We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

SoFi (Social Finance, Inc.) was founded in 2011 by a team of Stanford graduates, initially as a loan platform. SoFi started with the mission to help members refinance their student loans. Since 2011, SoFi members have paid off $22+ billion in debt.

In 2019 SoFi launched SoFi Invest, along with SoFi Money, in a continued effort to help users achieve prepare for their future. In 2020, SoFi celebrated over 1 million members.

SoFi offers a range of financial tools and account types, including insurance policies, cryptocurrency, student loan refinancing, and personal loans.

This review will focus on SoFi Automated Investing, compare it to other robo-advisors, and help you get started investing with SoFi.

| Annual Fee | 0.00% |

| AUM (Assets Under Management) | $523 Million |

| Minimum Investment | $1 |

| Free Version | Yes |

| Headquarters | 234 1st St San Francisco, CA 94105 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | No |

| Cash Management Account | Yes |

| Financial Planning | Yes |

| Customer Service | Live support via phone, email, and chat |

| Access to Human Advisor | Yes |

| Phone | 855-525-7634 |

What is SoFi Automated Investing?

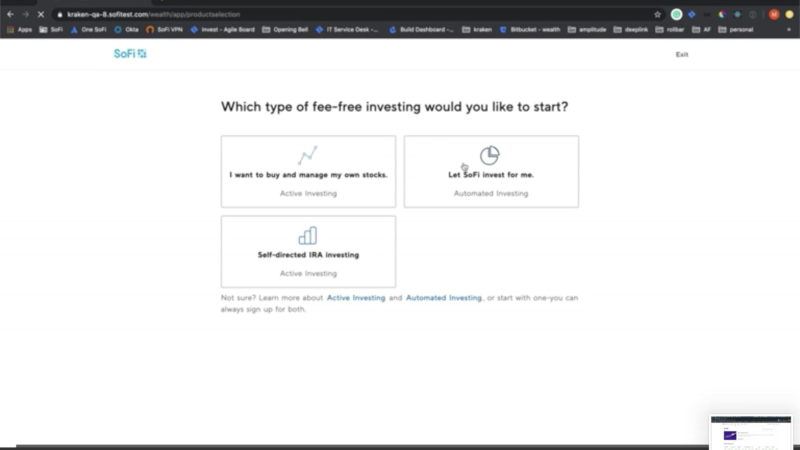

SoFi Automated Investing is a hybrid robo-advisor that helps you set financial goals and easily manage your investments. You can start investing your money without worrying about the market’s ins and outs. In addition to automated investing, SoFi offers an active investing platform. Active investing is more similar to Robinhood or Stash because the investors are directly in charge of investing their money.

Automated investing is simple to get started with. You’ll have a diversified investment account set up to reach your long-term goals. The SoFi investing algorithms will build your portfolio using low-cost ETFs (Exchange Traded Funds) based on your set goals and risk tolerance.

Your portfolio is rebalanced quarterly, as needed, so you can rest assured that your investments are growing and on track.

Fees and Minimums

One thing that makes SoFi Invest stand out is that it’s a free service. The average robo-advisor charges an annual 0.25–0.50% management fee. Depending on your portfolio balance, you can save hundreds of dollars annually with SoFi Automated Investing.

By offering other financial services like business loans and refinancing, SoFi can provide free access to their robo-advising service. And you can start investing in SoFi with just $1. That makes SoFi one of the best free robo-advisors on the market.

Account Types

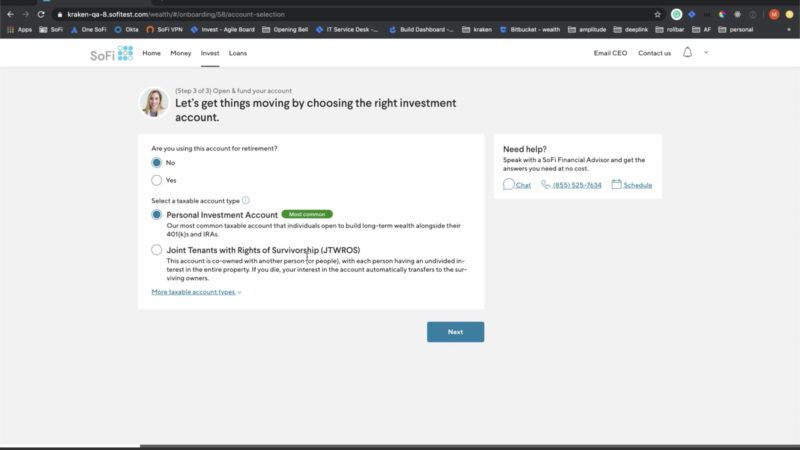

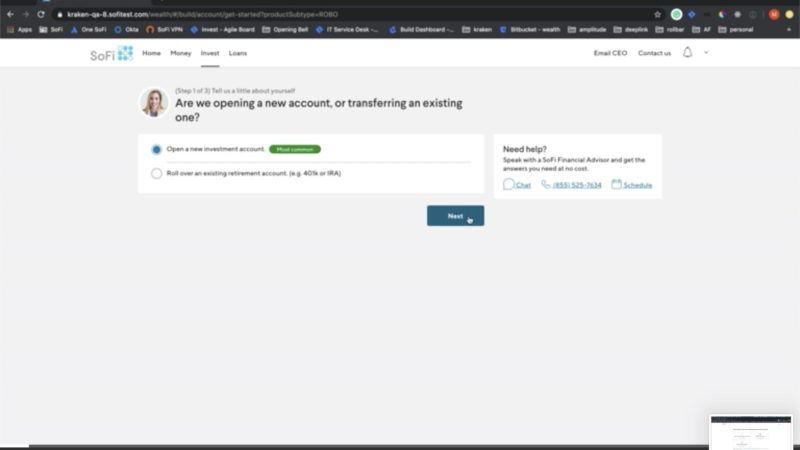

SoFi Automated Investing offers the standard individual and retirement accounts that most robo-advisors offer. And you can get help if you want to roll over your 401(k) into an individual retirement account.

- Individual and Joint Investment Accounts

- IRA

- Roth IRA

- SEP-IRA

Who is SoFi Best For?

Low entry barriers and free money management make SoFi Automated Investing perfect for beginner investors. If you don’t have a big chunk of cash available to invest, starting with SoFi can get you on the right track.

With SoFi Automated Investing, your money will be invested in various low-cost ETFs. Your investment portfolio will be built with your long-term financial goals in mind. Whether you want to save up to buy a house, plan for retirement, or save for your children’s college fund. Unfortunately, SoFi doesn’t offer a tax-loss harvesting plan. Tax-loss harvesting plans benefit investors with large account balances more significantly. SoFi investors with smaller portfolios aren’t missing out on significant tax savings.

SoFi Automated Investing is a hands-off approach, like many other robo-advisors, which means you won’t need to figure out which stocks or bonds to invest in. You can set up recurring deposits and have your money make money. You will have an investment portfolio of diversified stocks and bonds that will be automatically rebalanced quarterly to ensure you’re staying on track to meet your goals.

SoFi offers users discounts on their paid products. The discounts make SoFi a perfect option for customers looking for other services SoFi offers, such as loans, refinancing, and insurance policies.

Getting Started with SoFi Invest

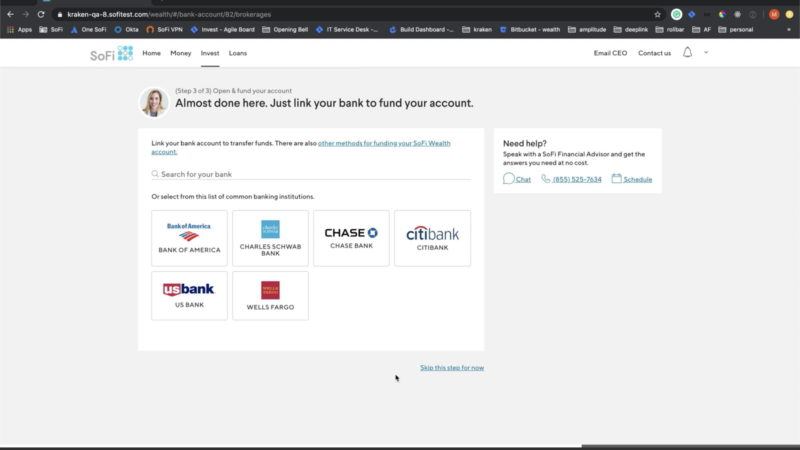

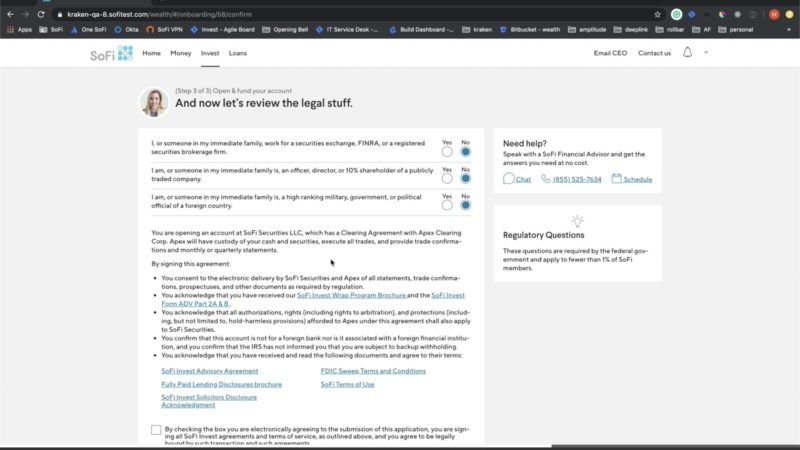

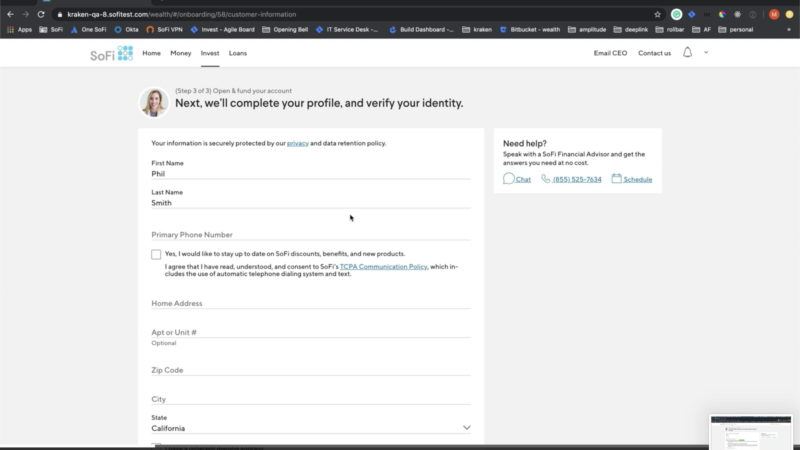

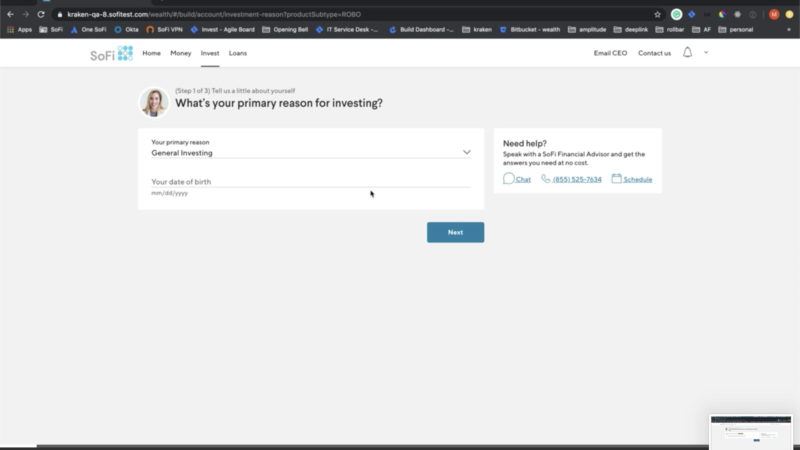

You can sign up for a SoFi Invest account in just a few minutes. Once you want to start Automated Investing, you will fill out a few survey questions about your age, risk tolerance, and financial goals.

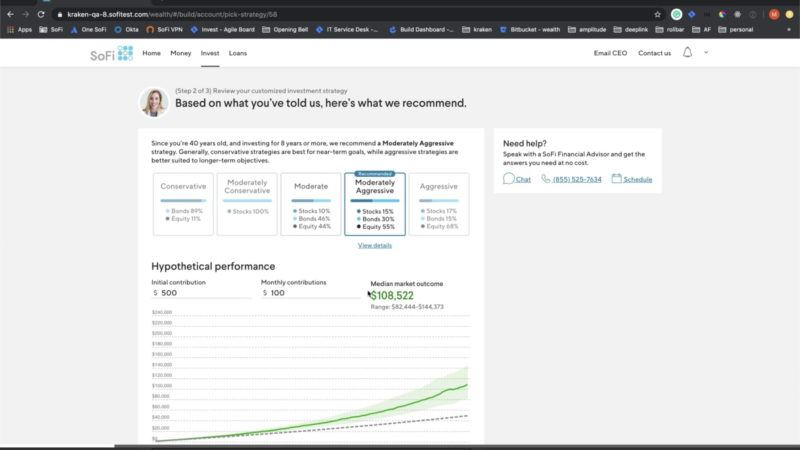

After that, SoFi will recommend one of five portfolio recommendations, ranging from conservative (100% bonds) to aggressive (100% stocks).

You can also view a hypothetical performance chart based on your portfolio choice, initial investment, and monthly recurring investment. After deciding which portfolio is right for you, you can choose which type of account you need—IRA, Roth IRA, Individual account, etc.

From start to finish, the process can be finished in just a few minutes. SoFi also offers support via live chat, phone, or a scheduled 30-minute financial planning call. Free access to financial planning can give you the confidence you need to start investing your money.

Investment Portfolio Options

- Conservative – 100% Bonds

- Moderately Conservative – 70% Bonds + 30% Stocks

- Moderate – 40% Bonds + 60% Stocks

- Moderately Aggressive – 20% Bonds + 80% Stocks

- Aggressive – 100% Stocks

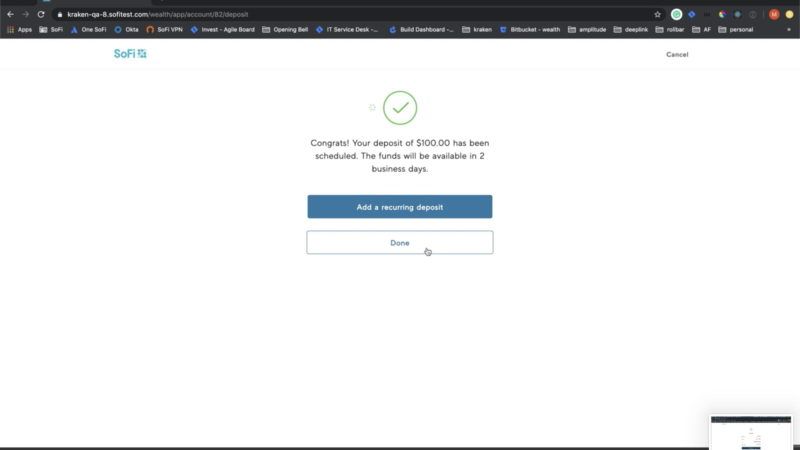

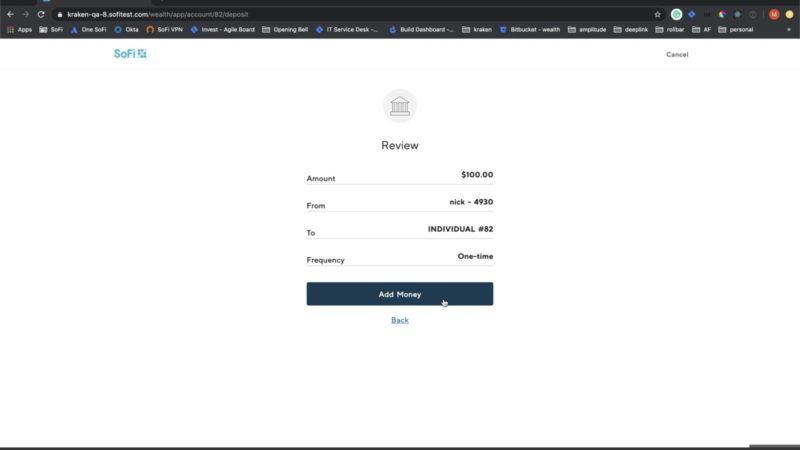

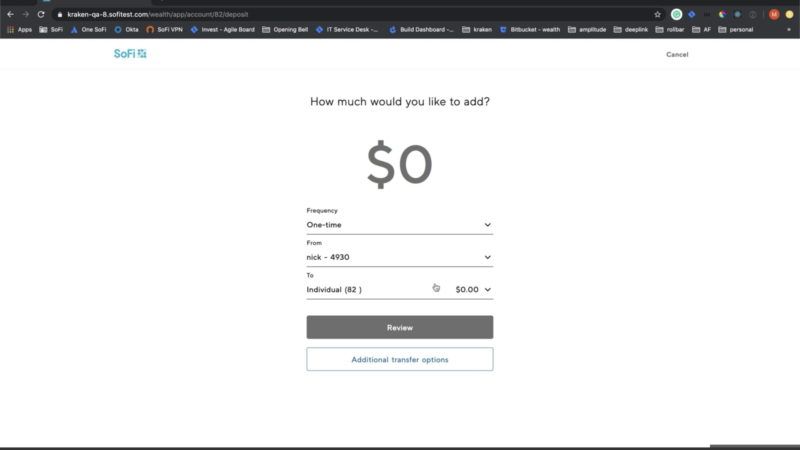

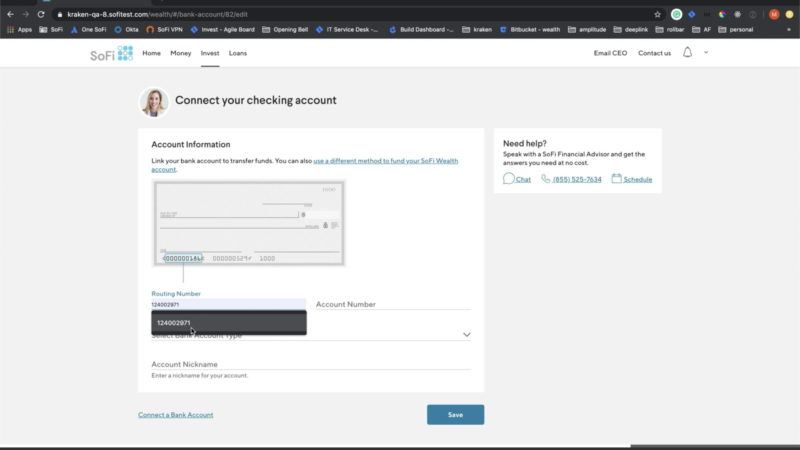

On-boarding Screenshots

Historical Performance & Returns

During your automated investing account setup, you can view your selected portfolio’s breakdown and determine which ETFs and mutual funds your funds will be invested in. SoFi doesn’t provide a historical performance for their portfolios; however, you can look at the ETFs that will be in your portfolio.

Most ETFs are low-cost Vanguard ETFs and two SoFi ETFs: SoFi Select 500 and SoFi Next 500. In the Moderate to Aggressive portfolios, SoFi’s ETFs can make up 30-60% of the portfolio, so we looked at the historical performance. Note that past performance doesn’t determine future potential.

Historical Performance as of September 2020

| Timeframe | SoFi Select 500 (SFY) | SoFi Next 500 (SFYX) |

|---|---|---|

| 52-Week Range | $7.84-13.11 | $6.44-11.12 |

| 6 Month Return | +27.66% | +21.88% |

| 1 Year Return | +20.74% | +5.83% |

| Since Inception (April 2019) | +23.73% | +4.36% |

SoFi Customer Service

Robo-advisors can easily automate the investment process from start to finish and provide a free service because they don’t need a big team of employees. This is great because investors can avoid paying a management fee, but it also causes a lack of customer service.

How does SoFi’s customer service compare to other robo-advisors?

SoFi has a few different ways to get help and answer any questions you have, including phone, email, and chat. SoFi has made a great effort to support all of its customers. On their contact page is a customer service phone number for each different account type, a button to Contact the Office of the CEO, and a link to tweet @SoFiSupport.

SoFi also has a chatbot that responds to your questions with articles if you want to problem-solve on your own.

Overall, SoFi provides excellent service to all of its customers, and even though it’s a free service, plenty of help is available.

Summary

SoFi Automated Investing is an excellent option for new investors. The services they provide are outstanding, considering there are no management fees and access to human financial advisors.

SoFi lacks some personalization that other robo-advisors offer, and you won’t get to take advantage of a tax-loss harvesting plan. Your portfolio will be limited to the five risk levels SoFi has created.

Access to financial advisors is a big plus, especially at no extra cost. If you’re looking for an easy way to start investing, SoFi is a great option and will help you reach your longer-term financial goals.

FAQ

Is SoFi Invest really free?

Yes, SoFi Automated Investing is a free robo-advisor. This includes portfolio rebalancing and access to financial advisors.

Who is eligible?

SoFi Invest is available to U.S. citizens and most permanent residents.

Do I need to use other SoFi services?

Nope. You can open a SoFi account for free without obligation to use their services. The financial advisors at SoFi are not commission-based and will offer unbiased advice without up-selling.

Does SoFi have a mobile app?

Yes, there is a free SoFi app on the App Store and Google Play Store. Currently, the SoFi App has a 4.8/5 rating in the App Store and a 4.⅖ on Google Play.

Is my investment account insured?

If SoFi was to declare bankruptcy, the SIPC protects your securities up to $500,000.

Is SoFi Safe & Secure?

SoFi makes keeping your personal information safe a top priority. Their website and mobile app use bank-level security and TLS encryption.

Disclaimer: BestRoboAdvisors.org has entered into a referral and advertising arrangement with SoFi Invest and may receive compensation when you open an account or for certain qualifying activity. You will not be charged a fee for this referral and SoFi Invest and BestRoboAdvisors.org are not related entities. It is a requirement to disclose that we earn these fees and also provide you with the latest SoFi Invest ADV brochure (PDF) so you can learn more about them before opening an account.