We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

- Active vs. Passive Investing: An Overview

- What is Active Real Estate Investing?

- What is Passive Real Estate Investing?

- Benefits of Active Real Estate Investing

- Benefits of Passive Real Estate Investing

- Best Passive Real Estate Investing Methods

- Best Passive Real Estate Investment Platforms

- Best Active Real Estate Investing Websites

- Active vs. Passive Real Estate Investing: Conclusion

While often touted as one of the best investment vehicles out there, real estate can be a tough nut to crack. Finding a property, going through the paperwork, and finally going through the hassle of getting good tenants is undoubtedly exhausting.

These challenges can turn some people off to the gains they could achieve with active real estate investing. Fortunately, there’s a route you can take to reap the benefits of the real estate market without having to deal with all the annoying parts of the process.

Today, we’re going to take a look at the critical differences between passive and active real estate investing!

Active vs. Passive Investing: An Overview

Active Investing

Active investors select and manage the investments in their portfolios themselves. That could entail trading handpicked stocks, scouting potential rental properties, or even getting into the cryptocurrency space.

The goal of most active investing is to beat the performance of the S&P 500. Their decision-making is driven by changes in the economy, political shifts, and trends occurring in the market.

Passive Investing

Passive investors don’t assess their passive investments individually. Instead, they seek to match the overall market’s performance rather than make an attempt at outperforming them. Passive investing tends to be less resource-intensive than active investment.

This is because you won’t have to worry about paying fees to portfolio managers, hiring research analysts, or dealing with fees on high-frequency trades. Due to this, it can be easier for some passive investors to beat the market.

Which is Better?

Both methods have their own unique set of pros and cons. Active investing can allow investors to improve their risk-adjusted returns if they execute their strategies properly.

On the other hand, passive investing requires less management and relies on the long-term growth of the market, ignoring volatility for the most part via waiting out any dips.

While the two methods have their own merits, passive investing is the way to go if you’re trying to grow your portfolio consistently without spending too much time on management.

What is Active Real Estate Investing?

Active real estate investing means you have a hands-on role. This could mean purchasing properties and renting them out for passive income, flipping cheap houses for a profit, or building brand new homes and selling them for more than it cost to make them.

An active real estate investor typically participates in most stages of the process, from picking the property, financing the payment, acquiring a loan where needed, and managing the real estate investments as they generate revenue. In most cases, this requires as much effort as a full-time job.

Pros:

- You have complete control over the real estate investments

- You can select properties yourself based on location, budget, and other factors that are important to you

- Active management can maximize profit since you don’t need to worry about management fees

Cons:

- Since you’re working as much or more as a 9-to-5 employee, there’s a higher profit threshold to make it worth the effort

- There’s a higher barrier of entry since securing capital and loans isn’t easy

- You’re facing a higher risk since you won’t be able to diversify as much

What is Passive Real Estate Investing?

The first thing you should note is that passive real estate investing doesn’t mean you do nothing while receiving profit. Instead, the difference with passive real estate investing is that as a passive investor, you won’t be playing an active role in most stages of the acquisition process, including the day-to-day operations that follow.

Regardless of whether you’re putting money into a REIT fund, buying stock in real estate companies, or funding active investors, it’s essential to do your due diligence. You should also look at quarterly reports to stay up to date on how your passive real estate investments are doing.

Pros:

- Less work means you don’t need to make as much profit to justify the real estate investments

- Lower barrier to entry with many passive real estate investment platforms requiring only $500 to sign up

- Diversified portfolios reduce your risk and can hedge your investment against volatility

Cons:

- You’ll have less control over which properties are acquired and how they’re operated

- Profit margins are usually lower since you need to share the revenue with those actively managing the property

Benefits of Active Real Estate Investing

Experience

No matter how frustrating actively managing real estate can be at times, it teaches vital skills like research, negotiation, and maintaining the excellent condition of properties. You’ll eventually become a real estate professional with enough experience. This can carry over to benefit you in other areas of life.

Less recurring fees

While it’s true that you’ll still need to pay closing costs and other fees necessary to the acquisition process, you won’t have to pay asset management fees for the remaining duration of your investment. This can leave you with more leftover profit.

Hidden opportunities

If you’re actively looking for properties, that increases the odds of finding a diamond in the rough. These properties are often for sale by the owners or are too disheveled to make their way onto a listing website or investing platform. However, flipping these can yield a massive profit.

Benefits of Passive Real Estate Investing

Stable growth

While active real estate investments like buying and selling properties may produce more yield in the short term, these strategies require more capital and are far riskier. They’re also more vulnerable to market crashes and can be quite volatile as a result.

Inflation defense

Passive real estate investing gives your portfolio a robust hedge against inflation. Housing prices tend to rise alongside stock market inflation, meaning you can offset losses from your other securities. Property prices may not double every ten years as the myth goes, but it does rise significantly.

Scalability

Passive real estate portfolios tend to be easier to scale than active investments. When you’re buying and selling houses or renting them out yourself, you get to a point where it doesn’t make sense to keep acquiring properties (from an administrative standpoint.)

Free time

Perhaps the most significant benefit of passive real estate investing is the fact that you’ll have a lot more free time left over. Extra free time will help you capitalize on other opportunities that could bolster your portfolio.

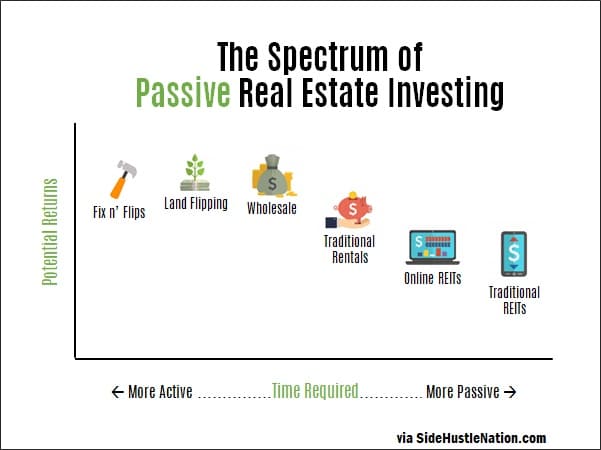

Best Passive Real Estate Investing Methods

REITs

Real Estate Investment Trusts (REITs) are one of the best ways to reap the benefits of the property market without a truckload of capital or excessive amounts of time investment.

These trusts acquire property through the collective capital of passive investors and then distribute the revenue to all shareholders either via operating income or final sale, depending on which trust you’ve invested in.

The safest trusts to invest in would be those that hold properties that are already cash-flow positive. In contrast, trusts acquiring new properties that don’t turn a profit yet can be riskier but may offer a higher potential return to compensate for the uncertainty.

Real Estate Crowdfunding

Crowdfunding is another form of passive real estate investing that reduces the barrier to entry for retail investors. Most crowdfunded real estate projects let you get started with as little as $500 in initial capital.

It’s worth noting that crowdfunding tends to be a slightly higher risk than REITs since the developers have shorter track records than the tried-and-tested trusts. The odds of losing your investment is higher, but the returns can be more lucrative.

Fundrise and CrowdStreet are two of the most popular real estate crowdfunding platforms for passive real estate investors. However, non-accredited investors will be capped at 5-10% of their annual income due to SEC regulations that protect consumers from crowdfunding risks.

Best Passive Real Estate Investment Platforms

If you want to get started with passive real estate investing, then the easiest way to do that is to find the right platform for you. There are quite a few out there, so be sure to check out our complete guides, but here are some options:

DiversyFund

DiversyFund is one of the most accessible platforms since all you need to get started is $500. You don’t need to be an accredited investor, nor will you have to worry about paying management fees since the platform makes its money at the point of sale.

You won’t be able to choose between properties which can be either a good or bad thing depending on what you’re looking for. On the one hand, it makes the investment completely passive, but on the other, you won’t have the chance to vet and select before you bet.

Fundrise

Fundrise’s minimum investment is $500, but you can get a premium account level if you can manage a $100,000 starting deposit. There are also no early redemption penalties, which is helpful if you need money for unforeseen expenses.

You will need to pay an asset management fee of 0.85% and an advisory fee of 0.15%, but it’s well worth the cost if this is the type of platform you’re looking for. In addition to REITs, you can also choose from a selection of eFunds along with the Interval Fund.

Like DiversyFund, Fundrise is open to non-accredited investors, so you won’t have to worry about hitting the $1 million net worth threshold if you want to use the platform. It’s worth noting that there’s always a possibility of delayed redemptions in the event of a market downturn.

CrowdStreet

CrowdStreet may not be as accessible as the other options we’ve covered so far due to its $25,000 minimum investment, but it does have perks that make up for that.

First of all, the website is about as intuitive as it gets in terms of the user interface. Secondly, fees can go as low as 0.50% (but may rise to 2.5% depending on the project). CrowdStreet pairs individual investors with project developers to create funding opportunities on both ends.

Those looking for a more passive experience can select one of CrowdStreet’s many mutual funds, compromising multiple properties in their extensive portfolio. The biggest thing to be wary of is that there’s no redemption program, so don’t expect an early payday.

Roofstock

Roofstock runs a marketplace that lets investors buy and sell SFH rental properties in their city or other markets, which they can then rent out for passive income. Investors can choose between ready-made portfolios, or they can build one out themselves, one deal at a time.

If variety is your goal, you’ll be happy to know that the platform contains offerings from more than 70 markets, which gives a wide selection of deals. Roofstock One (only available to accredited investors) also lets users buy fractional shares of rental properties.

Best Active Real Estate Investing Websites

Zillow

Zillow has a database covering more than 135 million properties with criteria sorting features that help you narrow the field. Other benefits include the how-to guides that Zillow publishes and the easy-to-use mobile app that allows you to do your research on the go.

Trulia

Trulia is one of the top real estate apps. It has unique features like personalized alerts for investment properties meeting your criteria, an app tutorial, and the ability to specify which areas you’d like to search by drawing a loop with your finger.

Realtor.com

Realtor.com‘s database covers 99% of all MLS-listed properties. You can use their “find a realtor” function to streamline your journey, but the drawback of the platform is that you won’t be able to access “for sale by owner” listings.

Active vs. Passive Real Estate Investing: Conclusion

As you can see, the benefits of passive real estate investing should not be overlooked. If you want to generate wealth without micromanaging your real estate portfolio or boost your passive income, using some of the real estate investment platforms above can undoubtedly act as the launchpad you need to get started!