We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

If you are a beginner in the investment world, you’ll be happy to know that FutureAdvisor offers impressive flexibility and an easy-to-use interface. So easy that we would like to believe that this automated investing service was deliberately made for newbie investors.

Seasoned investors will also feel at home with FutureAdvisor because it also offers direct management of taxable investment accounts.

FutureAdvisor was first established in 2010 by former Microsoft engineers Bo Lu and Jon Xu, and it is now a major player in the field of automated investing.

In 2012, this Robo Advisor managed over $600 million worth of assets, and for 2019, that figure has climbed to approximately $900 million. FutureAdvisor is now backed by the same venture capitalists that funded PayPal and Google, and their team is composed of data scientists, finance professionals, and software engineers.

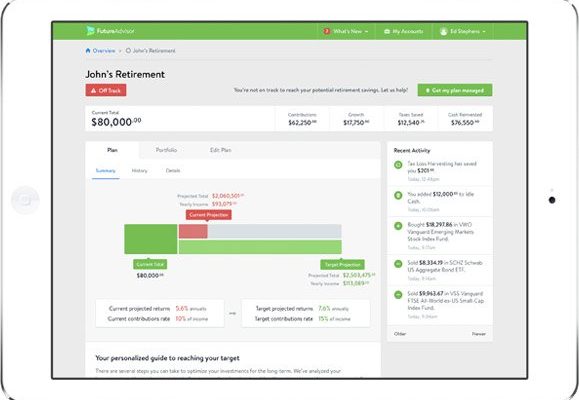

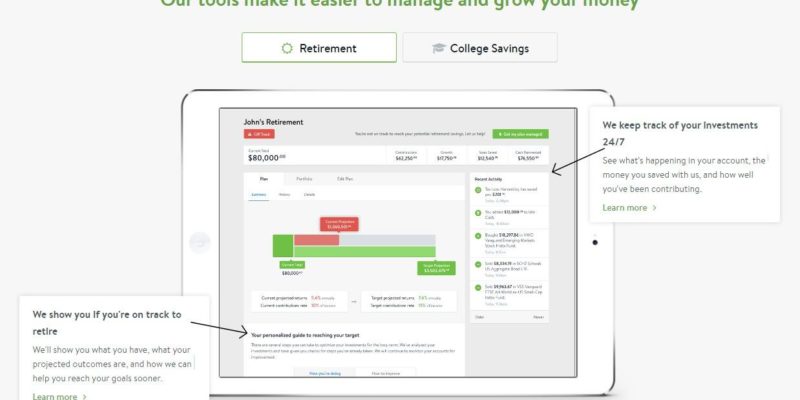

Screenshots

FutureAdvisor Fees

Investment Management

This includes services such as dividend reinvestment and automatic rebalancing, and costs 0.50% annually with a $10,000 minimum balance.

Retirement planning

This service will analyze and manage your funds while making future recommendations to improve your portfolio. The retirement planning service is free to use.

College Savings

College savings is a free service from FutureAdvisor and it will help you plan and optimize for you or your children’s financial education plans.

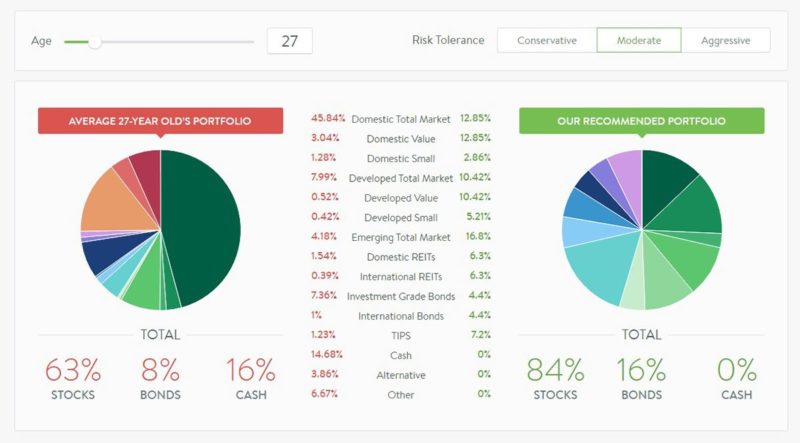

FutureAdvisor will allow you to link all your current investment accounts so you can receive in-depth allocation advice. The initial advice is based upon your current brokerage account, age, and expected retirement date. This free advice is available for any investment account.

Flexibility

FutureAdvisor scores high in terms of flexibility. As previously mentioned above, the ability to link your current brokerage accounts without having to transfer or close your investments is a welcome feature to have.

You can either act upon your own accounts, or let the Robo Advisor do the rest of the work. You can also turn down certain recommendations when desired. If you choose the FutureAdvisor Premium Service, you will gain access to a full range of services but there’s a catch: you will have to transfer your accounts if you’re not using the Fidelity and TD Ameritrade platform. Luckily, FutureAdvisor is happy to assist in this regard.

Ease of Use

FutureAdvisor is extremely easy to use. The fact that you can get tons of useful financial advice and guidance – even without making a deposit or transferring your brokerage accounts – is actually quite impressive, and the advice is easy to understand even if you’re new to investing. FutureAdvisor will literally walk you through the entire process, and will even explain what changes should be made in your portfolio and why the changes are necessary.

FutureAdvisor also comes with a user-friendly tool to accept or reject individual recommendations, and also offers assistance in transferring your accounts.

Account and Investment Types and Services

FutureAdvisor has one of the most varied selections when it comes to account types. Along with traditional taxable accounts and IRAs, you can also manage 401(K)s on the Fidelity platform. In terms of investment options, FutureAdvisor will allocate your investments between stocks and bonds ETFs.

The service also offers retirement planning and college savings as a FREE service. It can also open and manage 529 accounts. The investment management service will cost you 0.50% annually for a minimum balance of $10,000.

Suitability for Different Investment Budgets

FutureAdvisor is ideal for both small and big investors. However, we find the 0.50% management fee to be pretty expensive compared to other Robo Advisors, including the $10,000 minimum investment balance to access the Premium Service. But if you don’t want the Premium Service then you can still get excellent asset allocation advice, which FutureAdvisor offers for free.

Overall Summary

You can think of FutureAdvisor as a bridge that spans the gap between traditional financial advisors and a fully automated investing service. General asset allocation is offered for free and is generally available for all types of budgets.

The FutureAdvisor Premium Service is ideal if you have at least $10,000 in your investment account. The 0.50% management fee is steep, but paid accounts get a full plethora of services which includes automated rebalancing and reinvestment.

Overall, we find FutureAdvisor to be an excellent choice for many types of investors. It is not the cheapest Robo Advisor in terms of management fees, but it certainly isn’t the most expensive either.