We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

In today’s technology-driven world, many investors seek an accessible and efficient way to manage their investments. Wells Fargo’s Intuitive Investor robo advisor aims to provide just that, offering users a convenient way to plan and manage their investment portfolios.

In this review, we will take a detailed look at the offerings of Wells Fargo Intuitive Investor, discussing its pros, cons, fees, and more to help you determine if it is the right fit for your financial goals.

| Annual Fee | 0.35% |

| Minimum Investment | $500 |

| AUM (Assets Under Management) | $603 billion |

| Free Version | No |

| Headquarters | 420 Montgomery Street San Francisco, CA 94104 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | Yes |

| Crypto Investing | No |

| Cash Management Account | No |

| Access to Human Advisors | Yes |

| Tax Loss Harvesting | Yes |

| Customer Support | Contact Page |

| Phone Support | 855-283-5565 |

Highlights

- Hybrid robo advisor provides access to automated investment services and human financial advisors in one.

- 0.35% annual management fee is reasonable, down to 0.25% for existing Wells Fargo customers.

- $500 minimum investment amount is very reasonable.

- Wells Fargo Bank is a leading financial services company with a high reputation.

- Wells Fargo Intuitive Investor program is a hands-off and easy-to-use robo advisor, but not for hands-on or advanced investors.

Overview

One key benefit of the Wells Fargo Intuitive Investor platform is its ease of use. The platform’s intuitive interface makes it easy for users to navigate and understand their investment options. In addition, users can access their Intuitive Investor account and track their progress from anywhere, at any time, via the platform’s mobile app.

The platform charges a flat annual advisory fee of 0.35% of assets under management, which is on par with the fees charged by other hybrid robo-advisors. Existing Wells Fargo Customers get an additional benefit – their Intuitive Investor account management fees are lowered to 0.30% or 0.25%, depending on their existing account.

In addition to its automated investing features, the Wells Fargo robo advisor also offers access to professional financial advisors who can provide personalized investment advice. Users can schedule a call with a financial advisor at any time to discuss their investment goals and receive guidance on achieving them best.

For users who prefer a more hands-on approach, the platform also offers a range of educational resources, including articles, videos, and webinars, to help users learn more about investing and make informed decisions about their portfolios. The Wells Fargo Investment Institute provides investment research and insights to help customers further on their investing journey.

Overall, the Wells Fargo Intuitive Investor platform is an excellent option for anyone looking to start investing or simplify their investment management. With its low fees, automated portfolio creation and management, and access to professional human advisors, the platform provides a comprehensive solution for investors of all experience levels.

- Low Investment Minimum ($500)

- Access to Human Financial Advisors

- Reduced Fee for WF Customers

- Easy Hands-Off Investing

- Includes Tax Loss Harvesting

- More Expensive than Competitors (0.35%)

- No Account Promotions

- No Dedicated Mobile App

- Limited Portfolio Customization

Is Wells Fargo Intuitive Investor Right for You?

Wells Fargo Intuitive Investor is a hybrid robo advisor that combines automated investing with access to professional Wells Fargo advisors. This means you’ll have the best of both worlds: the convenience of automatic investing and the option to consult a human financial advisor if needed.

Wells Fargo Intuitive Investor’s user interface is intuitive and straightforward, making it easy for even novice investors to get started. Additionally, the platform offers a range of investment portfolio options accounting for various risk tolerances and investment preferences, such as socially responsible investing (SRI) portfolios built with a collection of Exchange-Traded Funds (ETFs).

However, Wells Fargo Intuitive Investor may not be the best option for everyone. If you’re an experienced and active trader who prefers a more hands-on approach to investing, you may find the platform’s automated features limiting. Additionally, if you’re looking for a more personalized financial planning experience, you may consider alternative brokerages and financial planning services offering more customized solutions.

Overall, Wells Fargo Intuitive Investor is an excellent option for hands-off investors who value convenience, ease of use, and access to professional financial advisors. If you’re looking for a hands-off approach to investing that still offers the option to consult with a human financial advisor if needed, then the platform could be a suitable choice for managing your investments.

Wells Fargo Intuitive Investor Fees & Pricing

Wells Fargo Intuitive Investor requires a minimum investment of $500 and charges an annual management fee of 0.35% of assets under management (charged quarterly). Existing Wells Fargo customers get a reduced annual management fee of 0.30% if they have a Wells Fargo Checking account or 0.25% if they have a Wells Fargo Premier Checking or Private Bank Interest Checking account.

To put the 0.35% annual management fee into perspective, if you invest $10,000 with Wells Fargo Intuitive Investor, you’ll pay $35 in advisory fees for the first year. If your investment grows to $20,000 the following year, you’ll pay $70 in fees.

The 0.35% is higher than average for an automated robo advisor but in line with the best hybrid robo advisors such as Vanguard Personal Advisor (0.30%) and Betterment Premium (0.40%).

In addition, Wells Fargo Intuitive Investor provides access to professional Wells Fargo advisors who can offer personalized advice and guidance. This can be particularly helpful if you’re new to investing or have questions about optimizing your portfolio for your specific goals.

It’s also worth noting that the 0.35% management fee does not include the expense ratios of the ETFs within your portfolio, which can range from 0.07% to 0.15%, depending on your selected portfolio. This is also the norm with other robo advisors.

Other fees you will want to know about include the following:

- IRA Termination fee ($95)

- Outgoing account transfer fee ($95)

- Outgoing domestic wire transfer fee ($30)

- Outgoing international wire transfer fee ($40)

There are no fees for outgoing domestic or international wires initiated online or on the mobile app.

Investment Strategies

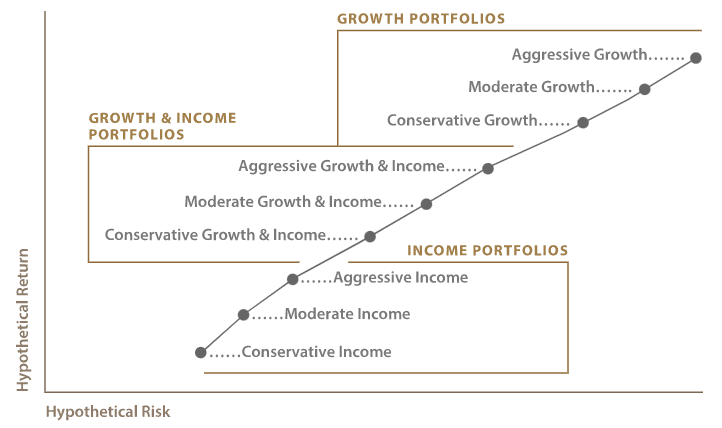

Wells Fargo Intuitive Investor offers nine diversified portfolio options comprising a mix of ETFs. These portfolios span various investment goals (Income, Growth, and Growth + Income) and risk tolerance (Conservative, Moderate, and Aggressive).

You can further customize your investment portfolio by choosing a Globally Diversified or Sustainability-Focused (ESG) investment style.

Once your risk profile and investment strategy have been determined, the robo advisor suggests an appropriate investment portfolio that suits your goals. They will offer one of nine model portfolios that can be broken down like this:

Although the platform does not offer a level of customization that some active investors might prefer, it does provide a streamlined and efficient way for hands-off investors to maintain well-diversified portfolios.

Features & Account Services

The Wells Fargo robo advisor offers a typical collection of available investment accounts that most investors will be happy with:

- Individual and joint taxable accounts

- Trusts and custodial accounts

- Traditional IRA or Roth IRA

- SEP IRA

- Inherited IRA

Intuitive Investor also offers standard features we expect in most robo advisors nowadays, including:

- Tax-Loss Harvesting (TLH)

- Automatic Portfolio Rebalancing

- Automatic Deposits

The main thing that sets Intuitive Investor apart is its access to live human Wells Fargo advisors to help you with financial and investment questions and plans. This makes it a hybrid robo advisor; an increasingly popular way of investing.

Unlike other legacy investment management companies’ robo advisors, such as Vanguard Personal Advisor and Schwab Intelligent Portfolios, Wells Fargo Intuitive Investor can be linked to your other Wells Fargo account services, such as your checking and savings accounts, credit cards, and loan products. They do not, however, offer some of the great high-yield cash management accounts that the newer robo advisors offer.

Conclusion

Wells Fargo Intuitive Investor may be an excellent choice for investors seeking a user-friendly, hands-off robo-advisor with access to human financial advisors for guidance.

Although its fees may be higher than those of some competitors, the platform’s features and support from a well-established financial institution make it a strong option for hands-off investors.

Their account types and available features, such as tax loss harvesting, automatic portfolio rebalancing, access to socially-responsible portfolios, and access to human advisors, make it a solid choice for many investors, although we believe there are better options out there.

If you’re an existing Wells Fargo customer, the reduced management fees will be of extra interest to you, and the low $500 account minimum makes it a great choice for investors looking for human financial advice but who don’t have enough money to invest with one of the other hybrid robo advisors’ higher minimum investment amounts.

Wells Fargo Intuitive Investor vs…

Let’s compare Wells Fargo Intuitive Investor to other hybrid robo advisors on the market to see where we stand. Should you choose the Wells Fargo robo advisor, or one of the other options?

Wells Fargo Intuitive Investor FAQs

What is the minimum investment for Wells Fargo Intuitive Investor?

The minimum investment to open a Wells Fargo Intuitive Investor account is $500.

What fees are associated with using Wells Fargo Intuitive Investor?

Wells Fargo Intuitive Investor charges 0.35% of assets under management. This fee does not include the expense ratios associated with the ETFs in your portfolio. Existing Wells Fargo customers get a reduced fee of 0.25% or 0.30%, depending on your account type.

Can I use Wells Fargo Intuitive Investor for active trading?

No, the platform is not designed for active or advanced traders. Wells Fargo Intuitive Investor is geared towards hands-off investors and automated portfolio management.

Do I have access to professional advice with Wells Fargo Intuitive Investor?

Yes, users have access to live financial advisors and the Wells Fargo Advisors team for financial guidance and advice.