We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Do you know why we love robo advisors? They are each unique in their own way, and Nest Wealth is no different. Along with Wealthsimple, Nest Wealth is one of Canada’s biggest and most transparent automated investment platforms.

Nest Wealth is also fully independent and comes with a subscription-based pricing structure. With this feature, you pay lower fees as your money grows. But it might not be suitable for investors with a smaller amount to invest.

Financial expert Randy Cass founded Nest Wealth. You might have heard of him before; he manages institutional assets at Orchard Asset Management and hosted BNN Market Sense from 2012 to 2014. Mr. Cass brings more than 15 years of experience in the financial services industry and is the majority owner of Nest Wealth.

Metroland Media invested $1.5 million in Nest Wealth back in 2015. The same went for National Bank when it invested $6 million in 2017 for a minority stake.

Nest Wealth belongs to the group of best robo advisors in Canada and happens to be the largest independent automated wealth management platform, period.

In this 2020 Nest Wealth review, we’ll find out if the subscription-based fee structure and personalized portfolio offerings of this robo advisor are enough to earn your trust.

| Promotion | Try Nest Wealth Free for 3 Months |

| Minimum Investment | $1,000 |

| Headquarters | 214 King St West, Suite 510 Toronto, Ontario, M5H 3S6 |

| Savings Account | Yes |

| Desktop App | Yes |

| Mobile App | No |

| Socially-Responsible Investing | No |

| Cash Management Account | No |

| Customer Service | Live support via Email |

| [email protected] | |

| Phone | 855-782-3559 |

Nest Wealth Fees

The biggest reason Nest Wealth is popular is the monthly subscription plan. We used to stay away from subscription-based financial services, but the transparency of this feature offers many benefits. Unfortunately, it doesn’t favor small investors in the long run, but we’ll discuss that later.

The monthly subscription fees are as follows:

$20

Under $75,000

$50

$75-$150k

$80

Over $150,000

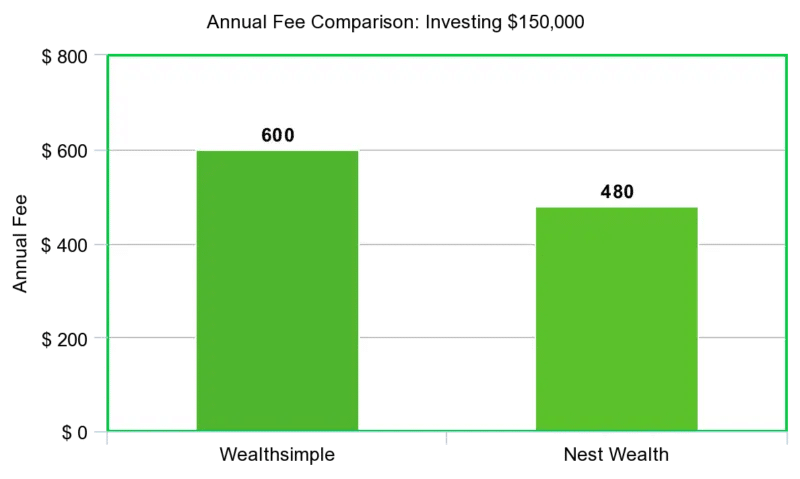

The subscription will never cost you more than $80 per month, even if your account balance is worth millions. From this alone, it is easy to see that Nest Wealth is excellent for investors with a high net worth.

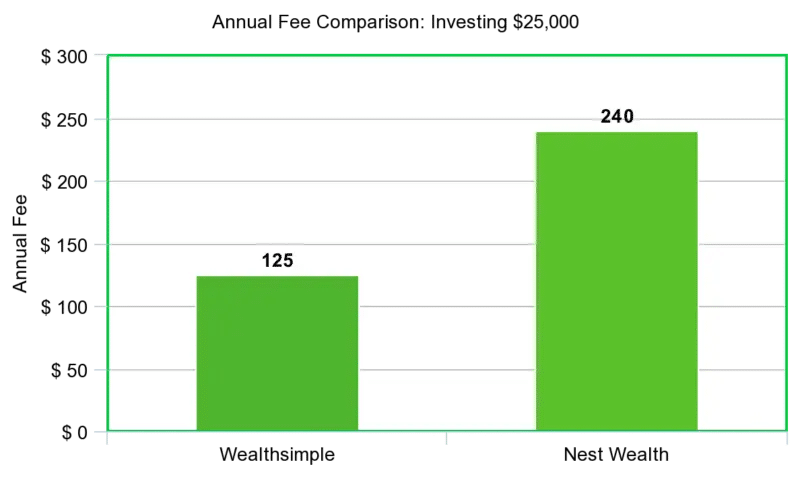

Let’s say you have $25,000 to invest. If you put that money into Wealthsimple, your annual fee would be $125 since they charge 0.50% for investments between $5k and $100k.

If you were to invest the same amount of money in Nest Wealth, the annual fee would be $240 based on the $20/month subscription model:

But if you invest $150,000 into Nest Wealth, the annual fee will only be $480, compared to Wealthsimple’s’s $600 (calculated at 0.40% annually):

As the account balance goes up, you can save more money on fees. This is why we say Nest Wealth is best suited for high-net-worth Canadian investors. It’s also worth noting that Nest Wealth uses ETFs with a lower Management Expense Ratio (MER) than most, which means a potential for more growth down the line.

We like the transparency of the subscription fees, and we also like the zero minimum deposit. We don’t like the trading fees, which are capped at $100 per account annually. If you joined before November 5, 2018, you’ll be using Nest Wealth’s custodian National Bank Independent Network (NBIN), which charges a flat rate of $9.99 per trade.

If you joined after that date, you’ll be using Fidelity Clearing Canada (FCC), which charges $7.99 per trade. Nest Wealth will shoulder trading fees above $100 (and cover your first account’s annual custodian fees,) but it’s important to be aware of this nonetheless.

If you are new to the world of robo advisors, Nest Wealth offers three months free to any new client if you sign up using our link.

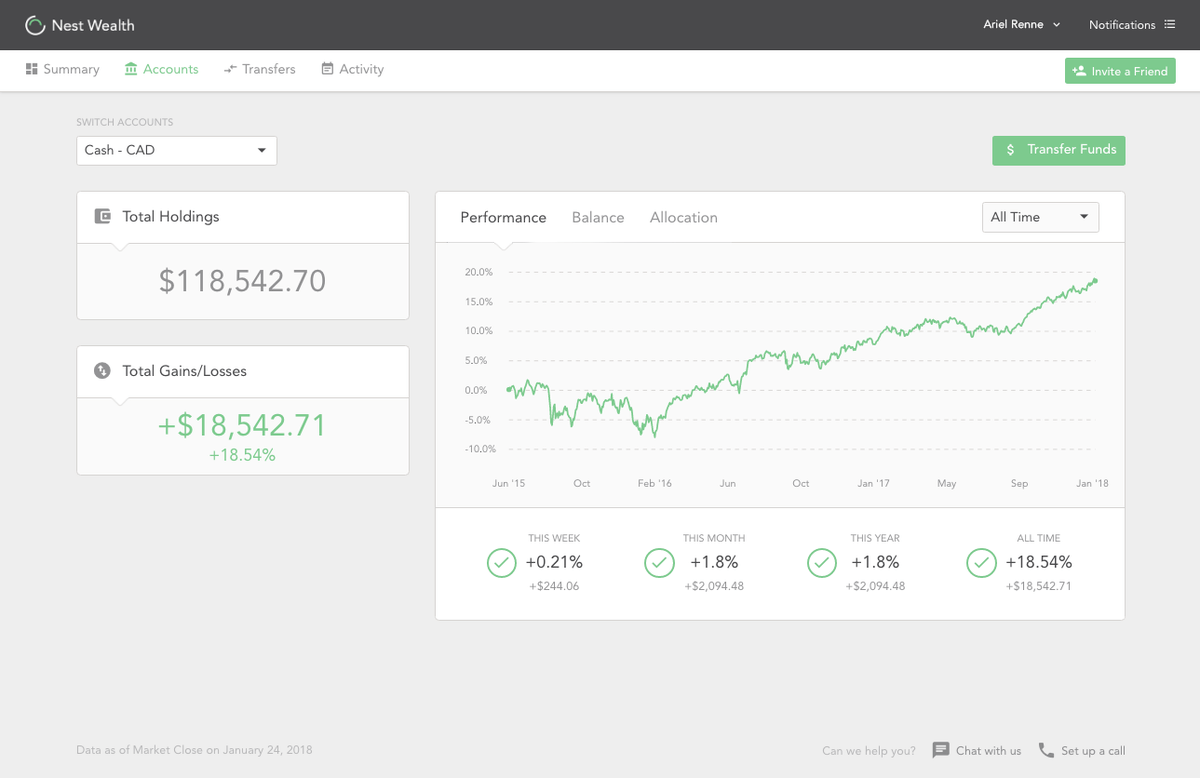

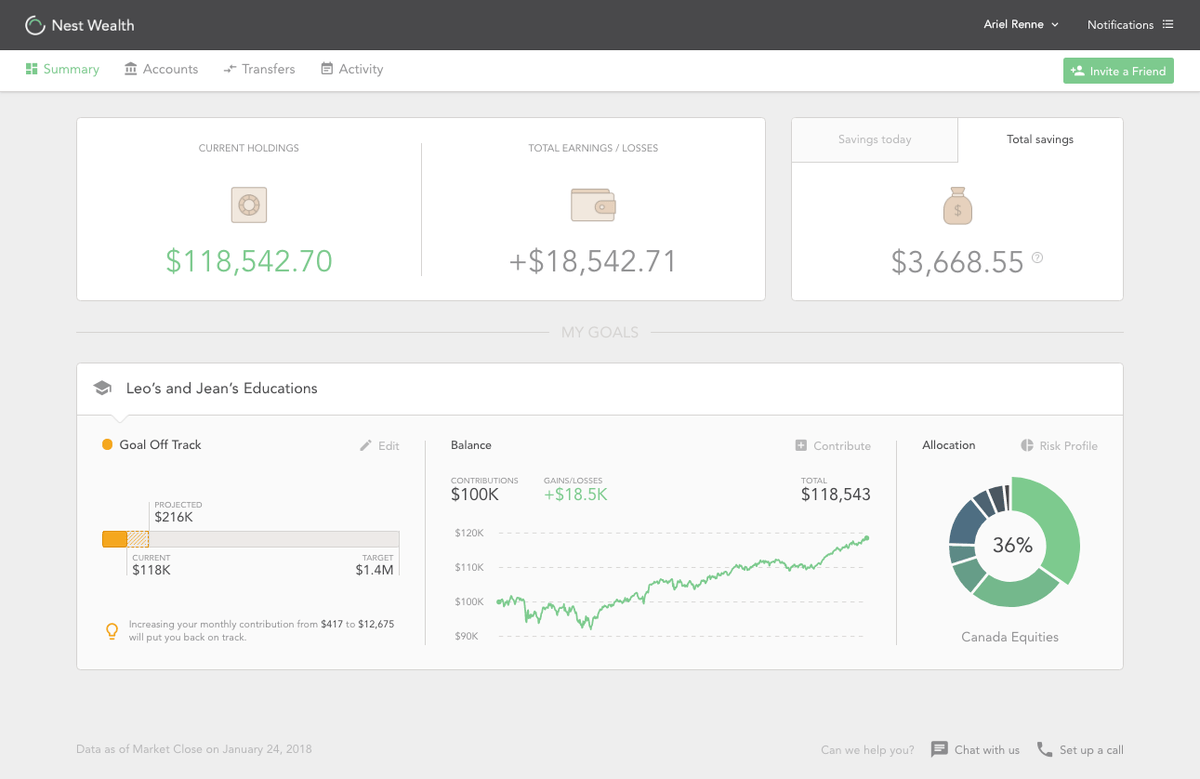

Nest Wealth Performance & Returns

Nest Wealth builds your custom portfolio by investing in low-cost ETF’s from seven asset classes: Short Term Bonds, Short Term Bonds, Medium Term Bonds, Real Return Bonds, Canadian Equities, U.S. Equities, Global Equities, and Real Estate.

Nest Wealth’s investment approach includes diversification of asset classes, regular rebalancing, and low-cost ETFs. Your portfolio will look unique depending on your investment goals, rebalancing, and risk tolerance.

For this reason, Nest Wealth doesn’t provide historical performances of generic portfolios. You can see the lineup of ETFs you will be investing in and check those ETFs’ past performance.

SCREENSHOTS

Flexibility

The Nest Wealth Robo Advisor gets a good score for flexibility. A hybrid robo advisor combines customized portfolios with professional human advice.

The entire rebalancing process is automated, but Nest Wealth has an ace up its sleeve: it offers investors the chance to talk or chat with a human financial expert to discuss portfolio options. You can do this by phone or email, and you can even visit the office, so you can speak with a human advisor personally if you’re in the Toronto area.

Ease of Use

The Nest Wealth platform is easy to use whether you’re using a tablet, smartphone, or laptop. Opening an account is easy and fuss-free. New customers can have a conversation with a human advisor to discuss a custom portfolio based on risk tolerance, goals, time horizon, investment style, and financial situation.

If you’re used to traditional investing, you will love Nest Wealth. If it gets too confusing, you get unlimited access to Nest Wealth’s team of expert portfolio managers. While this Robo Advisor is clearly suited for seasoned and larger investors, the user-friendly signup process and app interface are easy to understand, even for novice clients.

Account Types and Services

Nest Wealth is great for many investment types. Are you looking to build a retirement fund, or do you want to generate income from your retirement fund? Want to save enough money to buy a new home or car?

Need to create an educational fund for your children? Nest Wealth will allow you to do all of the above. It offers trust, corporate, joint, and LIRA and RRSP, TFSA, RESP, and RIF accounts.

Suitability for Different Budgets

The best thing about Nest Wealth’s subscription-based fee structure is that you can calculate your exact fees before signing up. This review found that fee-wise, the service is not the best choice for smaller investments.

But for larger investments, you are guaranteed to pay lower fees with Nest Wealth. Even though the service comes with a $0 minimum deposit, the fee structure favors clients with more money to invest.

Summary

There is a lot to like about Nest Wealth. The creation of customized portfolios and diversified asset allocations are a huge plus. The fee structure is one of the lowest on the market for larger investors. Sadly, we couldn’t say the same for smaller investors. But if you prefer automated investments with a human touch, look no further than Nest Wealth.

Give Nest Wealth a try using our link and get the first three months free of charge!