We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

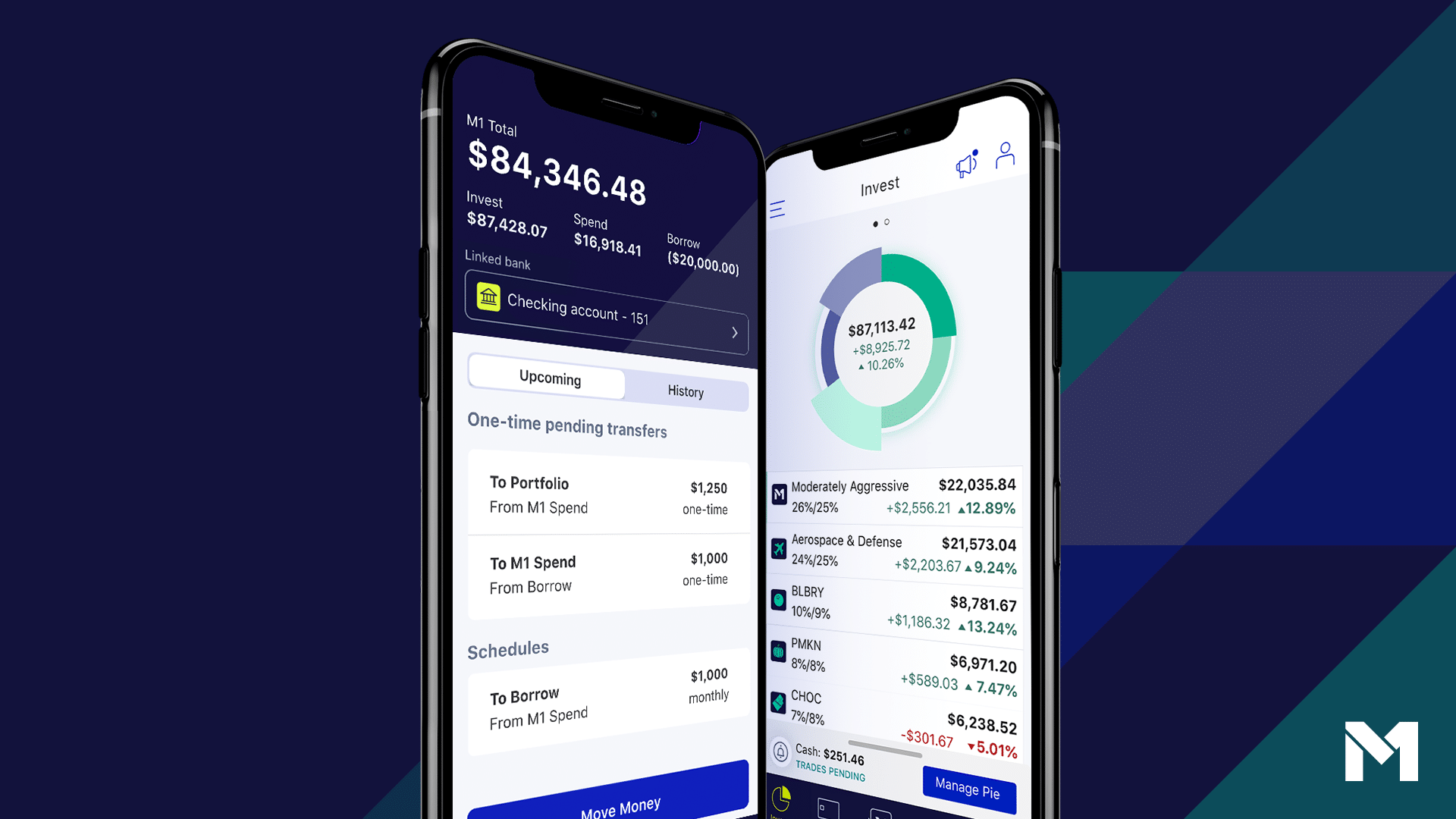

M1 Finance is a robo-advisor that offers customizable portfolio options. M1 also boasts low startup costs and $0 transaction and trading fees. Using their mobile app, you can start investing on your computer or on the go.

M1 Finance was established in 2015 and has quickly become one of the top automated investment platforms.

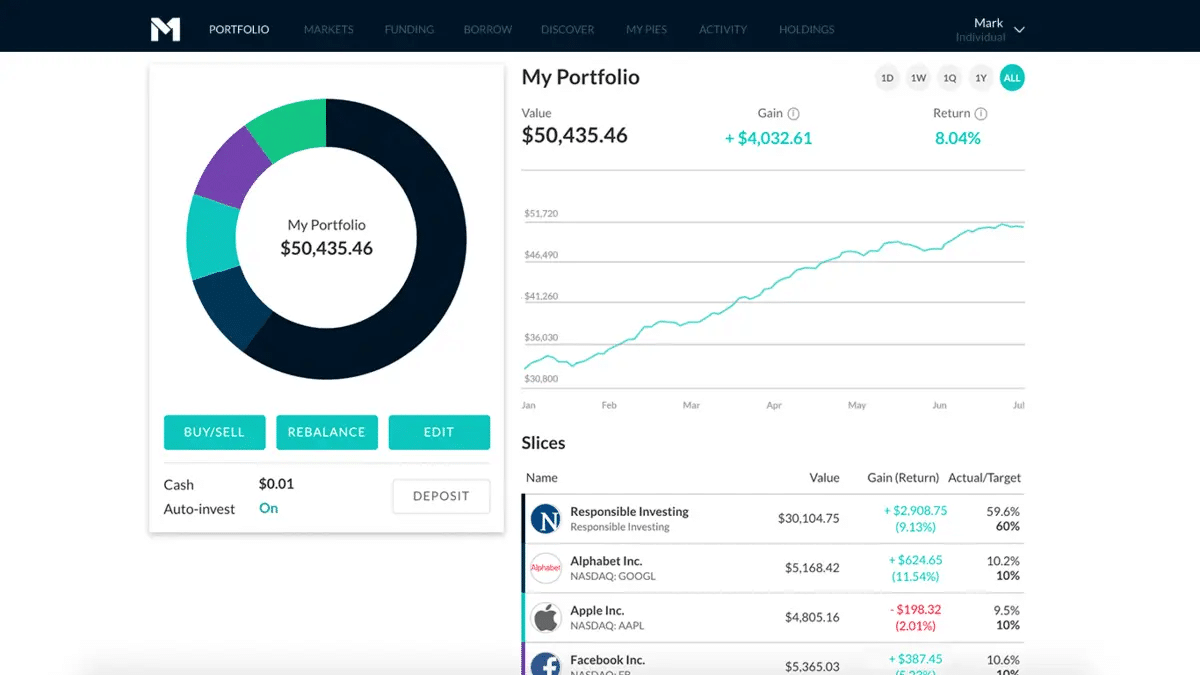

Many consider M1 Finance a perfect blend of a traditional online brokerage platform and an automated robo-advisor. What makes M1 unique is the investment portfolio template. When setting up your investments, your options are presented as investment pies (pie charts) showing the breakdown of your investment portfolio.

We find this to be a great way to visualize a portfolio. We like the flexibility of choosing pre-built expert pies (for beginners) and creating your own pie (for more hands-on investors.)

We have used a lot of different robo advisors and found that M1 Finance’s pie charts make allocating your investment funds simple and easy compared to other dashboards.

| Pricing (Basic) | None |

| Pricing (Premium) | $3/month |

| Minimum Investment | $100 |

| AUM (Assets Under Management) | $6+ Billion |

| Free Version | Yes |

| Headquarters | 213 W Institute Pl #301 Chicago, IL 60610 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | Yes |

| Crypto Investing | Yes |

| Cash Management Account | Yes, 3.30% APY |

| Customer Support | Live support via email and phone |

| [email protected] | |

| Phone | (888) 714-6674 |

Transfer Bonus

M1 Finance offers a transfer bonus of up to $10,000 for transferring your account from another brokerage to M1.

The bonus structure is as follows:

| Account Value | Promotional Credit |

| $50,000 – $99,999 | $250 |

| $100,000 – $249,999 | $250 |

| $250,000 – $499,999 | $1,000 |

| $500,000 – $999,999 | $2,000 |

| $1,000,000 – $1,999,999 | $4,000 |

| $2,000,000 + | $10,000 |

Head over to their transfer page to learn more.

M1 Finance Fees & Minimum Balance

The M1 Finance robo advisor is ideal for beginner investors, with a low $100 minimum investment balance and zero fees.

M1 Finance has focused on making money through loaning cash through M1 Borrow, interest, and M1 Checking to eliminate asset management fees for investors.

You can open an account without making an initial deposit, but you will need $100 to begin trading and at least $500 for a retirement account. These minimums are lower than most other robo-advisors and provide more investors with an opportunity to start.

Betterment offers a $0 minimum balance, but the digital plan comes with an annual fee of 0.25%. Wealthfront requires a minimum investment of $500 with a 0.25% fee.

You may incur only a few fees with M1 Finance: when you sell a stock or ETF, or when your account is inactive. When you sell an ETF or individual stocks, there is a mandatory SEC fee, usually only a few pennies. There is a $20 inactivity fee for accounts over $20 with no activity for 90+ days.

The premium option, M1 Plus, costs a flat fee of $3/month.

M1 Finance Performance & Returns

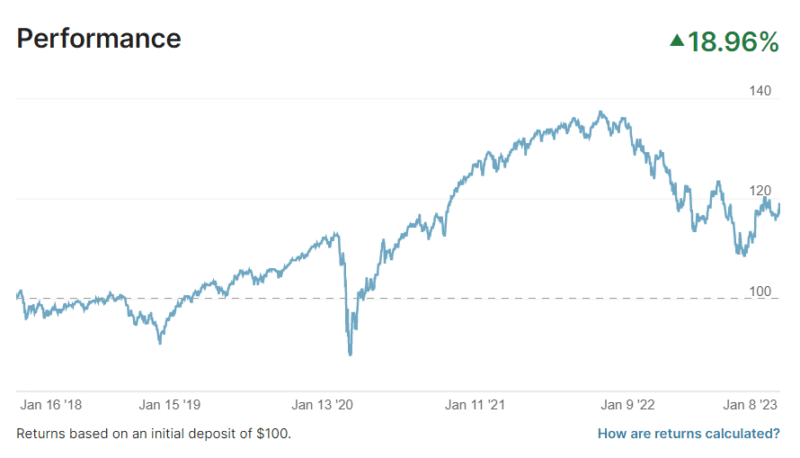

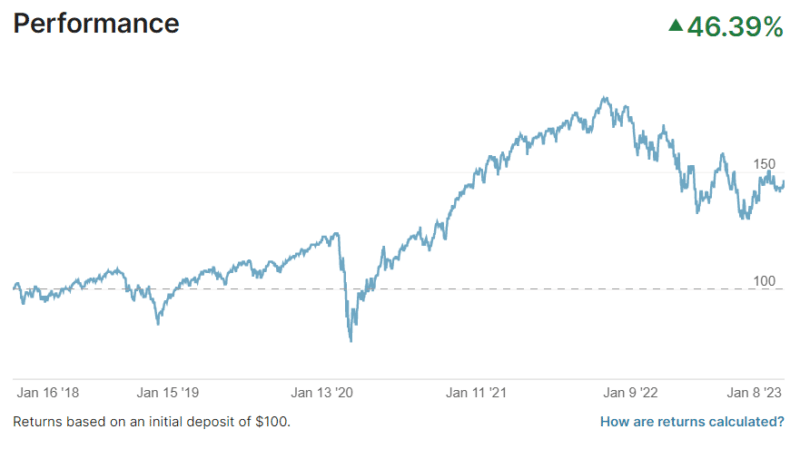

M1 Finance does not provide general information on historical returns, but for a good reason; it varies wildly from investor to investor. Depending on which “pies” you’ve chosen, if you’ve modified a pie, or stuck with an expert pie.

Expert Pie Performance

M1 Finance provides performance information on their Expert pies as you research them for your portfolio. Here are a few examples:

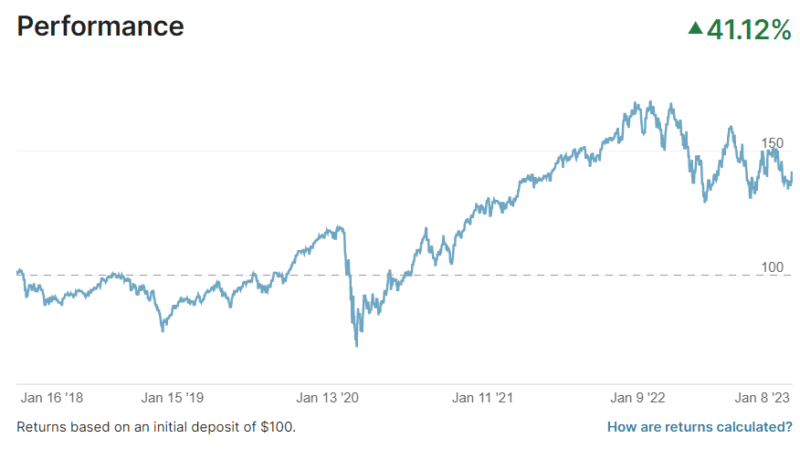

5-Year General Investing Moderate Risk Performance

5-Year Responsible Investing Performance

5-Year Berkshire Hathaway Pie Performance

Account Types and Services

M1 Invest offers several taxable investment accounts, including individual, joint, crypto, and custodial (M1 Plus only.) They also offer retirement accounts, including Traditional, Roth, and SEP IRAs.

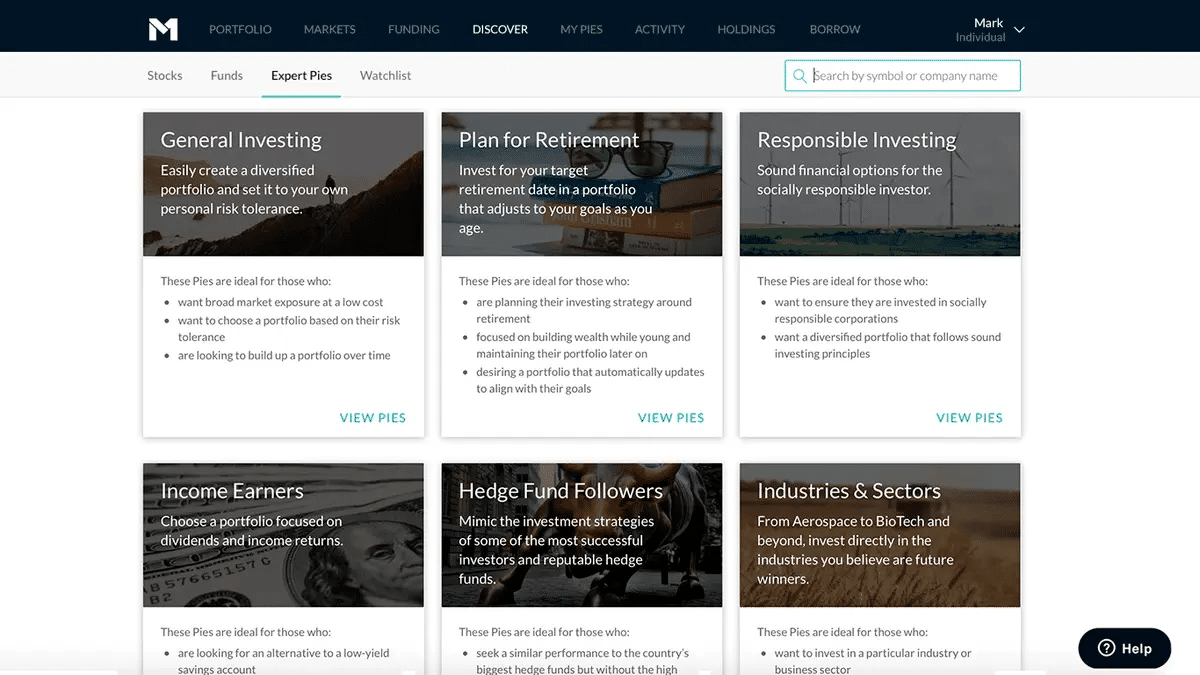

M1 Finance’s M1 Invest platform offers pie templates for many investment categories. This includes general investing, retirement investing, income portfolios, and hedge funds. As an added plus, M1 provides pies of socially responsible investing, which allows you to invest and make a positive impact.

As we mentioned earlier, M1 Finance comes with the usual taxable and joint account options, including Roth, Traditional, and Rollover IRAs. And you will need a minimum of $500 to open a retirement account.

We particularly like how the service integrates pie portfolios for impact investors. Thankfully, socially responsible investing is not a trend or fad; it’s here to stay. We also see other top robo-advisors integrating options for socially responsible investing in their portfolios.

What are the downsides of M1? We found two: no tax-loss harvesting and no option to invest in mutual funds. Investors can invest in a wide variety of ETFs and purchase fractional shares of stock, so your options are not exactly limited.

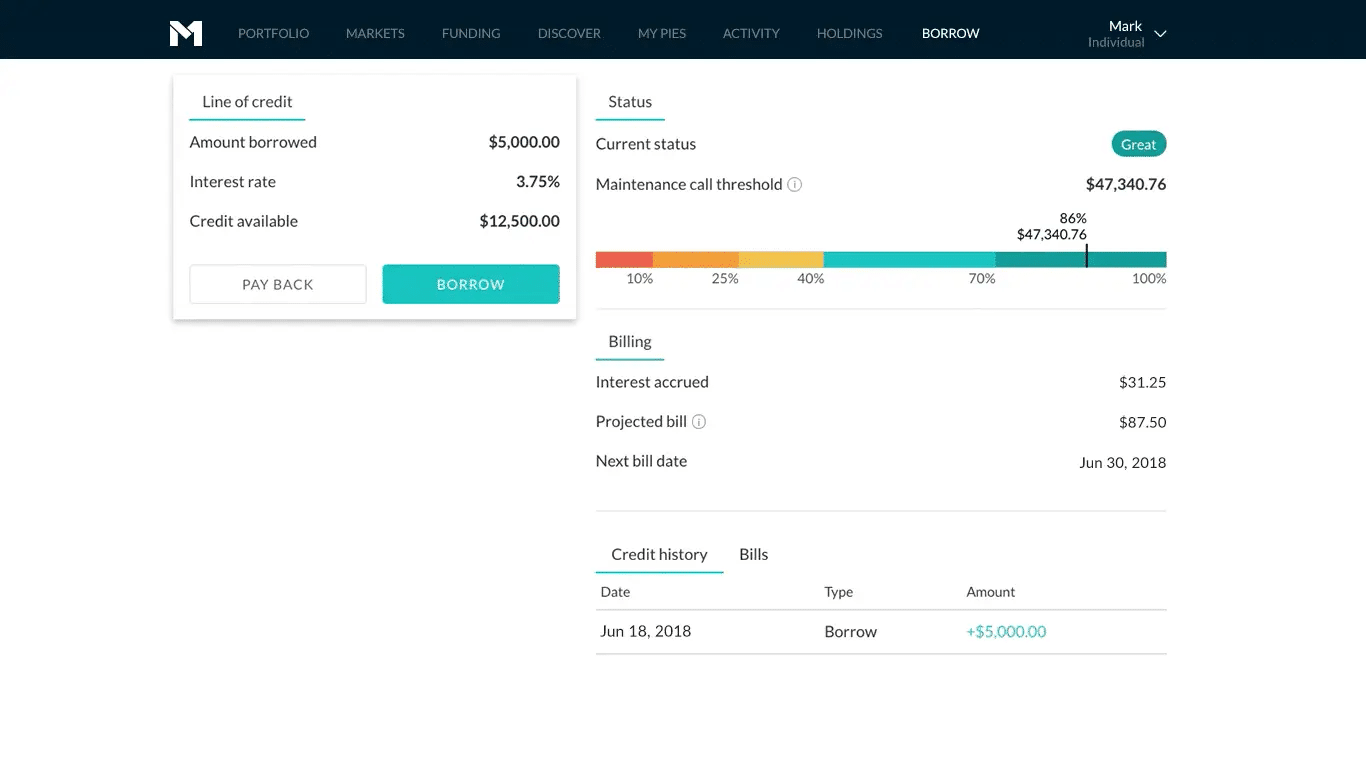

M1 Borrow

M1 Borrow is a low-cost line of credit that allows you to borrow using your M1 Invest balance as collateral. As long as your total account balance is at least $2,000, you can borrow up to 40% of your portfolio balance at a base interest rate of 8.25%.

You can use this line of credit as an emergency fund, for a large purchase, or to consolidate higher-interest debts. M1 Plus members can borrow at a base rate of 7.25%.

Borrow can also be seen as a margin account, meaning you can use the money you borrow and reinvest it. Please note that there are some additional risks involved with margin accounts, but the idea is that you can earn more than the borrowing rate by investing it.

Please read our full M1 Borrow Review here.

M1 Checking

In mid-2019, M1 Finance launched its M1 Checking account – a free checking account offering direct integration with your other M1 services. This checking account has a $0 minimum balance, no monthly or annual fees, and your money is FDIC-insured up to $250,000.

M1 Checking is an excellent option if you like to keep track of your personal finances in one place. You can transfer your money between M1 Checking, Invest, and Borrow. And M1 will send you a Visa debit card to use at stores and ATMs.

There are more benefits added to this account with an M1 Plus account.

M1 Owner’s Rewards Credit Card

In September 2021, M1 introduced the Owner’s Rewards Card – a credit card designed to help grow your investment portfolio by automatically reinvesting cashback rewards from select partners.

There are four tiers of cashback rewards; some top brands like Tesla Motors, Adobe, Dropbox, Netflix, Peloton, and Spotify have an impressive 10% cashback.

Some airlines (American, Delta, Southwest, United, JetBlue), food services like Starbucks, Domino’s Pizza, and Chipotle, and some other everyday brands like UPS, Nike, and FedEx have 5% cashback, a few dozen other everyday brands like Apple, Home Depot, Walmart, Best Buy, and Whole Foods offer 2.5% cashback. Everywhere else has an automatic 1.5% cashback.

The money you earn from spending can automatically reinvest into your Invest account to grow your portfolio over time. If you consider compounding interest, this can be very significant.

There’s no annual fee for the M1 Owner’s Rewards credit card, but only M1 Plus members get the cash back.

High-Yield Savings Account

M1 Finance must have felt left out, with all the other prominent robo advisors offering a high-yield savings account. So this year (2023), they’re launching one with an industry-leading APY. We don’t have much information on this account, but we know it will be limited to M1 Plus members.

M1 Plus

M1 Plus is M1 Finance’s premium membership program. For a fee of $3/month, you have access to several benefits:

- 3.30% APY on your M1 Checking account balance

- 1% cash back on all purchases with your M1 Checking card

- Additional trading windows in your M1 Invest account

- 1.5% discount on M1 Borrow line of credit’s interest rate

- Up to 10% cashback with the M1 Owner’s Rewards Credit Card

M1 Finance Plus vs. Basic Account

| Feature | M1 Plus | M1 Basic |

|---|---|---|

| Pricing | $3/month (3 months free) | Free |

| M1 Checking | ||

| APY | 3.30% | 0% |

| Cash Back | 1.0% | 0% |

| Minimum Balance | $0 | $0 |

| ATM Fee Reimbursements | 4/month | 1/month |

| International Fees | 0% (reimbursed) | 0.8% – 1% |

| Send Checks | Yes | No |

| M1 Borrow | ||

| APR | 7.25% | 8.25% |

| M1 Invest | ||

| Daily Trade Windows | 2 | 1 |

| Crypto Trading | On-Demand (10x/month) | Normal |

| Custodial Accounts | Yes | No |

| Owner’s Rewards Card | ||

| Cash Back | Up to 10% | 0% |

Is M1 Plus Worth It?

As with most things, it depends on your specific needs and risk tolerance. Deciding if a Plus account is worth the cost depends on your spending and saving habits. A Plus account’s main benefits are the 1% cash back, savings APY, and Borrow discount. If you also have the Owner’s Rewards Card and spend money on the partnered brands, you could see the cost for M1 Plus pay for itself many times over.

If you have a decent-sized balance in your M1 Checking portfolio (say $10,000) and spend an average of $1,000/month on your debit card, you will have a positive return from investing in the Plus account. But let’s also consider the alternatives.

If you usually have $10,000+ in your checking account with a low or no-interest checking account and don’t have a card with cashback, M1 Plus will be an upgrade.

On the other hand, if you have a larger balance in a high-yield savings account, have a credit card that gives you 1-3% cashback, and you pay off your credit card balance every month, you wouldn’t be getting the full advantages.

It would help if you also considered your habits and convenience. Having all your investments, checking, and credit in one place is more convenient. But, you might not get as much of a financial return compared to a more complicated setup.

M1 Plus is a good investment for some and is not overly expensive. There is a possibility of adding features and benefits that will make Plus appealing to more people in the future. You will need to pay for 12 months upfront, so ensure you take advantage of all the benefits.

The M1 Checking account alone doesn’t make much sense unless you enhance it with the M1 Plus benefits; you need to decide if it’s worth it.

With the Owner’s Rewards Credit Card, if you spend $1,250 per year or more on any of their 10% cashback partners, that alone will pay for the cost of M1 Plus.

Screenshots

Investment Flexibility

M1 Finance offers incredible portfolio diversity to cater to your specific needs and goals. M1 is designed to help investors reach their long-term goals, retirement portfolios, and general investing and might not be ideal for day traders or swing traders.

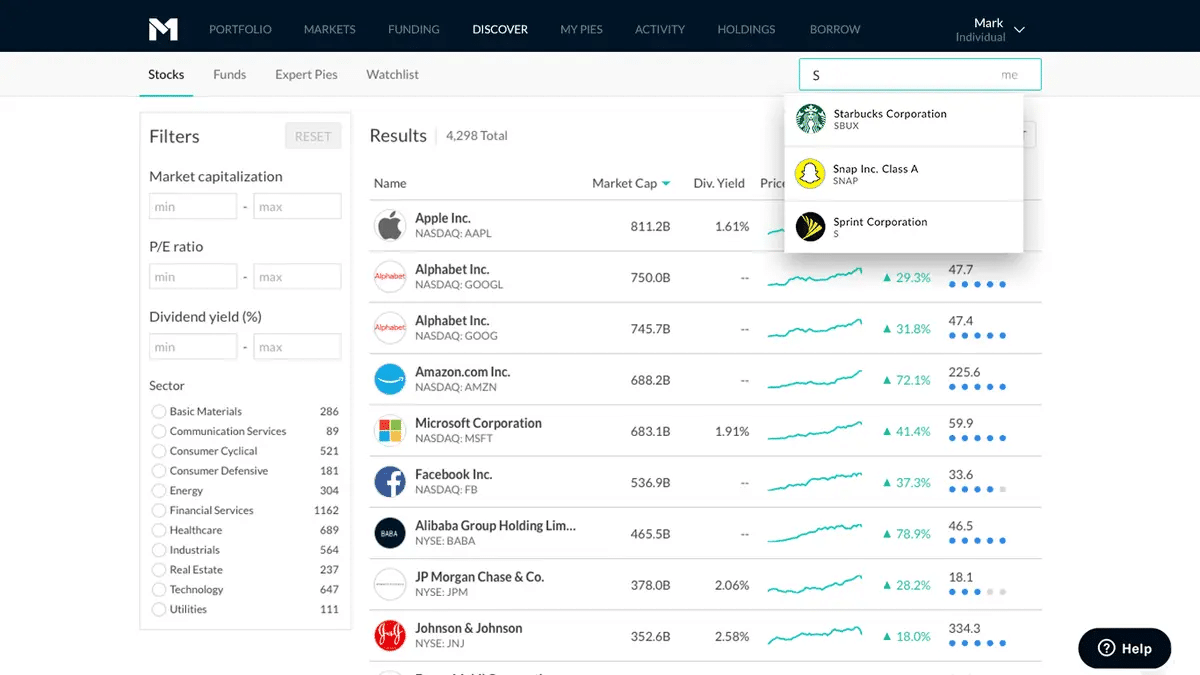

You can choose from one of the pre-made pie investment templates. The pies are based on Modern Portfolio Theory (MPT), the same system bankers and human advisors use.

You can start investing your money in one of the many pre-built expert pies, or customize the pies according to your preferences. M1 Finance manages your account by maintaining all your allocations and automatically rebalancing your investment portfolio as needed.

The service will also allow you to choose your own investments for each pie. Once your account is set up, you will see your performance by looking at your investment pie. You set a target for each slice of your pie, which will appear bigger or smaller, depending on its performance. As you invest in your pie, M1 will move your money to align with your investment goals.

Stock and ETF Trading

In addition to creating a custom pie, you can invest in ETFs and individual stocks. There are thousands of ETFs to choose from, and you can invest in fractional shares of stocks to ensure that all of your money is invested.

M1 Finance offers one trading window to all investors and two possible trading windows for Plus members. This means your trade orders will be completed at 10:00 am EST Monday-Friday. You can schedule trades after 10:00, but they won’t be completed until the next business day.

With an M1 Plus account, you can trade in either the 10:00 am or 3:00 pm window. And if you have a balance of over $25,000, you can trade in both windows.

If investing becomes overwhelming, you can schedule a free consultation with a human advisor or read some investment education articles on M1’s website.

Customer Service

The customer service offered by M1 is minimal. You are not paying for a financial advisor, so most of your financial decisions must come from your research. The M1 Finance team can help you with technical issues over the phone and via email. Their website also offers great articles and how-to videos.

Ease of Use

While reviewing the M1 Finance platform, we quickly familiarized ourselves with the pie charts, allowing us to view our investment allocations at a glance.

You can click on various portfolio movers to learn more about the company or stock. It will also display the stocks’ weekly, monthly, and yearly performance and estimate future performance.

You might expect a limited experience if you manage investments from your smartphone, but this isn’t the case. The app is easy to use and offers a user-friendly dashboard with your account balances. And the M1 app has an average rating of 4.6/5 in the App Stores.

Unlike some other Robo Advisors, signing up with M1 Finance will not require you to answer surveys and questionnaires. Instead, you can use either pre-made or custom-made pie graphs after signing up. Each pie can be divided into as many as 100 slices, where each slice represents an investment.

There are tons of pre-made pies for you to choose from. If you don’t find exactly what you want, you can replace any ETFs or stocks with whatever you like.

Once you choose how to invest, the automated system will handle the rest. M1 Finance gives you control over your investments and ensures you will reach your goals.

You have a few options when you start earning dividends from your investments. You can reinvest all your cash automatically, invest cash over a set threshold, or hold onto the money. The ability to purchase fractional shares is excellent because you don’t need to wait to buy individual stock. You can reinvest dividends and grow your account instead of having idle cash.

M1 Finance is perfect for beginner investors who don’t have much money to invest but want the same options as other investors. They make it easy to invest how you want to and give you the confidence that your investments will grow over time.

The $100 minimum balance for active trading on an automated investment platform is among the lowest you will find.

Intro Video

Summary

From the beginning of this M1 Finance review, it’s clear that M1 Finance is the best free robo-advisor currently available. M1 offers a service that’s easy to use, has zero fees, and offers impact investing,

Some of the other M1 services will be valuable to some and not to others. If you have a decent-sized balance in your M1 Invest account and need to borrow some money, the M1 Borrow program is a great way to feel more comfortable investing a more substantial portion of your money.

Since M1 Invest is free, SIPC-insured up to $500,000, and has a very low barrier of entry, we think it’s an excellent option for almost everyone looking for a robo-advisor investment platform.

If you’re ready to start investing and preparing for retirement, sign up for your M1 Finance account today!

Is M1 Finance Legit?

Yes, you can trust M1 Finance. We’ve invested our own money into the service and were very impressed with the platform. The free service is excellent, and if you want to take advantage of better rates and financial tools, M1 Plus could be a good option for you.

Is M1 Finance Good for Beginners?

Yes, although the platform has a bit larger of a learning curve than Wealthfront or Betterment, it’s great for beginner investors who want flexibility for hands-off investing as well as customizing their own portfolios. If you’re looking for something completely hands-off, you might want to go with a traditional robo advisor.

Does M1 Finance Offer Crypto?

Yes, with M1 Crypto, you can use M1’s pies to invest in cryptocurrency. You can use pre-made pies, or create your own, just like your regular M1 Invest account.

Is M1 Finance Safe & Secure?

Yes, M1 Finance is SIPC-insured for up to $500,000, and FDIC-insured for up to $250,000. All data transferred through their system is secured with military-grade 4096-bit encryption. They also offer Two-Factor Authentication (2FA) on all accounts.

How Does M1 Finance Make Money?

While M1 Finance offers many free financial and investment tools, they also provide loans, a credit card, and a checking account. They also offer a premium membership called M1 Plus, which has an annual fee.