We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Justwealth is a Canadian robo-advisor founded in 2015 by Andrew Kirkland, the current Justwealth President, and it quickly became one of the most popular wealth management service providers. Justwealth has made it its mission to provide exceptional service to investors who are being overcharged and underserved.

Justwealth offers a transparent fee structure, personalized portfolios, and access to human financial advisors who provide expert-level advice. As a Portfolio Management Association of Canada (PMAC) member, Justwealth has continued to provide unbiased advice and serve investors with the highest standards.

Justwealth offers various investment portfolios and sophisticated financial counselling that ensure your money is invested in the best way possible to reach your personal financial goals. Justwealth aims to deliver convenient, affordable, and appropriate services meeting the needs of every client.

There is a minimum of C$5,000 to open an account with Justwealth. The exception to the $5,000 minimum is a Registered Educational Savings Plan (RESP). You can open RESP accounts with no minimum balance and begin saving for your children’s college education. There is a minimum monthly fee of $2.50 for RESPs.

| Annual Fees | 0.40% – 0.50% |

| Minimum Investment | C$5,000 (RESP Excluded) |

| Founded | 2015 |

| Headquarters | 1 Yonge St., Suite 1801,Toronto, Ontario M5E 1W7 |

| Socially Responsible Investments | Yes |

| Tax Loss Harvesting | Yes |

| Mobile App | No |

| Cash Management Account | No |

| Customer Support | Live Chat, Phone, Email |

| Support Email Address | [email protected] |

| Promotional Offer | C$50 – $500 Free Bonus (with Our Link) |

Account Types and Portfolios

Justwealth offers various account types and portfolios designed to meet every individual’s needs. Justwealth offers over 70 different portfolios, including various low-cost ETFs, to grow wealth, generate income, or preserve your wealth.

They offer taxable and non-taxable portfolios in either Canadian or U.S. dollars at no extra cost. A range of income-oriented portfolios is designed to help retirees who may need a fixed income level and don’t want to sell off their securities to provide an income.

The account types that Justwealth offers are specific to your financial goals. When you sign up for Justwealth, your personal portfolio manager will guide you through the process and help you create a goal-based financial plan.

If you want to save for your children’s education fund, you can open an RESP designed to start at a higher risk level and mature the same year your child is ready to use the money. This account is also referred to as a target-date portfolio.

A non-registered account allows you to invest unlimited money into your account. This can be an excellent option for investors, but these accounts aren’t tax-sheltered, and the gains must be declared on your income tax filing.

Justwealth also offers taxable accounts paired with their annual tax-loss harvesting plan, saving you money on your tax bill and tax-sheltered accounts such as individual and spousal RRSPs, TFSAs, and RRIFs. Currently, Justwealth is the only robo-advisor in Canada that offers tax-efficient portfolios specifically designed for investors who invest large amounts into taxable accounts.

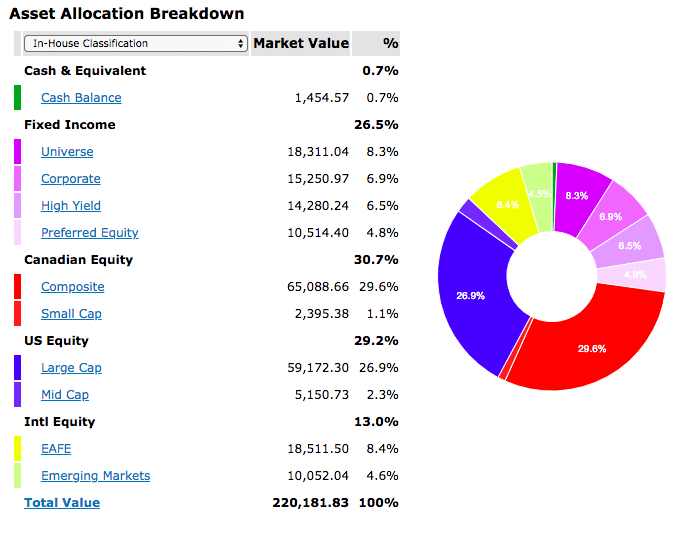

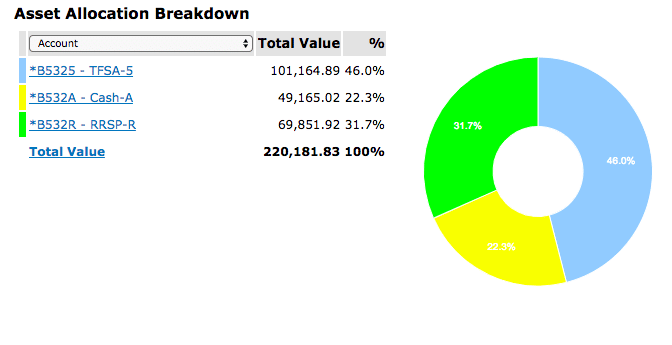

In your client dashboard, you can view your portfolio breakdown by Asset Class (on the left) or by account (on the right):

Account Types

- Individual & Joint Retirement Savings Plans (RRSP)

- Educational Savings Plan (RESP)

- Retirement Income Fund (RRIF)

- Tax-Free Savings Account (TFSA)

- Locked-in Retirement Accounts (LIRA)

- Life Income Fund (LIF)

- Non-registered investment accounts

Justwealth Pricing & Fees

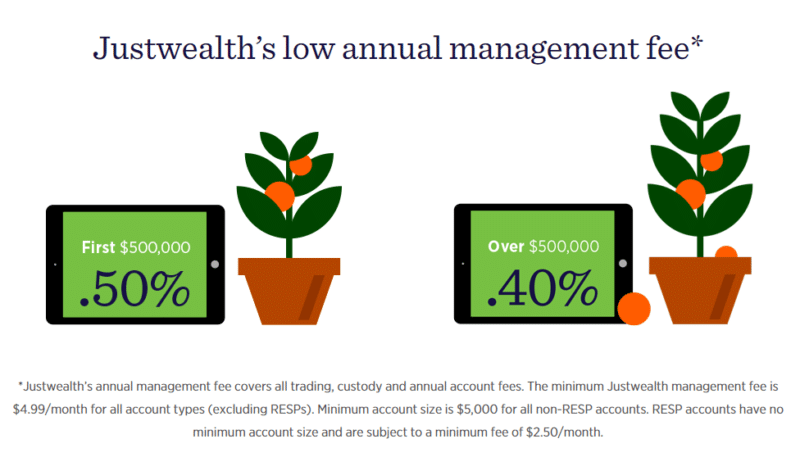

Justwealth’s management fees are straightforward, and you won’t need to worry about hidden costs that most mutual funds charge. Justwealth charges a 0.50% management fee for the first C$500,000, 0.40% for accounts over C$500,000, and an ETF fee around 0.25%.

How do Justwealth’s fees compare to other Canadian robo advisors?

Justwealth offers a premium service and personalization that many robo-advisors don’t provide to every client. We think that investors who take advantage of everything Justwealth offers to receive a service that is well worth the costs.

Justwealth vs. Wealthsimple

Justwealth and Wealthsimple are similar and have a similar fee structure. Both services have a base fee of 0.50%, which drops to 0.40% as your account balance increases. Wealthsimple’s fee drops to 0.40% for balances over $100,000, and Justwealth is 0.40% for balances over C$500,000. Justwealth also offers a few account types, like a spousal RRSP, that Wealthsimple doesn’t provide. For more info, please read our complete Wealthsimple review.

Getting Started

Opening a Justwealth account is similar to other robo-advisors. When you open an account, you will fill out a quick survey with your info and financial goals, and Justwealth will then recommend a portfolio that will meet your desired results.

After you’ve funded your new account, your personal portfolio manager will direct your funds into the ETFs in your portfolio. Justwealth currently invests funds in 40 different ETFs that meet different goals. Some ETFs are at higher risk, while others are designed to produce a regular income. The ETFs in your portfolio will depend on your financial objectives and risk tolerance.

Because Justwealth offers over 70+ different investment portfolios and doesn’t solely on algorithms to set up your portfolio, you can invest confidently that your financial goals will be met.

Once the setup process is complete, Justwealth will take care of the day-to-day monitoring of your account. The portfolio managers will monitor your account and make the necessary changes to keep you on the right track.

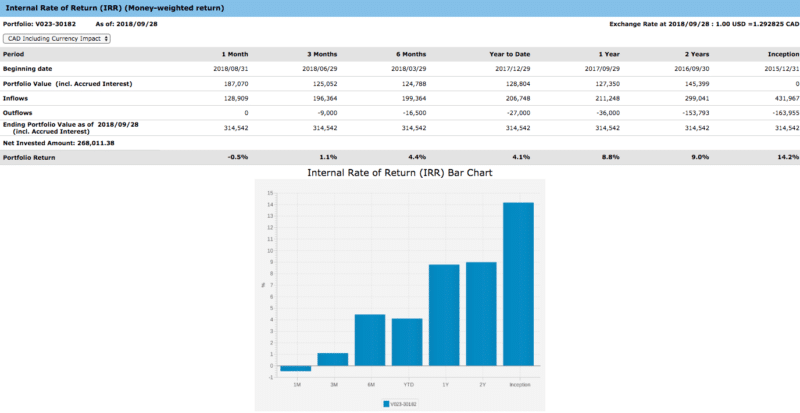

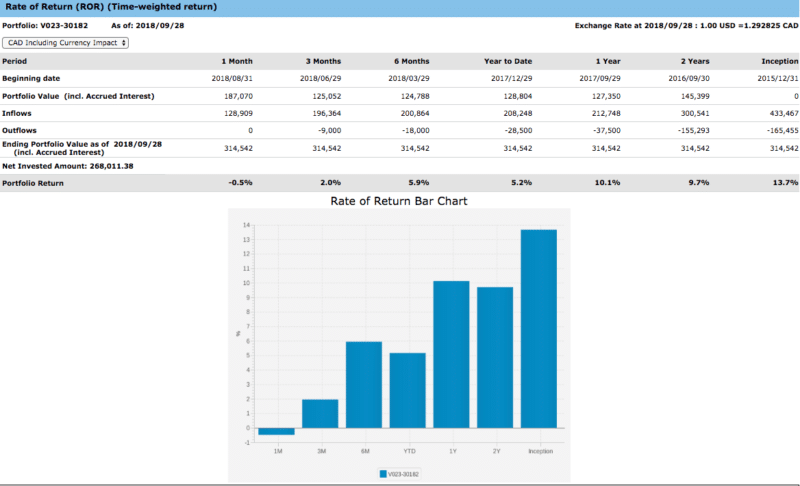

Multiple Performance Reporting Calculations

In your client account, you can view your portfolio’s performance by two different calculations: Money-Weighted (on the left) and Time-Weighted (on the right):

Justwealth’s Portfolio Review Service

If you want an overview of your current portfolio, Justwealth offers a free review service. Their investment professionals provide their unbiased opinion on how your portfolio is invested. Once you’ve submitted your review request, Justwealth will send you a report within 1 to 2 days. The report provides an overview of your hidden fees, investment diversification, and account structure.

This is a valuable service, especially if you have an investment portfolio and haven’t put much effort into managing it. You must submit a copy of your recent financial statements if you want to review your portfolio.

Financial Planning

Justwealth offers personal financial planning services at no extra charge, setting them apart from other robo-advisors. This service is complimentary and available to all Justwealth members upon request.

The financial planning that Justwealth offers can help you navigate financial decisions, help with asset allocation to get you on the right track for retirement, and help you achieve your big financial goals. Justwealth encourages members to take advantage of the service and provides unbiased advice as fiduciaries.

Justwealth Promotional Offer

Wouldn’t some extra money in your investment portfolio be sweet? We’ve partnered with Justwealth, and they have a special offer where you can earn a cash bonus when you open a new account.

The bonus is between C$50 – C$500, depending on the current value of your portfolio:

| Opening Account Balance | Your Cash Bonus |

|---|---|

| C$5,000–24,999 | C$50 |

| C$25,000–49,999 | C$100 |

| C$50,000–99,999 | C$225 |

| C$100,000+ | C$500 |

Historical Performance

Justwealth offers the historical performance of all of its portfolios on its website. The past performances are easy to read and understand, so you can check out how each portfolio has performed for the past months and years. Even though past performance doesn’t guarantee future success, it can give you an idea of what to expect.

When you go to justwealth.com/performance, you can check the historical performances of the various portfolios. And if you click on a specific portfolio, you can view more details about the specific ETF holdings, MER fees, and risk level:

| PORTFOLIO | 1 MTH. | 3 MTHS. | 1 YR | 3 YR | 5 YR | SINCE INCEPTION |

|---|---|---|---|---|---|---|

| (%) | (%) | (%) | (%) | (%) | (%) | |

| Global Conservative Growth Portfolio | -2.03 | 1.59 | -10.76 | 0.84 | 2.14 | 3.12 |

| Global Moderate Growth Portfolio | -2.83 | 2.81 | -10.31 | 2.86 | 3.72 | 4.92 |

| Global Balanced Growth Portfolio | -3.55 | 4.10 | -9.67 | 4.48 | 4.97 | 6.47 |

| Global Advanced Growth Portfolio | -3.70 | 4.86 | -9.70 | 4.44 | 5.28 | 5.62 |

| Global High Growth Portfolio | -3.94 | 5.45 | -9.45 | 5.05 | 5.66 | 7.32 |

| Global Maximum Growth Portfolio | -4.51 | 6.46 | -9.97 | 6.33 | 6.56 | 8.56 |

| Low Volatility Equity Portfolio | -3.17 | 4.79 | -12.52 | 3.03 | N/A | 5.79 |

| Global Tax-Efficient Conservative Growth Portfolio | -2.21 | 1.22 | -10.69 | 1.67 | 2.30 | 3.48 |

| Global Tax-Efficient Moderate Growth Portfolio | -2.95 | 2.03 | -10.77 | 3.34 | 3.71 | 5.08 |

| Global Tax-Efficient Balanced Growth Portfolio | -3.61 | 2.99 | -11.14 | 4.40 | 4.54 | 6.21 |

| Global Tax-Efficient Advanced Growth Portfolio | -3.89 | 3.78 | -10.92 | 4.97 | N/A | 5.87 |

| Global Tax-Efficient High Growth Portfolio | -4.15 | 4.60 | -10.74 | 5.41 | 5.69 | 7.49 |

| Global Tax-Efficient Maximum Growth Portfolio | -4.35 | 6.32 | -9.48 | 6.78 | 7.09 | 9.05 |

Justwealth does not publicly share its assets under management because it’s always changing. A Justwealth rep shared that their year-over-year growth has been at 100% for multiple years.

Summary

We found that Justwealth is an excellent choice and one of the best Canadian robo-advisors we’ve reviewed. If you can meet the initial minimum investment of C$5,000 and want to grow your portfolios with the help of trusted financial advisors, Justwealth is an excellent option.

The vast portfolio options and added human touch make Justwealth stand out. And the extra cash bonus when you sign up using our link is the icing on the cake.

Disclaimer: BestRoboAdvisors.org has entered into a referral and advertising arrangement with Justwealth and may receive compensation when you open an account or for certain qualifying activities. You will not be charged a fee for this referral.