We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

- Wealthfront Pricing & Fees

- Wealthfront Historical Performance & Returns

- Flexibility

- Ease of Use

- Account Features

- Wealthfront Cash: A High-Yield Cash Account

- Borrow: Portfolio Line of Credit

- Stock Investment Account

- Automated Bond Portfolio

- Other Features

- Suitability for Different Investment Budgets

- Wealthfront Reviews Around the Internet

- Overall Summary

- Wealthfront FAQs

Wealthfront is one of the world’s biggest and most well-established robo advisors. In 2013, they managed just over $97 million worth of investments. For 2024, this robo advisor is now managing over $50+ Billion for more than 500,000 customers.

This Wealthfront review will see if this fully-automated robo advisor is the best option for you.

Wealthfront started life as kaChing, a mutual-fund analysis company, in 2008. After receiving funding from Benchmark Capital and DAG Ventures in 2013, founders Andy Rachleff and Dan Carrol slowly pivoted to wealth management.

| Annual Fee | 0.25% |

| AUM (Assets Under Management) | $50+ Billion |

| Minimum Investment | $500 |

| Promotion | $5,000 managed free (with our link) |

| Headquarters | 900 Middlefield Rd. Ste. 200 Redwood City, CA 94063 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | Yes |

| Crypto Investing | Yes (limited) |

| Cash Management Account | Yes, 5.0% APY |

| Individual Stock Trading | Yes |

| Tax Loss Harvesting | Yes, incl. Direct Indexing |

| Referral Program | Refer a friend, and you both get $5,000 managed for free & a 0.50% APY increase in your Cash account for 3 months |

| Customer Support | Support form |

| Phone Number | (844) 995-8437 |

Wealthfront Pricing & Fees

Wealthfront’s annual fee is 0.25% of assets under management, no matter the account balance.

This fee is very competitive and stacks up well against most of Wealthfront’s competitors. Betterment, Wealthfront’s biggest competitor, charges the same annual fee for their basic account, but only if your account is over $20,000 or you have automated deposits turned on.

They also give readers of this website a special offer. Sign up using our link and get your first $5,000 managed for free. On top of that, if you refer any friends to sign up, you get an extra $5,000 managed for free for each friend. You will also get a 0.50% increase on your Cash APY for three months.

Wealthfront’s $500 minimum deposit is very low; it’s among the lowest among robo advisors with a minimum investment amount. This makes it perfect for beginners and first-time investors. This isn’t just a ruse to get you to sign up, though – even the basic service gets features like Tax Loss Harvesting and fully-managed services.

Wealthfront Historical Performance & Returns

Wealthfront provides some insight into the historical returns that investors have seen in the past. Even though past performance can’t guarantee future success, it gives an idea of what your returns might look like.

Here is a quick overview of some of the historical average annual returns, last updated in April 2023.

| Risk Level | Account Type | 1 Year Return | 3 Year Return | 5 Year Return | Since Inception (2012-2014) |

|---|---|---|---|---|---|

| 1.0 | Taxable | -2.76% | 22.93% | 20.95% | 42.67% |

| 1.0 | Non-Taxable | -5.05% | 12.89% | 17.19% | 38.93% |

| 4.0 | Taxable | -3.82% | 39.36% | 29.25% | 71.76% |

| 4.0 | Non-Taxable | -7.11% | 26.51% | 22.55% | 63.21% |

| 6.5 | Taxable | -5.14% | 46.25% | 30.07% | 72.64% |

| 6.5 | Non-Taxable | -8.47% | 36.39% | 25.38% | 66.27% |

| 9.5 | Taxable | -6.35% | 56.18% | 30.71% | 73.10% |

| 9.5 | Non-Taxable | -9.91% | 44.87% | 24.65% | 65.81% |

2022 was not a friendly year for the market, which can be seen very clearly by the large negative returns for all portfolios over the one-year returns column. Taxable accounts typically did better than non-taxable accounts.

Longer-term, the low-risk portfolios have seen average annual returns between 3-5%, while the higher-risk portfolios have seen better long-term gains hovering around 6%.

All of the returns and risk levels can be found here.

Flexibility

Wealthfront is a prime example of a fully automated investing service that provides an almost entirely hands-off wealth management experience. This makes it very attractive to investors who don’t have the time, inclination, or ability to manage their investments manually.

In April 2021, Wealthfront released a feature that gives investors much more flexibility in deciding how their portfolios are allocated. Hands-off investors can still use Wealthfront’s default portfolios for fully automated investing; those who would like more flexibility can now diversify their portfolios into whichever industries or ETFs they choose, including SRI & ESG portfolios.

In March 2023, they released a new, highly-requested feature – the free Stock Investing Account – allowing investors to purchase individual stocks, including fractional shares, or Stock Collections – expert-researched collections of stocks within a specific industry or type.

Best of all, there are no commissions or fees, and you can start trading for as little as $1.

With this new stock trading capability, Wealthfront propelled itself forward in the robo advisor market, even ahead of its main competitor Betterment.

Ease of Use

Opening an account and getting started with Wealthfront is quick and straightforward, involving answering a few financial questions, giving them your risk tolerances, and then they give you their recommendations. You can tinker around with allocations, or leave it all up to Wealthfront.

From that point on, all of the portfolio management, including rebalancing, reinvestment, and tax loss harvesting, is entirely handled on the investor’s behalf, making Wealthfront one of the simplest and easiest robo advisors for anybody to use.

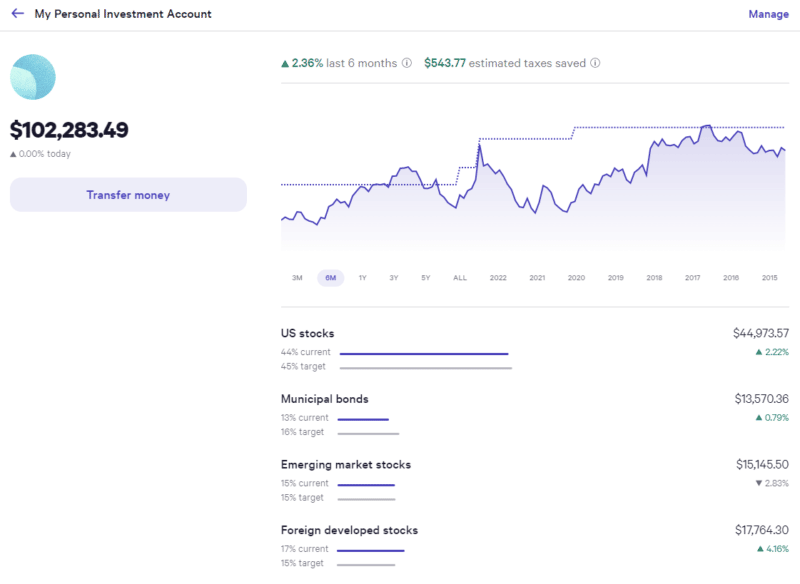

The main dashboard is simple and straightforward, giving you a holistic view of your finances managed by Wealthfront and your other banking and investment accounts, along with your estimated net worth at retirement and any other significant milestones you’ve set.

The investment account-specific pages show a time-based graph with annualized returns, growth or decline, and your asset allocations compared to the target, which can be rebalanced automatically:

Account Features

Like most robo advisors, Wealthfront’s Automated Investing will allocate your money between stocks and bond ETFs. While this is relatively standard, the service’s provision for both account types and features is exceptional.

Wealthfront offers individual and joint taxable accounts, trusts, 529 College Savings Plans, and Traditional, Roth, SEP, and rollover IRAs. Wealthfront’s investable account selection is above average.

Every portfolio managed by Wealthfront gets automated rebalancing and dividend reinvestment to maintain profit potential and tax loss harvesting for taxable accounts to improve investments’ efficiency further. If your account balance is over $100,000, Wealthfront will activate additional advanced strategies:

Risk Parity Fund (WFRPX) is Wealthfront’s attempt to deploy the most sophisticated investment strategies in cost-effective software through an enhanced asset allocation strategy to constantly maintain a higher rate of return.

Tax loss harvesting is a huge plus, but Wealthfront goes one step further by offering Direct Indexing to accounts worth more than $100,000, harvesting losses on individual stocks in an index, not just the index itself. This can make a massive difference to the value of any portfolio.

Smart Beta activates when your account level reaches $500,000, weighing the stocks in your portfolio more intelligently.

As time progresses and machine learning and AI become more advanced, we expect Wealthfront to be on the leading edge of additional features to optimize your portfolio.

Wealthfront Cash: A High-Yield Cash Account

Wealthfront also offers a high-yield cash account offering 5.0% APY – a market-leading interest rate in a market full of disastrously low interest rates. To give this some reference, the current national average interest rate is 0.58%. Ouch.

Your Wealthfront Cash account is also protected by up to $8 Million FDIC insurance, comes with no account or transaction fees, no transaction limits, and no minimum deposit. They also offer a debit card, bill pay, direct deposit, check deposit through the app, and integration with many other services and financial planning features. This is one of the best robo advisor cash management accounts on the market.

Sign up for a high-yield Wealthfront Cash account here and get a 0.50% increase in your Cash APY for three months, making Wealthfront Cash the highest-yielding cash account available on the market. If you refer a friend to Wealthfront Cash, you’ll both get another 0.50% APY increase for three months.

Borrow: Portfolio Line of Credit

Wealthfront also offers a Portfolio Line of Credit if you need to borrow money for an unexpected expense or want to use it as a margin loan.

Portfolio Line of Credit is available for taxable accounts of $25,000 or more, and you can borrow up to 30% of your account’s value without upsetting your investment strategy. There are no credit checks, funds are available nearly instantly, and there’s no repayment schedule.

Rates are between 7.25% – 8.75% APR, depending on your account size. This rate fluctuates with the federal interest rate.

Stock Investment Account

In March 2023, Wealthfront announced their most highly-requested feature – individual stock trading. Not only did they add this feature, but they knocked it out of the park.

Firstly, the stock trading app is free, with no commissions or fees, and the minimum balance to trade is only $1. On top of that, their stock and company research tools are excellent, and you can trade fractional shares.

Finally, they introduced dozens of Stock Collections, or what they call “playlists for stocks.” These allow you to choose an industry, company model, or investing preference, and get a collection of stocks packaged together by experts to help you diversify and discover new companies you may not have ever even heard about.

For example, you could choose the “Dividend Blue Chip Stocks” collection, consisting of nine companies, or the “Transformative Software Tech” collection, with 15 companies included. Wealthfront calls this feature “playlists for stocks.”

Automated Bond Portfolio

In June 2023, Wealthfront announced the Automated Bond Portfolio, a service that’s been designed to offer a higher yield than a traditional savings account, but with less risk compared to a diversified equity portfolio. This service is particularly useful for investors who are looking to grow their extra cash over the next few years.

The Automated Bond Portfolio is not just a collection of bonds, but a personalized portfolio of bond ETFs. It’s tailored around your individual tax situation, providing liquidity and flexibility thanks to a diversified mix of these bond ETFs. A particular focus is given to tax optimization, with high tax rate portfolios leaning more towards treasuries to increase state tax savings.

Wealthfront has designed the service to be more liquid than CDs or I Bonds, allowing you to withdraw money within a couple of days without any penalties or waiting on maturity dates. The use of multiple low-cost bond ETFs minimizes your exposure to excessive risk, and the overall management of the bond ETFs portfolio is made easy, negating the need for buying individual bond certificates or dealing with various maturity dates.

The Automated Bond Portfolio is ideal for those saving for significant purchases in the next 1-3 years. It is fully managed for you. This includes automatic rebalancing, dividend reinvesting, tax-loss harvesting, and optimal allocation adjustments. So, you can invest and potentially earn a yield without worrying about managing the details.

Other Features

The 529 College Savings Plan makes it easier for parents to open and manage a college savings account for a 0.43% to 0.46% fee, which will vary on the investment expense ratio. The first $5,000 will be managed for free.

Suitability for Different Investment Budgets

With a low minimum deposit amount of $500, Wealthfront is an excellent robo advisor for any budget. Unlike many of its competitors, Wealthfront provides a full range of account features – including tax loss harvesting – to all accounts regardless of their size, making it even more attractive to those with lower budgets.

The low 0.25% advisory fee will also please investors of all budgets.

While wealthier investors may complain about the lack of discounted fees for larger accounts, they can benefit from many advanced features if their portfolio is worth more than $100,000, including Risk Party, Direct Indexing, and Smart Beta (available for accounts over $500,000.)

Wealthfront Reviews Around the Internet

We give Wealthfront a very high rating for being one of the best robo advisors out there, but it will give you confidence to know what other users and publications think about the service.

- Wealthfront won TheRoboReport’s “Best Robo for Performance at a Low Cost” award for 2022 and one of the top spots in nearly every other category.

- NerdWallet loves Wealthfront, giving them a 5.0 out of 5 score. They summarize, “Wealthfront is a force among robo-advisors, offering a competitive 0.25% management fee and one of the strongest tax-optimization services available from an online advisor.”

- Hundreds of users rated Wealthfront 4.0/5 on ConsumerAffairs.

- SmartAsset doesn’t give a score, but they rated Wealthfront very highly, saying “Wealthfront is a great, low-cost option for online investing services as well as software-based financial planning and short-term cash management solutions.”

- Investopedia rated Wealthfront 4.8 out of 5, saying “Wealthfront is our top choice overall for robo-advisors as well as best for goal planning.”

- BankRate gives Wealthfront a perfect 5 out of 5, saying, “Wealthfront ranks among the best robo-advisors, offering sophisticated portfolio management, a top cash management account, and some of the most useful planning tools.”

- Forbes gives Wealthfron 4.4/5, saying, “Wealthfront is best for someone who’s looking to make as few financial decisions as possible—as well as users who enjoy lots of features and messing around with graphs and charts.” (this review is outdated.)

- BusinessInsider gives Wealthfront a 4.34/5, mentioning, “Wealthfront is a good robo-advisor option if you’re in search of low-cost automated portfolio management and access to features like tax-loss harvesting, US Direct Indexing, and crypto trusts.”

- Reddit, as usual, has mixed reviews across the r/Wealthfront, r/PersonalFinance, and r/Investing communities. Some (especially in r/Wealthfront) swear by them, while other more active traders don’t like it so much, and suggest that they’re only good for taxable accounts since you can self-allocate a tax-advantaged account (which is true, if you want to manage it yourself.)

Overall Summary

Since its inception in 2008, Wealthfront has grown to become one of the largest robo advisors in the world. You can select from many outstanding wealth management features as long as you meet the low account minimum of $500.

Wealthfront makes its service even more impressive by offering Direct Indexing and other features to accounts worth over $100,000, making a potentially huge difference to the growth potential of any portfolio.

Their free stock trading app, Stock Investment Account, is the perfect addition to help more hands-on investors customize their investment portfolio to their investing preferences and interests.

Wealthfront is one of the best robo advisors for reasonable management fees, diverse investment, and personal finance services, and ease of use.

If we were to choose one quintessential example of a robo advisor, it would be Wealthfront.

Wealthfront FAQs

What are the Pros of Wealthfront?

Wealthfront is an easy-to-use, trusted, hands-off robo advisor with an excellent history, low (0.25%) fees, a free stock trading app, a good referral program, and some extra personal finance features such as savings, checking, loans, and college savings plans that make it an excellent robo advisor for every investor.

What are the Cons of Wealthfront?

Wealthfront doesn’t include access to a human financial advisor, so you might want to look elsewhere if you’re looking for human advice along with your algorithmic investment features.

Can Wealthfront Make You Money?

Yes, Wealthfront has industry-leading historical returns for the investment portfolio, and its high-yield cash account is one of the best high-APY cash accounts on the market.

Is there a penalty for withdrawing from Wealthfront?

No. In fact, if you withdraw money from your taxable investment account, Wealthfront will withdraw it in a tax-advantaged way to ensure you pay as few taxes as possible.

Is Wealthfront Good for Beginners?

Yes. Wealthfront is probably the best robo advisor for beginners due to its low cost, ease of use, and low entry barriers.

What is Wealthfront’s Minimum Investment Amount?

$500

What Bank Does Wealthfront Use?

Wealthfront partners with Green Dot Bank to offer checking features in their Cash accounts.

Can You Pick Your Own Stocks with Wealthfront?

Yes, you can choose individual stocks, fractional shares, and expert-picked stock collections.

Does Wealthfront Offer Cryptocurrency Investing?

Can You Lose Money with Wealthfront?

Yes. Any investment comes with a risk, and Wealthfront is no exception. Your portfolio may go up or down depending on market volatility, but historically, it will go up if you invest for the long term. If Wealthfront fails, your portfolio is insured for up to $500,000 by the Securities Investor Protection Corporation (SIPC).

Can Wealthfront Manage My 401(k)?

Not directly, but you can roll over your 401(k), 403(b), 457, TSP, or another employer-sponsored retirement plan into a Rollover IRA managed by Wealthfront, which will most likely have lower fees, once you’re no longer with your employer (with some exceptions).

Which is Better: Wealthfront or Empower (Personal Capital)?

Wealthfront is a better robo advisor for most investors, but Empower has a better personal finance dashboard and access to human financial advisors.

How Much Can I Invest with Wealthfront for Free?

Wealthfront manages your first $5,000 for free (using our link), and manages an additional $5,000 for free for every new customer you send them.

What Happens If I Withdraw Money From Wealthfront?

When you withdraw money from your Wealthfront individual investment account, they extract the funds in the most tax-efficient way possible. This means, among other strategies, selling securities with the most long-term gains possible first, to avoid short-term capital gains taxes.

How Do I Sign Up For a Wealthfront Account

You can sign up for a new Wealthfront account here.