, but you can schedule unlimited free appointments over the phone or via video. Sometimes your meeting will be scheduled a week or two in advance, and a financial advisor will respond to an email within a 48-hour time frame on business days.

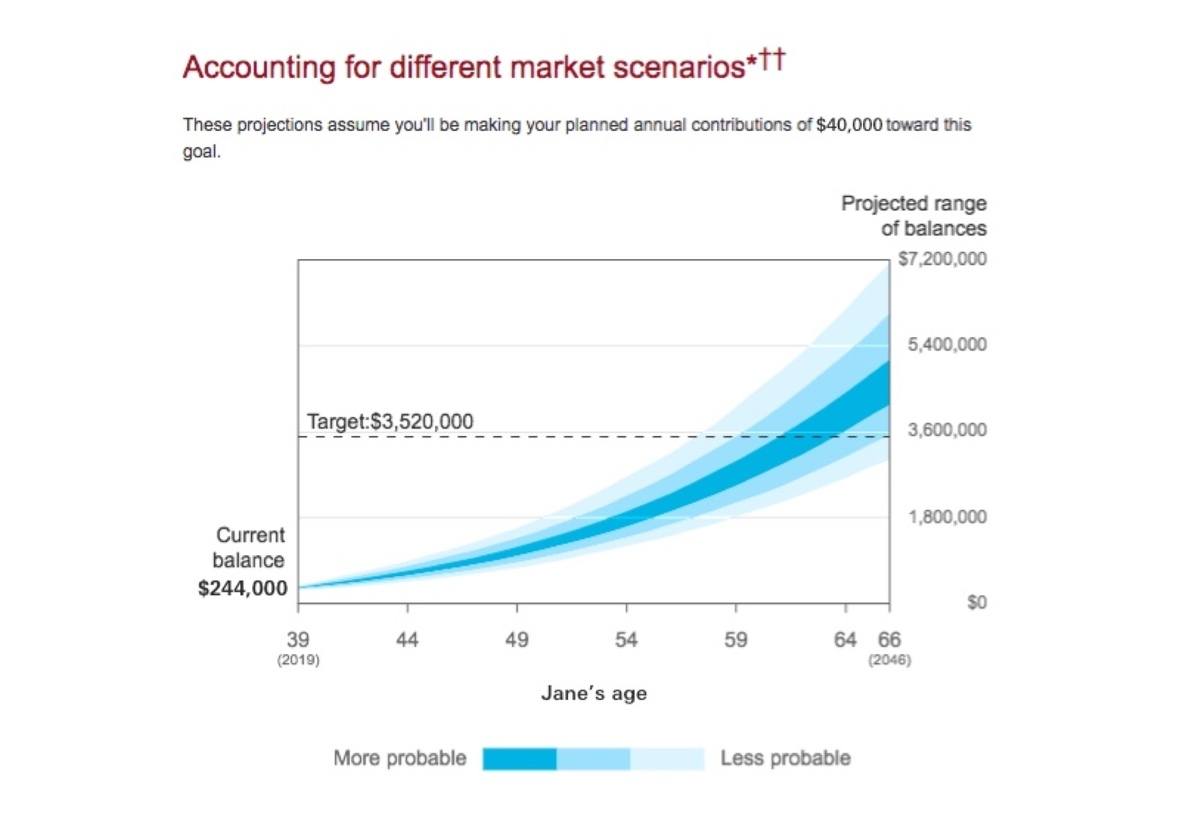

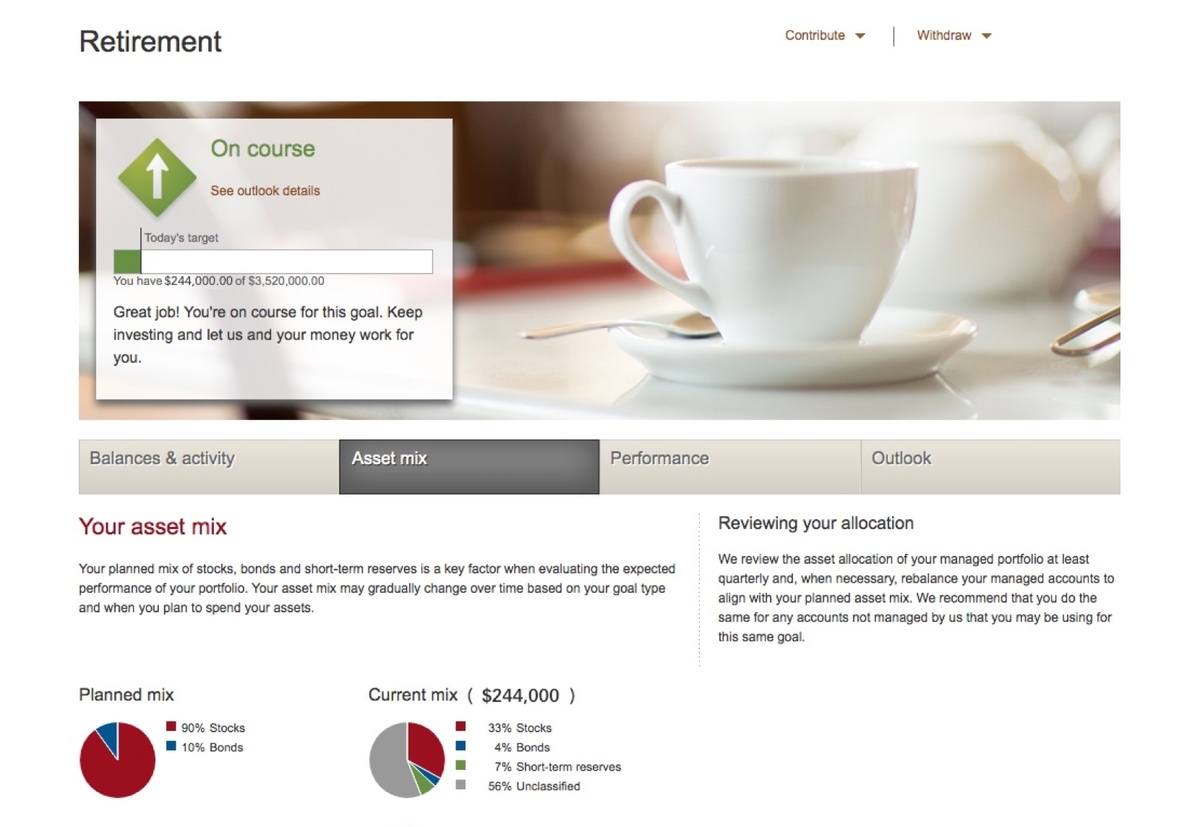

Your account is reviewed quarterly and rebalanced as needed (if any asset class deviates from the target allocation by 5% or more) to keep you on track to meet your goals.

Every Vanguard advisor will offer personalized advice, and they are obligated to keep your best interests in mind. Vanguard stands out here because you will get trusted advice from a real person and the robo-advisor algorithms.

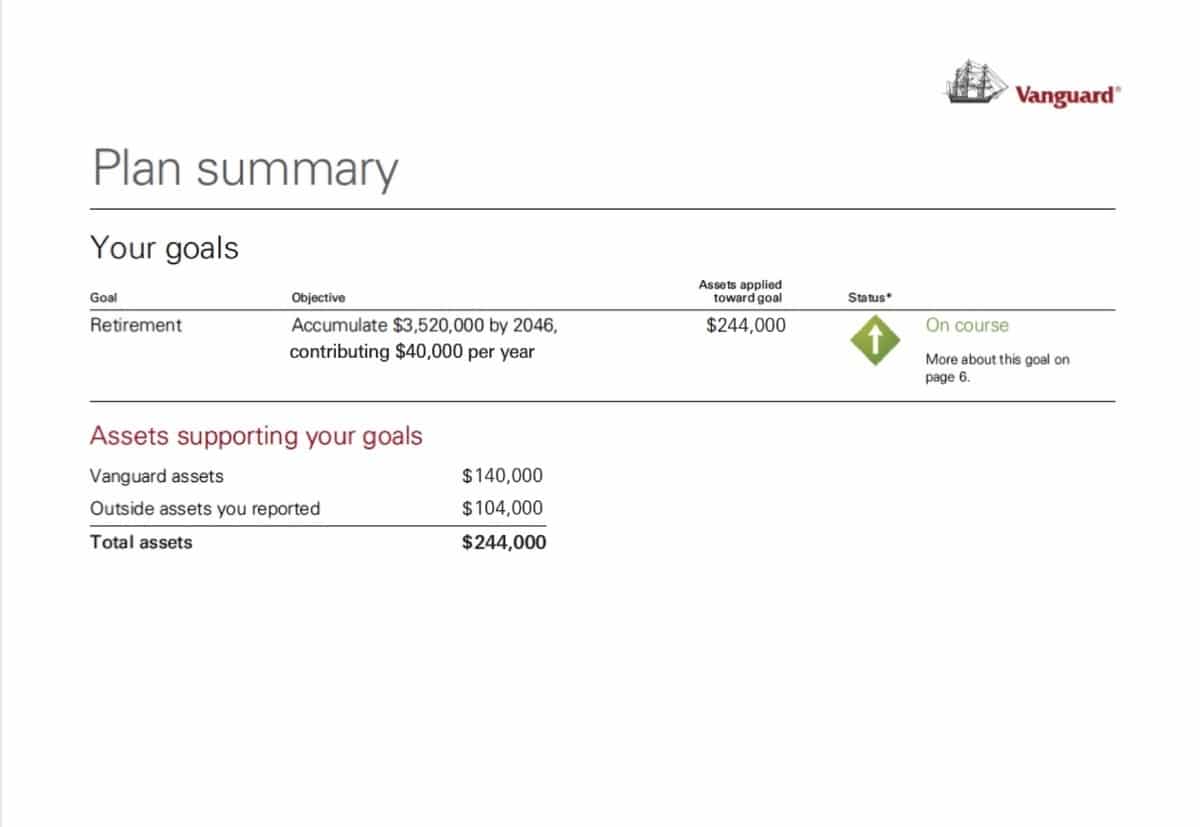

Your advisors will also take into consideration your investments outside of Vanguard. That’s important because your other 401(k)s, savings, and investments will impact your financial plan.

Vanguard Personal Advisor Fees and Pricing

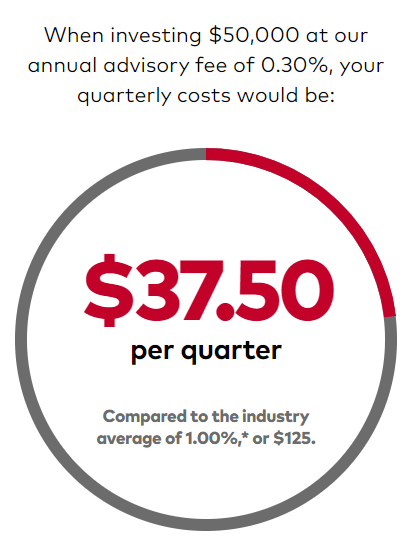

The account minimum for Vanguard Personal Advisor is $50,000, and the annual advisory fee is 0.30%, charged quarterly. A $50,000 account would cost about $150 per year in fees. This does not include investment expense ratios.

If you’re a high-net-worth investor, the advisory fee decreases with higher account balances:

- Less than $5 Million: 0.30%

- $5 – 10 Million: 0.20%

- $10 – 25 Million: 0.10%

- Over $25 Million: 0.05%

The $50,000 minimum balance can be distributed across all account types, such as a combination of IRAs, Mutual Funds, and Trust accounts.

How Does Vanguard Personal Advisor Compare to Its Competitors?

Vanguard Personal Advisor is a hybrid robo advisor; an automated investing service combined with human financial advice.

Their closest competitor is Empower (formerly Personal Capital), which carries a fee between 0.49% and 0.89% depending on the account balance, which is a minimum of $100,000. Similarly, Betterment Premium has a $100,000 minimum and charges a 0.40% annual fee.

Schwab also offers a comparable service – Intelligent Portfolios Premium, which costs $30 per month, a fee of $300 for the initial financial planning, and a minimum balance of $25,000.

We put a handy comparison chart below to compare similar services’ pricing and minimums. Compared to other hybrid robo advisors, Vanguard Personal Advisor offers excellent services at a relatively low cost.

Hybrid Robo Advisor Comparison Chart

Account Types and Services

Vanguard Personal Advisor offers advice on various IRAs and trust accounts. Vanguard won’t manage a 529 plan but will consider it when providing financial planning advice.

Here are the account types Vanguard offers:

- Taxable

- Joint

- Roth IRA

- Traditional IRA

- Rollover IRA

- SEP IRA

- Simple IRA

- Trust

- 401k

Tax Loss Harvesting is a strategy used to minimize the taxes paid on investment gains or other income. This is available with Vanguard Personal Advisor but on a minimal basis. You will need to discuss it further with your Vanguard financial advisor.

Unlike some of their peers, like Wealthfront and M1 Finance, Vanguard is strictly an investment service and does not provide banking services like checking or savings accounts.

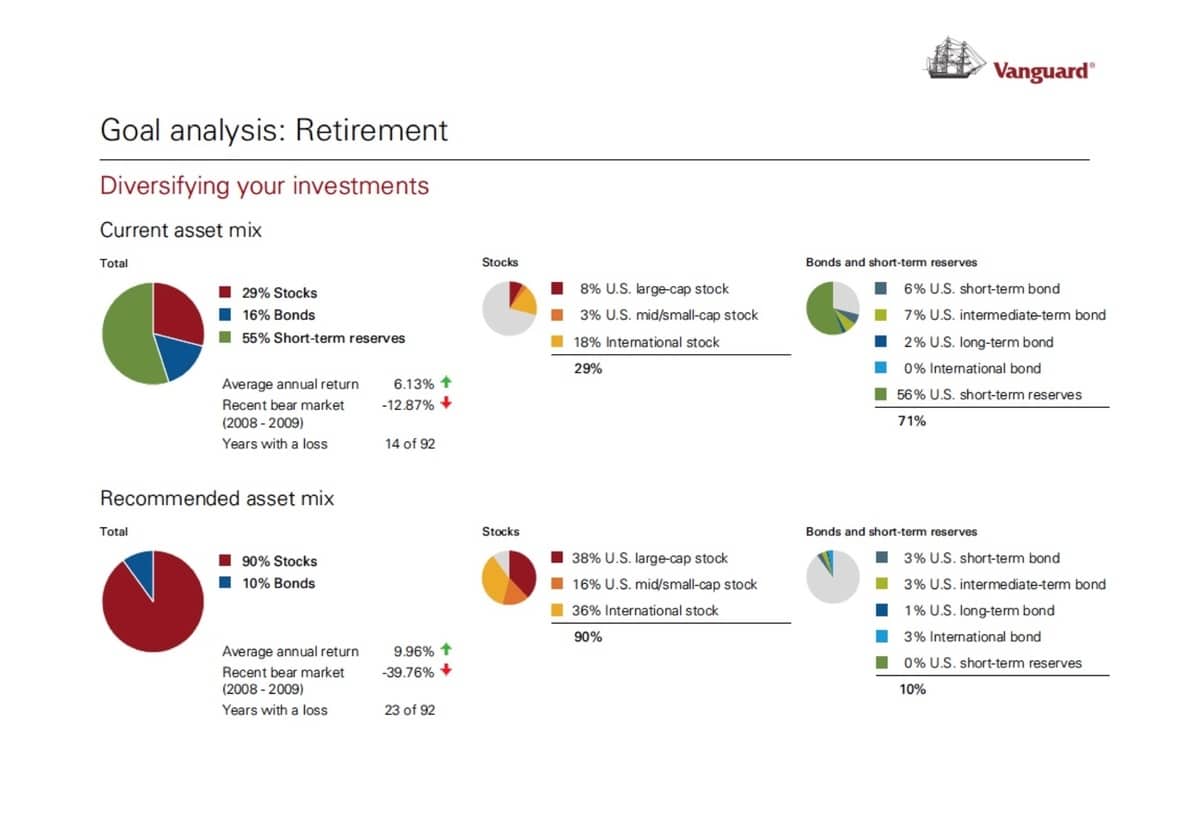

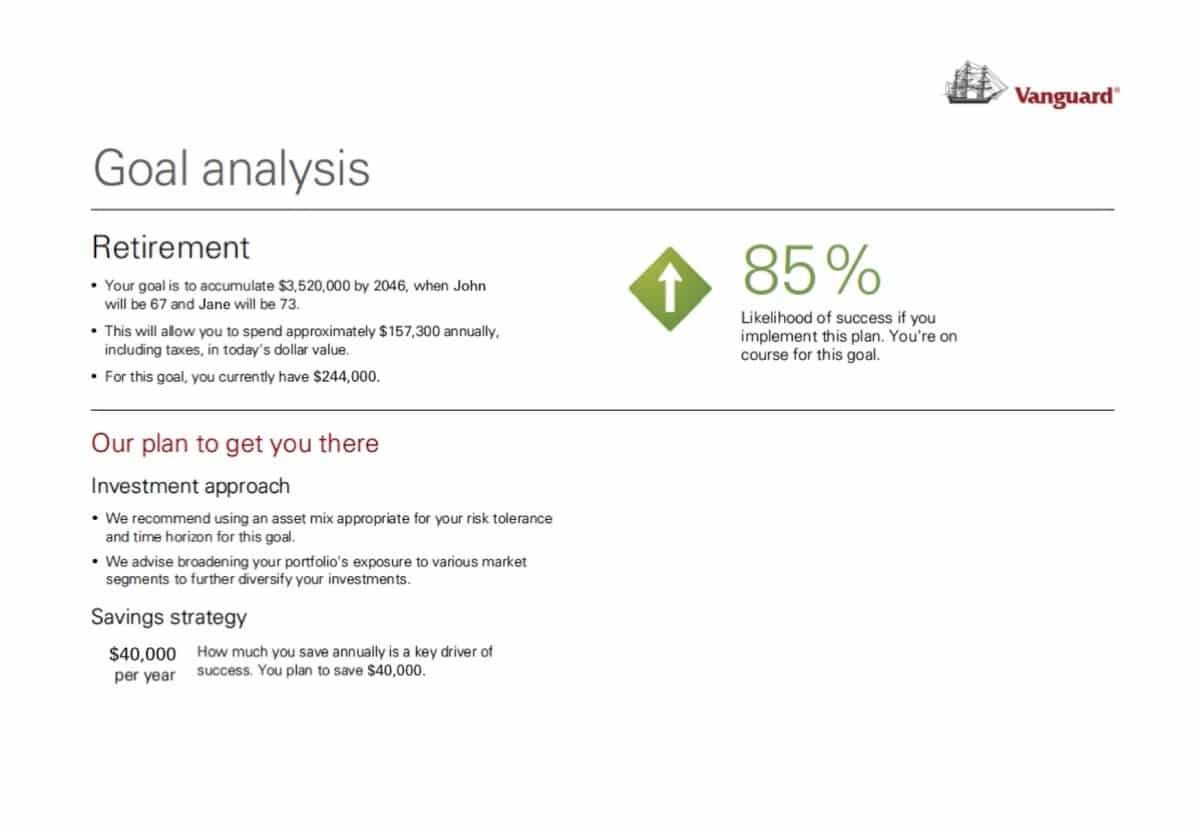

Sample Financial Plan

User Experience & Mobile App

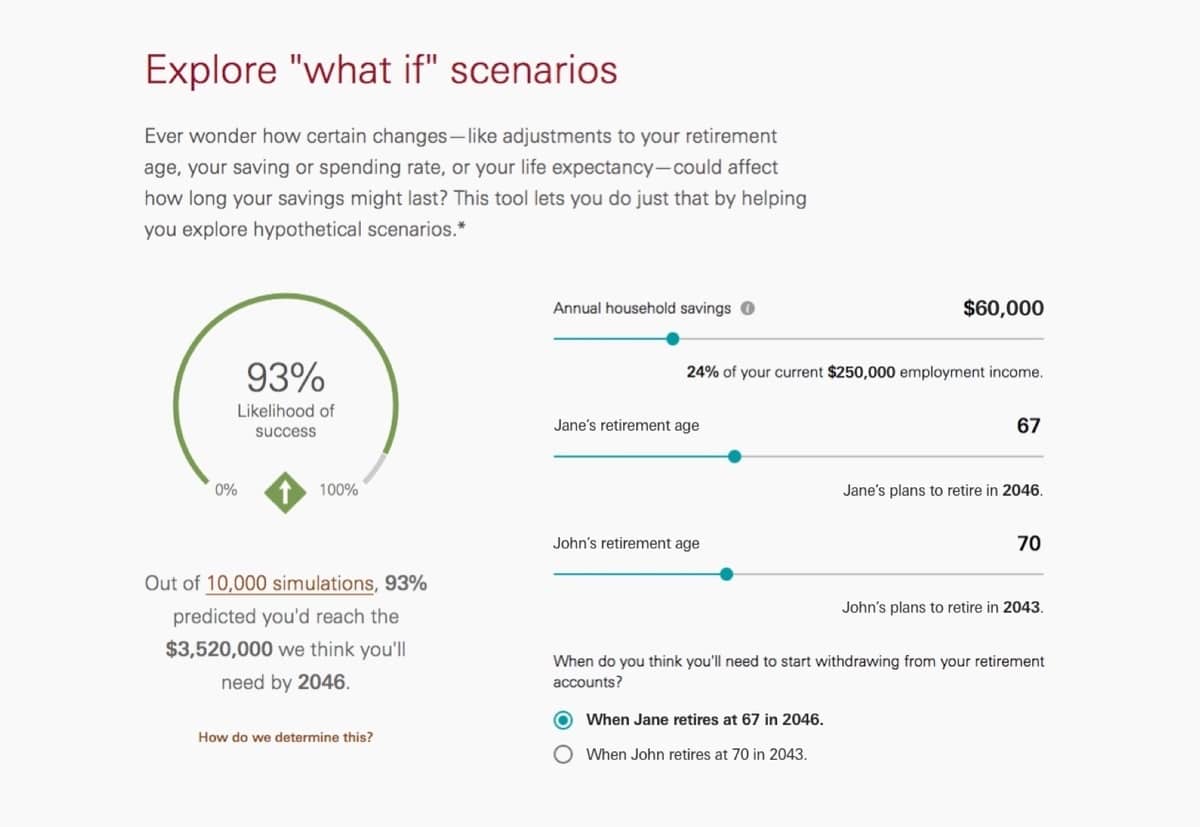

Vanguard’s website offers all the tools for investment success and a simple dashboard that provides your account overview. You will need to look around to take advantage of the available tools, savings calculators, and simulators.

The Vanguard mobile app has received some criticism for being outdated. They’ve updated it since then to have a more modern appearance and user experience, but it seems to lack some features that the old version had. Considering it’s Vanguard, we trust that they’ll consider this feedback.

Sample Account Dashboard

Onboarding Process

There is an onboarding process before investing with Vanguard Personal Advisor, just like any other service. Vanguard’s financial advisors want to understand your goals before creating your financial plan. This isn’t an overnight process; it will likely take a couple of weeks.

First, you will share your financial goals, expectations, timeline, risk tolerance, and financial situation with Vanguard. Then you will schedule a meeting with an advisor who will answer your questions and get to know you better.

Within a few weeks, you will have a personalized financial plan based on your goals and risk tolerance and can decide if you want to move forward.

Vanguard Digital Advisor vs. Personal Advisor

Vanguard Digital Advisor and Personal Advisor are both fully-automated robo-advisors that build a portfolio of low-cost Vanguard ETFs for customers and automatically manage the portfolios for them.

The key difference between the two is that Digital Advisor is fully digital with no human intervention, meaning that your portfolio is managed entirely by Vanguard’s algorithm. Vanguard Personal Advisor, on the other hand, is a hybrid service, coming with unlimited access to human financial advisors for personalized financial advice and guidance.

| Annual Fee | Minimum Investment | Access to Humans | |

|---|---|---|---|

| Digital Advisor | 0.20% | $3,000 | None |

| Personal Advisor | 0.30% | $50,000 | Advisory Team |

| Personal Advisor Select | 0.30% | $500,000 | Dedicated Advisor |

Basically, this means that you’re paying an additional 0.10% annually to get unlimited financial planning and investment management advice from Vanguard’s Certified Financial Planners. And if you have over $500,000 with Vanguard, the fee stays the same, but you’ll get a dedicated financial advisor with Personal Advisor Select.

Who Is Vanguard Personal Advisor Best For?

Vanguard Personal Advisor is an excellent choice for those with $50,000 to meet the account minimum. If you don’t have that much to invest but still want access to their investment algorithms, their Digital Advisor product has a minimum of only $3,000 (in Vanguard brokerage accounts) and reduced advisory fees of only 0.20%.

Vanguard Personal Advisor is also a good choice for investors with long-term goals. Vanguard is investor-owned, which means the fund shareholders own the funds, which in turn own Vanguard. Before investing, you will discuss your financial planning goals with an advisor.

That said, day traders or those looking for a quick turnaround might want to look elsewhere. Instead, Personal Advisor focuses on your retirement goals, college savings, and long-term growth.

The Bottom Line

Vanguard Personal Advisor is one of the best options for people looking for easily-managed investments and personalized help. It is an excellent choice if you can meet the $50,000 minimum, want a human touch to your portfolio, don’t mind owning Vanguard funds, and want to be more involved than traditional robo-advising.

If you also want banking features included in your investment service, however, you might be better off investing in one of the other good hybrid robo advisors listed below.

Or Call: 800-462-5999

Our Favorite Hybrid Robo Advisors

- $50,000 account minimum

- 0.30% Annual Fee

- Personalized financial plan

- Access to Human Advisors

- Best Hybrid Robo Advisor

- $100,000 Account Minimum

- 0.40% Annual Fee

- Human Financial Advice

- Excellent Banking Features

- Socially Responsible & Crypto Investing

Disclosure: BestRoboAdvisors.org has entered into a referral and advertising arrangement with Vanguard and may receive compensation when you open an account or for certain qualifying activities. You will not be charged a fee for this referral, and Vanguard and BestRoboAdvisors.org are not related entities. All investing is subject to risk, including the possible loss of your investment money. Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company. The services provided to clients who elect to receive ongoing advice will vary based on the amount of assets in a portfolio. Please review the Vanguard Personal Advisor Services Brochure (PDF) for important details about the service, including its asset-based service levels and fee breakpoints.