In a world where the stock market can feel as crazy as a Vegas casino with rapid volatility, widespread FOMO, and sky-high valuations, some people just want to invest in a reliable investment that accumulates value over time.

There’s nothing wrong with going for high-ROI investments if you have the risk tolerance and the financial capacity for it, but putting all your eggs into one basket is never a good idea.

Whether you look at real estate as your main investment vehicle or just another way to diversify your portfolio, there’s no doubt that the long-term stability it provides is certainly worth capitalizing on.

The internet has made all wealth generation methods more accessible to the general public, and real estate is no exception to that. Passive real estate investing, in particular, has become quite popular.

What is Passive Real Estate Investing?

Passive real estate investing is a form of investment in which you put your capital into a real estate venture that you don’t actively manage or have any direct responsibility for. There are quite a few ways to invest in real estate passively (vs. actively), and we’ll go over all of them in this article.

The simplest path would be to purchase stock in a publicly-traded real estate company like SPG, PSA, STAG, and similar options. This doesn’t always maximize returns, though, so read on if you want to find the best method for you.

Passive Real Estate Investment Goals

Investors usually have one of two goals when going into passive real estate investing – passive income or growth. Those looking for passive income hunt investment opportunities that pay regular dividends or fixed payments with interest.

On the growth side of things, you’re investing for the sake of seeing the properties appreciate. Once the appreciation has occurred, the property might be resold, and the profit will be distributed to all the investors.

There’s nothing wrong with looking for both regular passive income and long-term growth as well. Many investors choose a mixed portfolio for this purpose.

Types of Passive Real Estate Investing

Crowdfunding

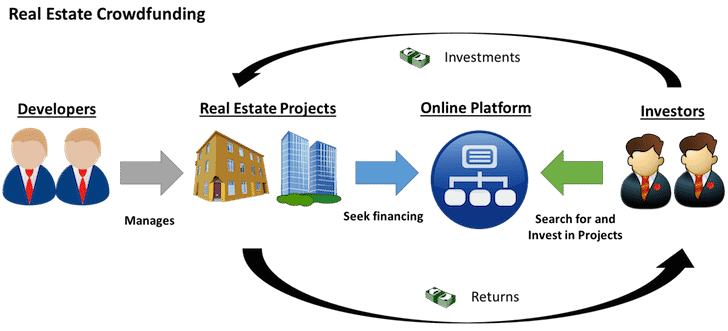

Crowdfunding campaigns take a similar approach to REITs. They reduce the barrier to entry of real estate by pooling multiple investors’ capital to acquire commercial or residential properties.

Some crowdfunding campaigns use social media platforms like Facebook, Twitter, and LinkedIn to advertise, while others rely on dedicated crowdfunding websites. Fundrise is a popular option for beginners, but CrowdStreet tends to beat the competition in the big picture if you’re accredited. If not, we really like DiversyFund (read review) for their low barrier of entry and low minimum deposit for all investors.

Rest assured, we’ll be covering various real estate websites in future articles to give you a clear understanding of their pros and cons. Be sure to subscribe to our mailing list, so you get updates whenever new content goes live.

The minimum investment in real estate crowdfunding ventures is often around $1,000, making it possible for people of all socioeconomic backgrounds to partake in the development or acquisition of even the most prestigious high-rise condominiums.

Of course, crowdfunding doesn’t come without its own set of risks. You’re essentially putting money into a company with little to no track record (at least in comparison to traditional stocks), so there’s always the possibility of losing the investment if the venture goes south.

The SEC has investment limits on crowdfunding campaigns for non-accredited investors. These are put in place to protect investors from losing it all in risky ventures. The cap usually lies at 5-10% of your annual income, depending on how much you’re putting in.

Debt Crowdfunding

Debt crowdfunding has investors financing property loans. This is one of the lowest risk forms of crowdfunding since the property itself secures the loans, but you won’t get anything beyond interest-only fixed payments.

We found Groundfloor Finance to be one of the best options for short-term, high-yield real estate debt investments, and you can start with as little as $10 minimum investment.

Preferred Equity Crowdfunding

This is a higher-risk alternative, but the return can also be greater. You’ll often get your return in the form of current payments, but you could also get accrued return at maturity with some properties.

Common Equity Crowdfunding

Common equity crowdfunding is often reserved for larger properties rather than single-family homes. Despite being the highest-risk option, you can bring the highest return since you’ll get a direct share of the net profit generated by the property.

REITs

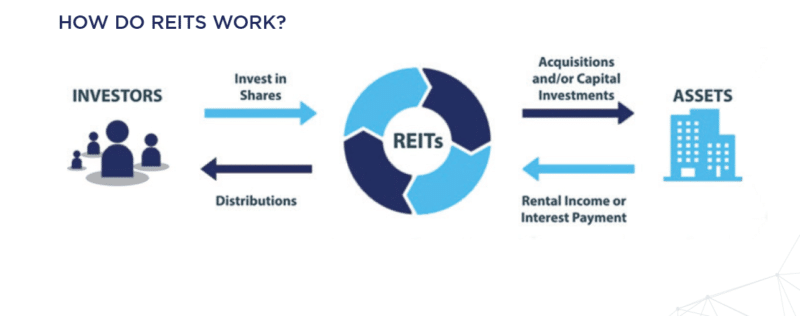

Real estate investment trusts (more commonly referred to as REITs) are companies that own, operate, and/or finance income-producing real estate, both commercial and residential. While online REITs are becoming increasingly popular, REITs themselves actually predate the internet.

They first came around in the 60s and continued to serve as a way for retail investors to get their cash into the property market without having to get a giant mortgage. It was a non-committal way to reap the benefits of rising real estate prices and passive income.

REITs start by scouting out properties with the potential to produce income reliably then purchase it with stockholder money. Once it begins leasing out the property, profit will be distributed across investors in the form of dividends.

Buying shares in commercial real estate portfolios was actually possible before the introduction of REITs in the 60s. However, it was only feasible for high-net-worth individuals with the proper connections to financial intermediaries.

Beyond monetary barriers to entry, REITs are also favored by some investors because they’re more liquid. You can easily sell your share in REITs like most stocks, whereas selling a physical property that you’ve purchased is a much more arduous process.

If words like escrow strike fear into your heart, then REITs might be the best option for you.

Properties making up REITs could include hotels, healthcare facilities, data centers, apartment complexes, energy pipelines, cell towers, retail centers, warehouses, self-storage, office buildings, and a myriad of other categories.

One of our favorite REIT investment companies, DiversyFund (read review), is unique here in that while the amount you invest (as low as $500) is not liquid for the first few years until they sell the property, you are a direct owner in their Growth REIT, and you don’t need to be an accredited investor. We think this is one of the best ways to start investing in real estate, with high potential value.

The most common types of REITs are:

Retail REITs

A quarter of all REIT investment goes into shopping malls and freestanding retail. If you’ve been to a shopping mall, it’s likely owned by a REIT. Bear in mind; retail REITs make their money from tenant rental income.

If their tenants experience poor sales and run into cash flow issues, they could default on the rent. At this point, it can be tough to find a new tenant to replace them.

Top Tip: Find retail REITs with reliable anchor tenants like home improvement or grocery stores.

Office REITs

Office REITs, as the name suggests, invest capital in office buildings. The tenants in this sector usually sign long-term leases, which can increase cash flow security. Of course, there are still some considerations to be made.

The ideal time to invest in office REITs would be while the economy is on an upward trajectory and the country has consistently maintained low levels of unemployment. Also, take note of the vacancy rates both on the market as a whole as well as the specific property in question.

Pro Tip: Pick office REITs in economic strongholds like New York City or Washington D.C. rather than rural or crime-ridden areas. Lastly, find a REIT that has enough capital for acquisitions to keep growing and avoid stagnation.

Mortgage REITs

$1 out of every $10 invested in REITs goes into the mortgages rather than the real estate itself. Freddie Mac and Fannie Mae are two government-sponsored enterprises that purchase mortgages through the secondary market, for instance.

While investing in mortgages rather than equity is generally considered safer, it’s important to understand that they aren’t risk-free. If interest rates rise, the book value of mortgages will drop, and the stock itself will follow suit.

The majority of mortgage REITs come from debt offerings (both secured and unsecured.) If interest rates were to rise, financing would become more expensive and start reducing the value of the portfolio as a whole.

Residential REITs

Residential REITs operate and own multi-family rental apartments along with manufactured housing. If you’re considering investing in this form of REIT, then aim for urban centers with low home affordability for tenants.

Los Angeles is the perfect example since single-family homes are too expensive, and thus more people rent — reducing demand and raising the amount that landlords can charge each month. Rural properties also tend to struggle with lower occupancy rates.

Pro Tip: Try to find apartments close to schools, in low-crime areas, and have good access to public transportation. These perks drive up the rental price and increase the odds that every unit will be occupied year-round.

Healthcare REITs

The healthcare subsector could be a good subsector for REIT investors who want to capitalize on the aging population. Both America and Japan have seen rapidly growing senior populations who require regular healthcare.

These REITs include medical centers, hospitals, nursing facilities, and retirement homes. Occupancy and Medicaid/Medicare reimbursements provide most of the income to such facilities.

Pro Tip: To reduce your risk, find a healthcare REIT that diversifies between different facility types. Look for companies with a solid track record in the healthcare space, have robust balance sheets, and easily access low-cost capital.

Best Real Estate Crowdfunding Sites

- Excellent Historical Returns

- High Relative Liquidity

- Low ($10) Minimum Investment

- Tons of Investment Options

- Low Management Fees

- Open to non-accredited investors

- Low minimum investment ($500)

- No management fees

- Completely Automated

- Free $50 Amazon gift card (with our link)

More Real Estate Investing Articles

- Fundrise Review 2023: Real Estate Investing for Everybody

- RealtyMogul Review (2022) – Passive Real Estate Investing For Everyone

- Active vs. Passive Real Estate Investing: In-Depth

- DiversyFund Review: Pros, Cons, and Who it’s Best For

- How to Invest in Real Estate with CrowdStreet

Choosing the Right Industries

Whether you’re investing in real estate online or in person, the same advice holds true: always pick industries carefully. The retail sector is perhaps the most applicable example. After all, it’s been in decline for years.

The last thing you’d want to do is put all your money into shopping centers only for consumers to complete their transition to eCommerce.

In contrast, putting your money into healthcare facilities could be far more lucrative in the long term as baby boomers finally enter their golden years. It’s all about planning ahead in anticipation of the socioeconomic shifts that the population will go through.

Don’t Chase Yield

Getting a good ROI is always nice when investing, but you mustn’t start chasing raw yield at all costs. If you’re investing in REITs and see a 15% annual dividend, then it might be tempting to dump all your cash into that.

However, REITs with interest rates this high are generally considered risky investments. In fact, the high yield is usually a way to draw investors into failing sectors that provide low security. If the yield was equal, no one would be investing in that industry anymore.

The same holds true for properties that you buy yourself if you’re active investing. If you see a cheap house that you think you’ll be able to rent out at a huge profit, then start thinking about why it’s so affordable. Is there a catch?

You might be saving some money upfront by buying a surprisingly underpriced property, but you’ll either struggle to find tenants due to high crime rates or spend all your profit on repairs due to poor construction standards.

When you put hard-earned money into a property or fund, always look at the big picture. If you don’t look at the long-term considerations, then you’re bound to lose money in the end.

Finding Properties

Finding properties to invest in if you’re actively investing is much easier now than it has ever been before, thanks to the advent of digital listings. While someone in the 60s may have had to spend hours circling classified ads with a Sharpie marker, you can just run a Google search.

Instead of buying newspapers or going to real estate agents, you could literally just navigate to a website and set your filters up. Zillow, Trulia, and similar platforms help you narrow things down using criteria based on your personal preferences.

It’s much faster to add filters for square footage, price, and location rather than manually scan classified ads on the newspaper looking for keywords. The modernization of real estate marketing is one of the breakthroughs to hit the market in recent decades.

Conclusion

As you can see, technology has made it far easier for investors to get into the real estate market. Whether you want to dip your toe in the water by putting a portion of your monthly income into REITs or find your fifth rental property, the internet can hasten the process.

Be sure to subscribe to our mailing list, so you get notified when we release well-researched articles covering other aspects of real estate investing.