We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Less than a decade ago, investing directly in real estate as an individual was tough. Your options were essentially either to hear about a deal from a real estate developer you knew personally and invest millions in that one project or buy a rental property yourself. However, the 2012 Jumpstart Our Businesses Startup (JOBS) Act made it possible for firms to market their deals online. It ultimately led to the creation of the online real estate crowdfunding industry.

CrowdStreet, the largest online commercial real estate investing platform, gives individual investors direct access to deals that previously had been closed to all but the wealthiest and most connected. Some of the industry’s biggest firms have funded deals through CrowdStreet, including Greystar, Foulger-Pratt, and Harbor Group International.

How Does Real Estate Crowdfunding Work?

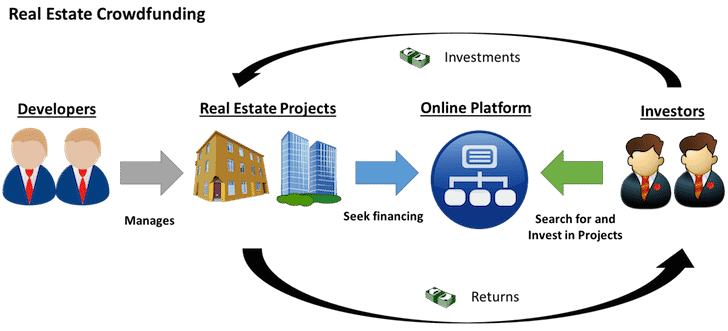

Real estate crowdfunding is a method of raising money for real estate deals. Just like any other kind of business-related crowdfunding, a larger group of people invest smaller amounts of money to raise capital for a project quickly.

- First, real estate developers or “sponsors” create a plan to purchase an asset and make any necessary changes to turn a profit—for example, an apartment complex that needs some updates to attract new tenants.

- Next, the sponsor lists the deal on a platform like CrowdStreet to raise the money they need to pull off their business plan from multiple individual investors.

- Then, as the sponsor enacts the plan and the asset (hopefully) becomes profitable, those investors will get their share of the returns.

Unlike more traditional real estate investing, crowdfunding has a lower barrier to entry. The old-school investing process for big real estate deals usually involved extremely high minimum investments and some personal connection to the sponsor or developer. Regulatory changes in the last decade, however, have made it possible for sponsors to list their deals on online platforms like CrowdStreet and market them to individual investors. This increase in access has made it far easier for the average investor to take advantage of the benefits of investing in real estate.

Why CrowdStreet?

With 488+ deals funded, $1.9+ billion invested, and $197+ million in investor distributions, CrowdStreet is one of the industry’s leading online platforms and our favorite option for accredited investors.

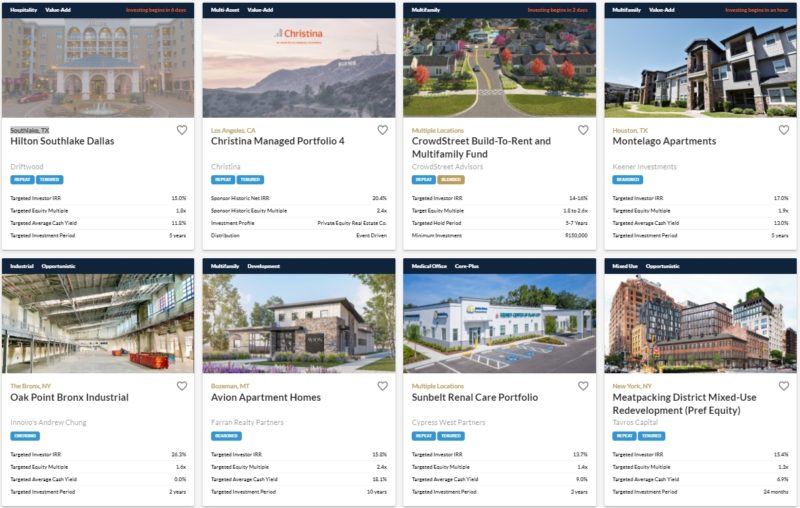

The CrowdStreet Marketplace gives investors access to institutional-quality real estate investment opportunities across every asset class and risk profile, allowing them to choose the right investment opportunity for their portfolios. To date, they’ve listed deals in 24 different asset classes and 40 states. They have some of the highest deal flow volume of any online platform, meaning more opportunities for investors to find something that fits their criteria. Whether you’re a seasoned real estate expert or completely new to real estate investing, they make it easy to find the approach that’s right for you.

To support their investor community and demonstrate their commitment to transparency, in 2020, CrowdStreet formally published their Investment Thesis. They kicked off 2021 with their first-ever “Best Places to Invest” report, which breaks down their top markets (both nationally and by asset class) so investors can see not only what kinds of deals CrowdStreet is considering but also where they’re looking.

What Kinds of Deals Does CrowdStreet Offer?

The deals on the CrowdStreet Marketplace all fall under the umbrella of commercial real estate, or CRE. This covers a lot more ground than might initially come to mind. A good way to think of CRE is in comparison to a single-family home, whether it’s owner-occupied or rented out, which would be classified as residential real estate. Almost everything else would be considered commercial real estate. That includes your local grocery store, the apartment complex down the street, and the warehouse where your Amazon packages are sorted.

Just like you can pick individual stocks and bonds, investors can pick individual deals on the CrowdStreet Marketplace. A direct real estate investment is just that—you can invest directly into the equity of the project of your choosing, not a fund that picks the assets for you. As a passive investor, you’ll leverage the power of online syndication (a.k.a. crowdfunding) and join dozens, potentially hundreds, of other individual investors to contribute to the equity stack in a real estate deal. Your capital will go directly to the sponsor/issuer for use in the proposed project. CrowdStreet also lists funds managed both by sponsors and by CrowdStreet itself, as well as professionally managed portfolios through their subsidiary, CrowdStreet Advisors.

How Does a Deal Get on the CrowdStreet Marketplace?

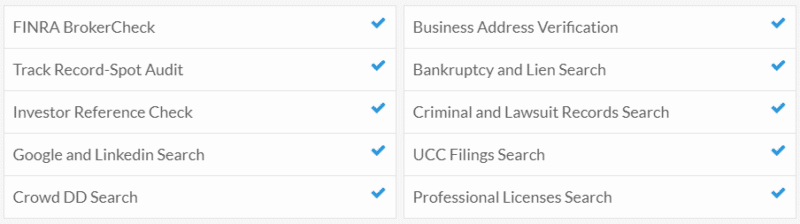

The CrowdStreet Capital Markets team seeks out best-in-class sponsors nationwide to find potential investment opportunities to list on the platform. Then, the Investments team conducts a 3-step review of each deal to see if it would be a good fit for the Marketplace, looking at the sponsor’s credentials, the deal specifics, and the legal documentation to ensure each meets CrowdStreet’s standards. As a result, out of every hundred deals they review, only about five make it all the way to investors.

How Do I Invest Through CrowdStreet?

The first step is to create a free account. CrowdStreet deals are only open to accredited investors, so you’ll need to provide documentation that you qualify before making your first investment. To be accredited, you need to have made more than $200k as an individual or $300k jointly in the last two years or have a net worth greater than $1 million, excluding your primary residence.

Investors have the opportunity to review the business plan and documents for deals on the Marketplace before investing begins. Each investment opportunity has its own specifics, with target metrics, payout structures, and max allocation amounts varying from deal to deal. CrowdStreet also hosts a webinar for each deal, allowing the sponsor to present the information directly to potential investors. During that webinar, investment opens, and CrowdStreet investors can begin submitting offers.

Because there’s a limited amount of investment money needed for each deal, slots are limited, and some deals will fill up very quickly. Others may be open for offers for a week or more.

Once offers are submitted, investors have some time to finalize the process and transfer the money. At this point, the investment management is fully in the hands of the sponsor, and they’ll carry out the steps outlined in the business plan. Sponsors are required to communicate regularly with their investors, and investors can track the performance of their deals on the CrowdStreet platform.