We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Titan Invest is a robo advisor that offers everyday investors the ability to invest like world-class hedge funds. While we still use the term “robo advisor” here, they aren’t a typical robo like we’re used to talking about. More on that later.

While Titan Invest (sometimes called Titanvest) is not a hedge fund, it offers clients a personalized hedge designed to protect capital during market downturns. In doing so, they aim to replicate the investment strategies of high-quality, long-term focused hedge funds and outperform the overall market return in the long run.

As of September 2022, Titan has over 42,800 clients and over $792 million in AUM (assets under management.)

But the differences don’t just end there. Titan Invest has an in-house investment research team working behind the scenes for you. At every step of the way, their team of investment professionals provides in-depth videos, deep-dive reports, digestible market updates, podcasts, and more. They aim to keep you more informed about your investments than any other global advisor.

Titan Invest was launched in early 2018 by Clayton Gardner, Joe Percoco, and Max Bernardy. This robo advisor has a low minimum deposit, though the annual fee is higher than average. But before we get into the nitty-gritty in this Titan Invest review, let’s talk about hedge funds in general.

| Annual Fee | 0.7% – 0.9% (Market Index is Free) |

| Minimum Investment Amount | $500 |

| Total AUM (Assets Under Management) | $792 million+ |

| Number of Clients | 42,800+ |

| Cash Management Account | Yes, 5.28% APY |

| Headquarters | 110 Greene Street, Suite 910 New York, NY 10012 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | No |

| Discounts | $50 per referral |

| Free Version? | Yes, Market Index |

| Customer Support | Live support via email, phone, chat, and social media |

| [email protected] | |

| Phone | (908) 500-0207 |

What is a Hedge Fund?

A hedge fund is an alternative investment aiming to grow your capital while protecting (“hedging”) from significant market declines. Hedge funds are investments designed to minimize risk and maximize profits, with particular attention to maximizing profits. Although historically, hedge funds have been shown to increase profits over the long term, keep in mind there are also some downsides to this style of investing.

Unfortunately, genuine hedge funds are only available to accredited investors, or those with a net worth exceeding $1 million or assets exceeding $5 million.

But the hedging style of investing is available to anyone with the know-how. That’s where Titan Invest comes in.

Titan Invest Portfolio Selection

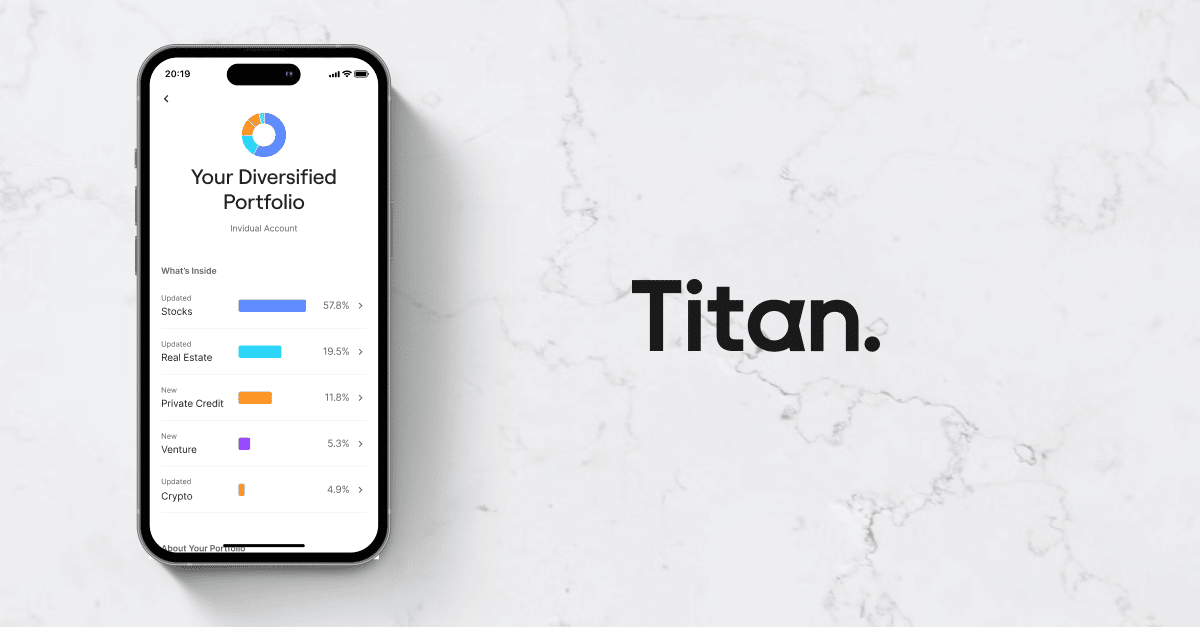

Similar to conventional robo advisors, Titan creates and manages your investment portfolio. But instead of building a portfolio based on traditional ETFs, Titan will invest your portfolio in a selected group of individual stocks or funds, depending on your portfolio selections.

Stocks

Titan offers four stock investment strategies: Titan Flagship, Opportunities, Offshore, and Market Index. Each investment strategy has the same underlying philosophy: find 15-25 of the best companies in the world and hold on tight for the long run. The 15-25 stocks are chosen by the investment team using bottoms-up fundamental analysis and a mixture of quantitative and qualitative analysis.

In the case of the Market Index, this portfolio aims to track the S&P 500, has around 500 holdings, automatic dividend reinvestment, and a low expense ratio of 0.03%.

Unlike the other actively managed portfolios, the Market Index strategy is managed for free.

Cryptocurrency

Titan Crypto is an actively-managed cryptocurrency investment strategy aimed at the Bitwise 10 Large Cap Crypto Index and holds 5-10 large-cap cryptoassets

Other Strategies

Titan also offers various other types of investment strategies across credit, venture capital, and real estate, through partners:

- Carlyle Tactical Private Credit Fund: Privately held credit performing across all market cycles

- Apollo Diversified Credit Fund: Generate a return comprised of current income and capital appreciation

- ARK Venture Fund: Aims to capitalize on disruptive innovation in the public and private markets

- Apollo Diversified Real Estate Fund: Invests in a combination of large, established private real estate funds and public real estate securities.

We like that Titan allows for a wide variety of investment portfolios and lets everyday investors access types of investing usually reserved for high-net-worth individuals.

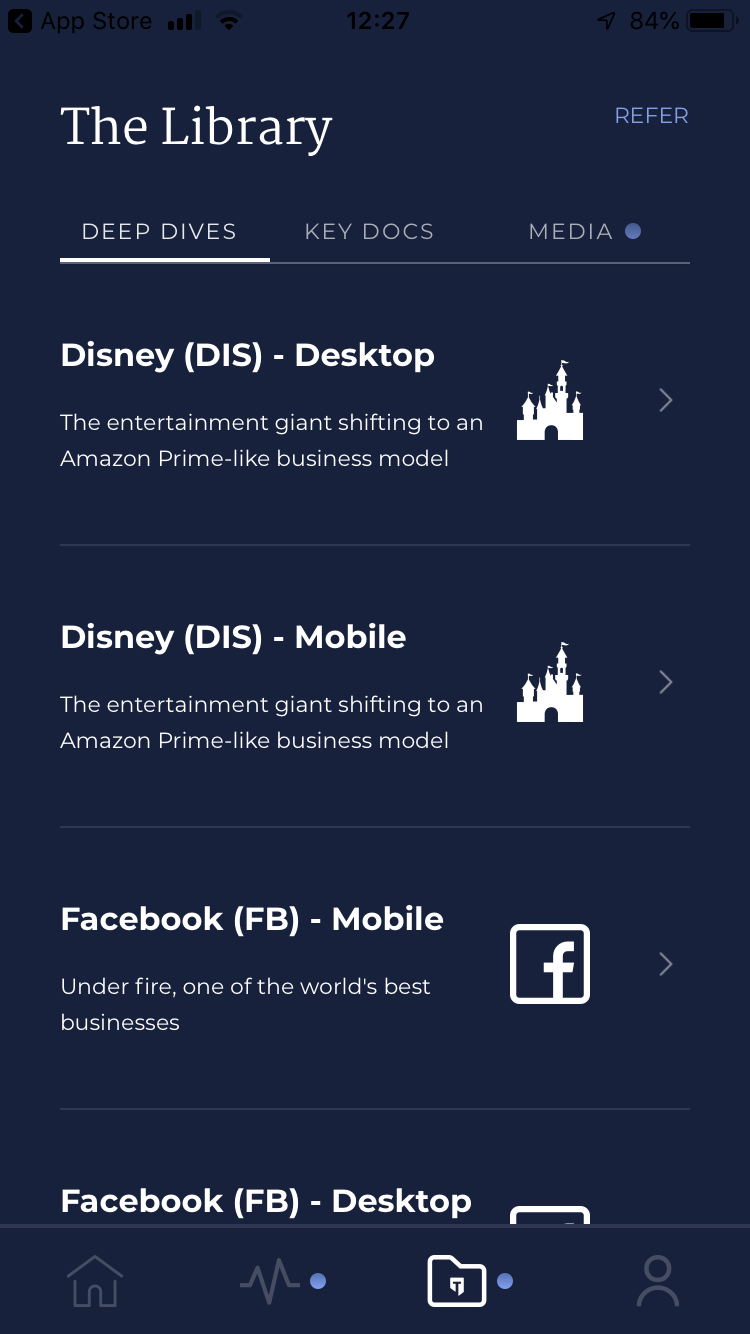

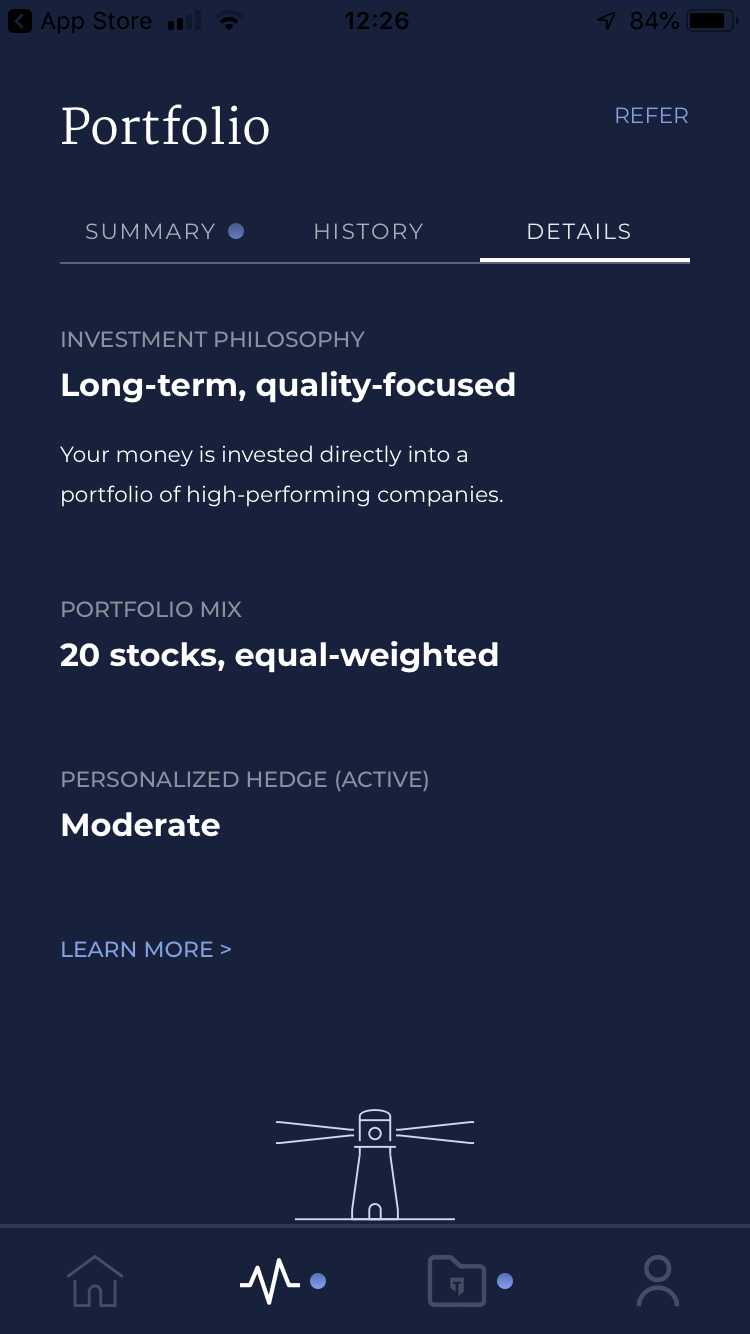

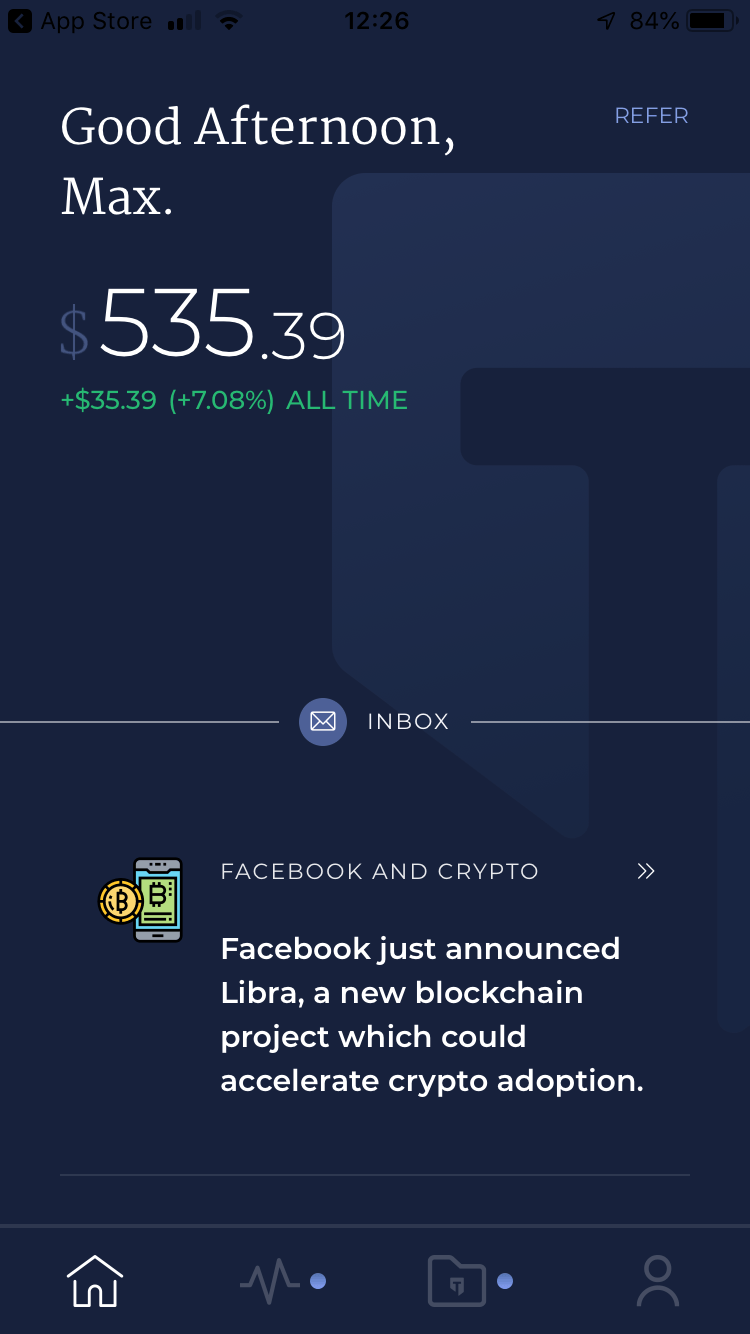

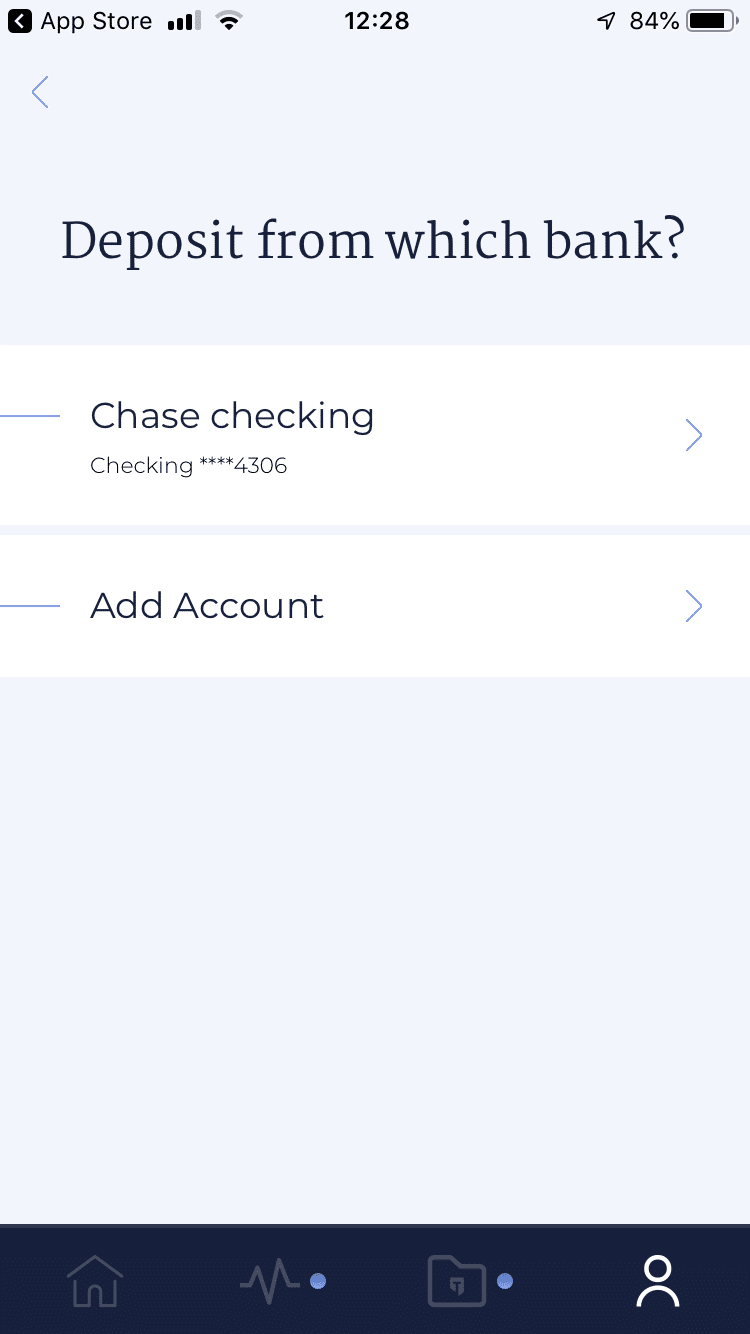

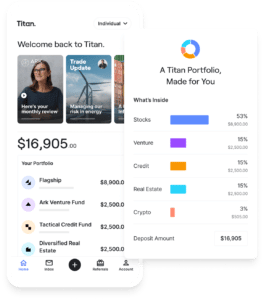

Screenshots

Titan Invest’s Costs & Fees

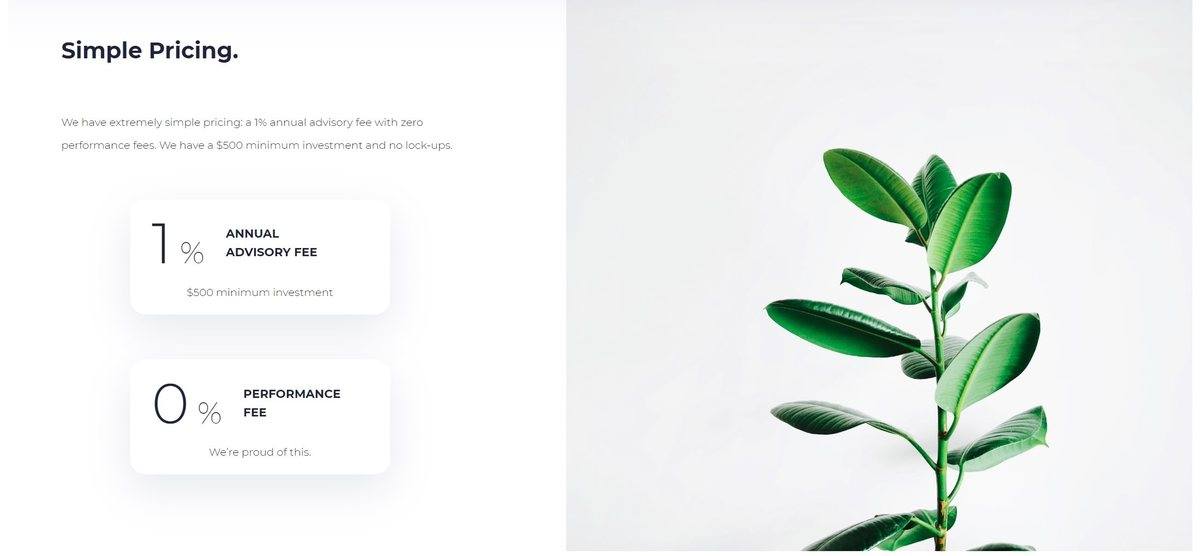

Titan charges an annual fee of 0.7% – 0.9% for their actively-managed portfolios, depending on your account balance. Here’s the breakdown:

- $500–$24,999: 0.9%

- $25,000–$99,999: 0.8%

- $100,000+: 0.7%

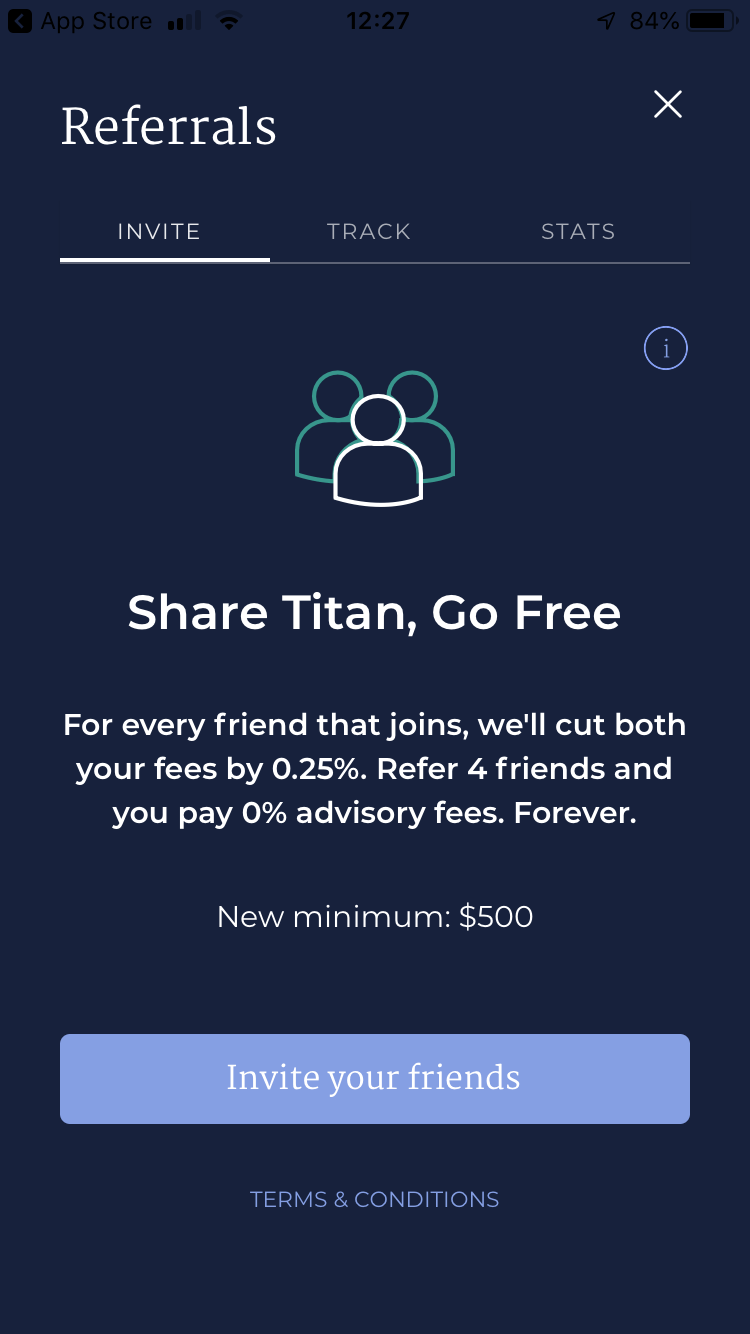

This is, of course, lower than their previous fee structure of 1.0%. Still, they removed the ability to reduce your advisory fees by referring clients, replacing it with a program that earns you $50 per referral (more on that below.)

Investing in the Market Index strategy is free of advisory fees.

Their partner strategies are priced independently, so be sure to check each of those before investing. For example, while exciting, the ARK Venture Fund comes with a high management fee of 2.75% annually and a total expense ratio of 4.22%.

The Carlyle Tactical Private Credit Fund has a management fee of 1.0% and a performance fee of 15% after they hit the 6% hurdle rate (the minimum acceptable rate of return).

You can open an account and start investing with Titan Invest immediately, as they have a low $500 minimum investment. This means you can sign up and start using the platform to give it a try before throwing all your money into it.

The real value of low minimum deposits is only in the ability to try out the platform before investing a more substantial amount later.

Referral Program

Every referral you refer to Titan gets a 100-day free trial, and $50 free. You also get $50 as a thank you. There are no limits to the amount you can earn, and your referral link is already built into your account.

Costs vs. Other Robo Advisors

How much does Titan Invest cost compared to other robo advisors? Titan’s new fee structure for 2023 is much better than before. The base rate is slightly lower than it was (1.0%), but they reward investors for depositing more money into their accounts by lowering the fees for higher account balances.

We would like to see Titan offer extra features for higher account balances like Wealthfront and Betterment, but that’s just nitpicking.

We do miss the old referral bonus of being able to lower your fees for each referral you made.

Account Types

Retirement (Traditional & Roth IRA, 401(k))

Titan will allow you to set up or roll over a Traditional or Roth IRA with the same benefits as Titan’s Individual Investment portfolios. That is, the same automated management, same annual fee, same style of investing like hedge funds, and the same referral program to lower your fees, but with all of the added potential tax advantages of an IRA. You can also roll over your 401(k) or 403(b) retirement accounts; they have a concierge system to help you roll those into your Titan account.

We think this is a great move and allows investors without individual taxable accounts to get in on a high-performance hedge fund-like investment portfolio. Due to regulations, you cannot invest in Titan Crypto with your retirement accounts; you’ll need a brokerage account.

Titan Cash

Like most modern robo advisors, Titan has a high-yield Cash account for Invest members. As long as you have a minimum of $1,000 invested with Titan, you can open a Cash account that offers 5.28% APY.

That’s significantly higher than your average US savings account, which sits at an embarrassingly low 0.58%, but quite a bit lower than some other high-yield savings accounts through other robo advisors such as Wealthfront (5.0%), Empower (4.7%), and Betterment (4.75%). It also only applies to up to $10,000, then the APY is dropped to 0.50%.

All funds are FDIC insured for up to $250,000, and Titan will pay the balance into your Cash account every month.

Titan Invest Performance and Historical Returns

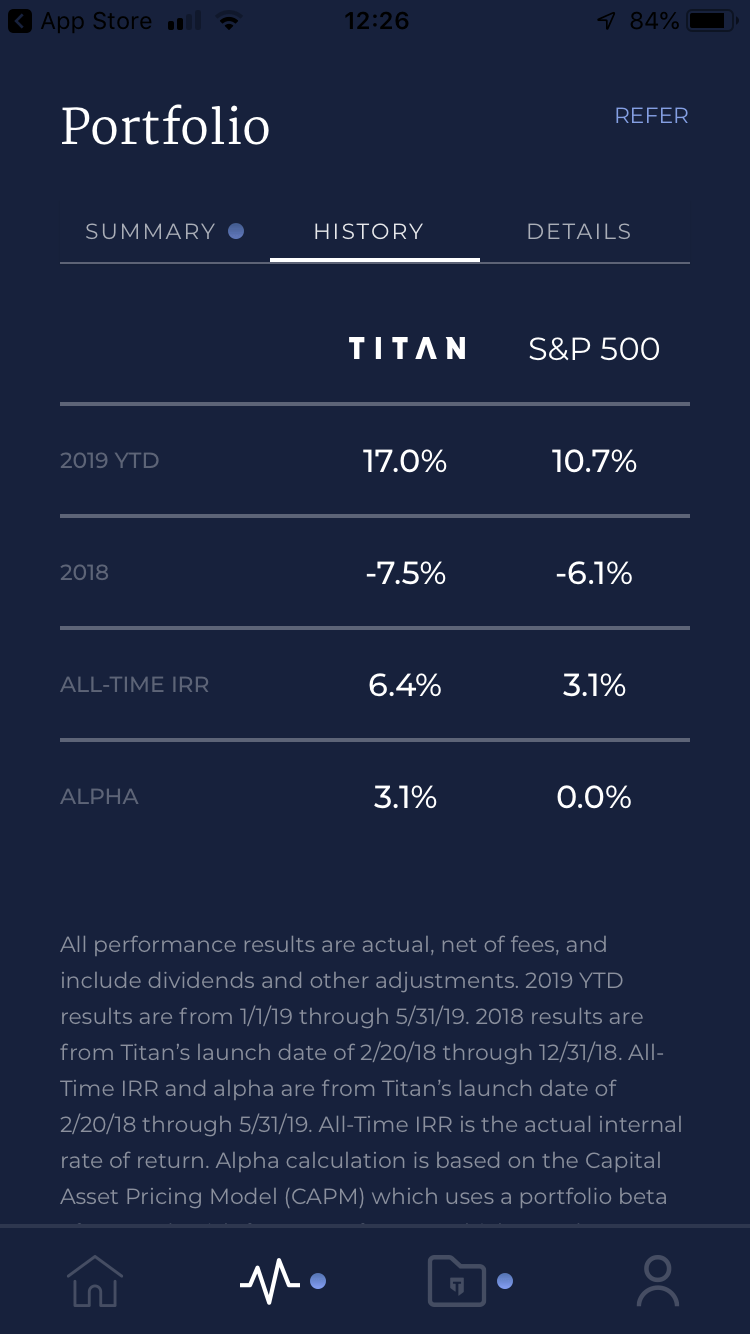

Titan Invest was only launched in 2018, so it’s tough to discern historical performance and returns over such a short period.

However, Titan has seen a very high rate of return since inception, usually far surpassing the performance of their target funds. Having said that, the recent market challenges have proven very difficult for our Titan portfolios.

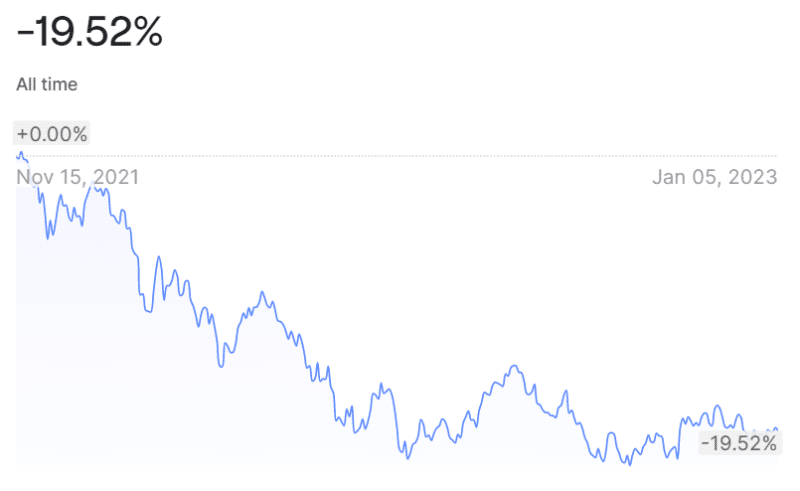

Titan Flagship Performance

As we mentioned, Flagship aims to beat the S&P 500 with its 20 large-cap stocks with an average market cap of $477 Billion. It hasn’t lived up to that goal as of January 2023, with a cumulative return of 48% after fees since its inception in August 2018, versus the S&P 500’s 63.4%.

Our portfolio has seen a decrease of -19.52% since investing in it in November 2021:

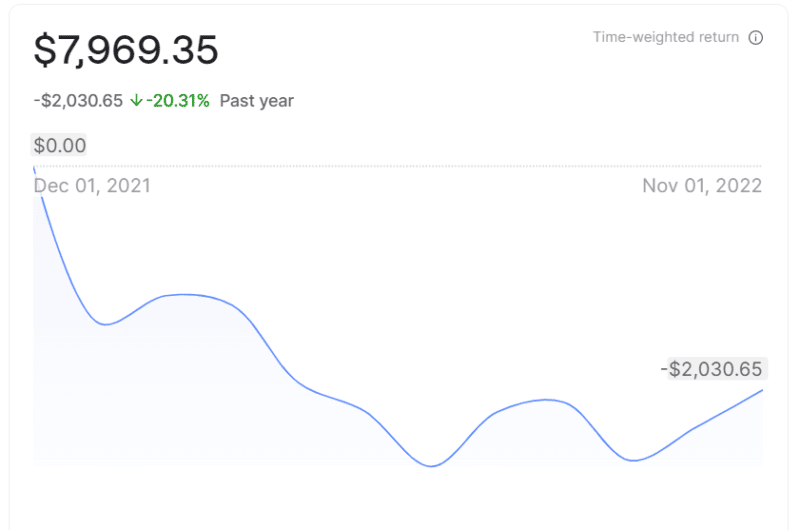

Titan Opportunities Performance

The Opportunities strategy, available to clients with at least $10,000 invested, is Titan’s U.S. small/mid-cap growth strategy aiming to outperform the Russell 2000. They do this by investing in carefully selected companies with a market cap below $10 Billion. By doing this, they hope to catch the “next big thing,” and so far, they’ve done a decent job.

Opportunities has outperformed the Russell 2000 since its inception in August 2020 by a few percentage points, returning 27.0% over Russell 2000’s 22.3%.

We invested in Opportunities in late 2021, and haven’t been so lucky, losing around -20% of our portfolio:

Titan Offshore Performance

The Titan Offshore portfolio was introduced in April 2021. Offshore aims to beat the MSCI World ex-US index. It has underperformed, with a loss of -29.8% compared to its benchmark’s -13.5%.

Our portfolio has lost around -15% since our investment in late 2021:

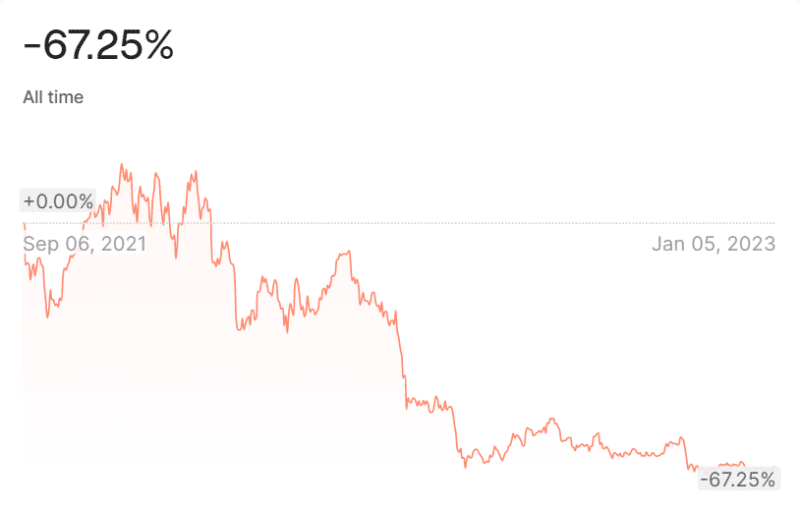

Titan Crypto Performance

Cryptocurrency investors have taken a severe beating lately. Luckily, if you invested in Titan’s Crypto portfolio aiming to beat the Bitwise 10 Large Cap portfolio, you might have lost slightly less money than average. Since its inception in August 2021, this portfolio has lost -60.3%, compared to the target’s -63.2%.

Our portfolio, which we started in September 2021, has lost a whopping 67.25%. Ouch:

See complete performance disclaimers at the end of this review and on Titan’s website.

Safety & Security

Titan Invest uses bank-level 256-bit encryption and Secure Sockets Layer (SSL) to process your data, so it’s safe. Your accounts are also SIPC-insured for up to $500,000.

Flexibility & Diversification

With the advent of hybrid robo advisors and personalized investment services, determining a service’s flexibility is getting tougher still.

With Titan, your portfolio is invested strictly in twenty top-performing stocks, and this means you are a direct owner of the stocks in your portfolio. This contrasts with other robo advisors investing exclusively in mutual funds or ETFs. So while you may be looking for broad diversification with some more general investment advisors, investing with a company like Titan is not meant for that – it’s made for a specific purpose, and that’s what they provide.

Their objective is to compound your capital at the highest rate possible over the long term, so Titan uses 20 high-quality stocks and a personalized hedge vs. a handful of ultra-diversified ETFs or mutual funds.

Ease of Use

Titan is only fully available via a mobile app. You can download the app from the Google Play Store and Apple App Store. Titan has a beta version available on desktop but is still working on the full web app. The mobile app is easy to use and has an excellent interface. It starts by supplying the necessary information like your name, social security number, email address, home address, and date of birth.

You then link your investment account to your bank account to make an initial deposit, or you can use wire transfers to fund your account. You can also use the mobile app to make automatic deposits in weekly, biweekly, or monthly increments to make sure you’re growing your portfolio effectively.

Conclusion

We hope you now have some insight into how choosing a hedge fund-like investment service can be smarter in a relatively volatile market. But this doesn’t come cheap when compared to other robo advisors. A better comparison may be Titan versus alternative managed investments (e.g., hedge funds) – they’re a great value on that basis.

Admittedly, we haven’t had very good luck with our Titan portfolio, but considering the current investment landscape, most portfolios aren’t looking so hot. Yes, a hedge fund is supposed to, well, hedge against these losses, but I’m still going to give them some time to see where things go. After all, their performance in 2020 was excellent compared to other investment services, so let’s see where things go.

Overall, we like the idea of a hedge fund-like robo advisor since it aims to compound your capital at an above-average rate of return over the long term while protecting you from significant losses in a down market. We also love that Titan gives smaller investors access to a type of investment research and portfolio management service, usually only for those with a high net worth.

Disclaimer: BestRoboAdvisors.org has entered into a referral and advertising arrangement with Titan Invest and receives compensation when you open an account or for certain qualifying activity, which may include clicking links. You will not be charged a fee for this referral, and Titan Invest and BestRoboAdvisors.org are unrelated entities. We must disclose that we earn these fees and provide you with the latest Titan Invest ADV brochure so you can learn more about them before opening an account. By signing up for Titan from this page, you acknowledge receipt of the Wrap Fee Brochure (PDF) and Solicitor Partner Compensation Disclosure (PDF). In addition, you understand the new account opening requirements. Solicitors may receive compensation for funded account openings on the Titan app through this referral landing page.