We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Welcome to our Polaris Portfolios Robo Advisor review. We’ve been hearing a lot of talk about Polaris Portfolios and most of them border on the positive. Some investors even say this Robo Advisor is one of a few (if not, probably the only one) with genuine investment management knowledge.

Polaris Portfolios was founded by Evan Kulak, Grant White, and Mike McDermott. This trio of experts worked for Merrill Edge, Oracle, and other successful start-ups before establishing Polaris Portfolios, a new kind of investment service that utilizes top-notch investment strategies.

In this review, we will take a closer look at those strategies and see if this Robo Advisor truly deserves its place as a finalist for the Best Robo Advisors in the 2017 Benzinga Fintech Awards.

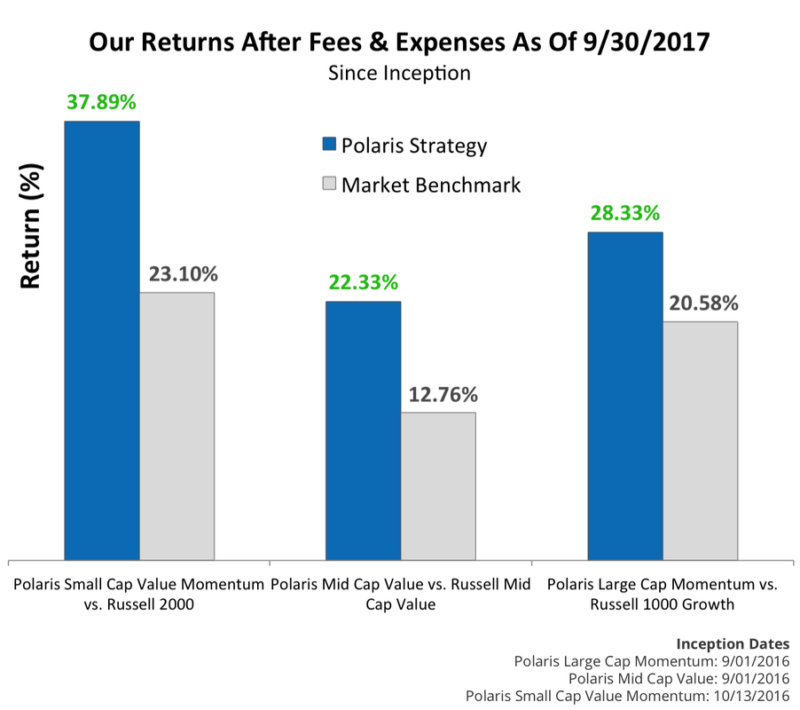

“Unlike a lot of robo advisors that invest in third-party index funds, we use our own proprietary investment strategies to deliver a diversified portfolio designed to provide greater exposure to long term out-performance factors.”

Polaris Portfolios Fees & Pricing

Polaris Portfolios charges management fees of 0.95% per year and has no minimum deposit.

While they did lower their minimum deposit amount a great deal (from $5,000,) there is no longer a drop in management fee over a certain balance (which used to be $100,000.) This is fine for most people but leaves their annual fee at a much higher than average level.

0.95%

Annual Fee

Polaris Portfolios fares badly compared to M1 Finance, Betterment, and Wealthfront since they charge significantly lower management fees.

Polaris Portfolios has no deposit or account minimum. Investing a small amount isn’t going to make you rich, but it’s a good way to dip your feet into the water, so to speak, before committing to a higher contribution. Polaris’ minimum balance used to be $5,000, which I could see making some investors nervous.

On another plus side, Polaris Portfolios has $0 trade fees, $0 transaction fees, no load fees, and no rebalancing fees. It is also possible to open multiple investment accounts with the condition that each account should fulfill the $500 minimum balance.

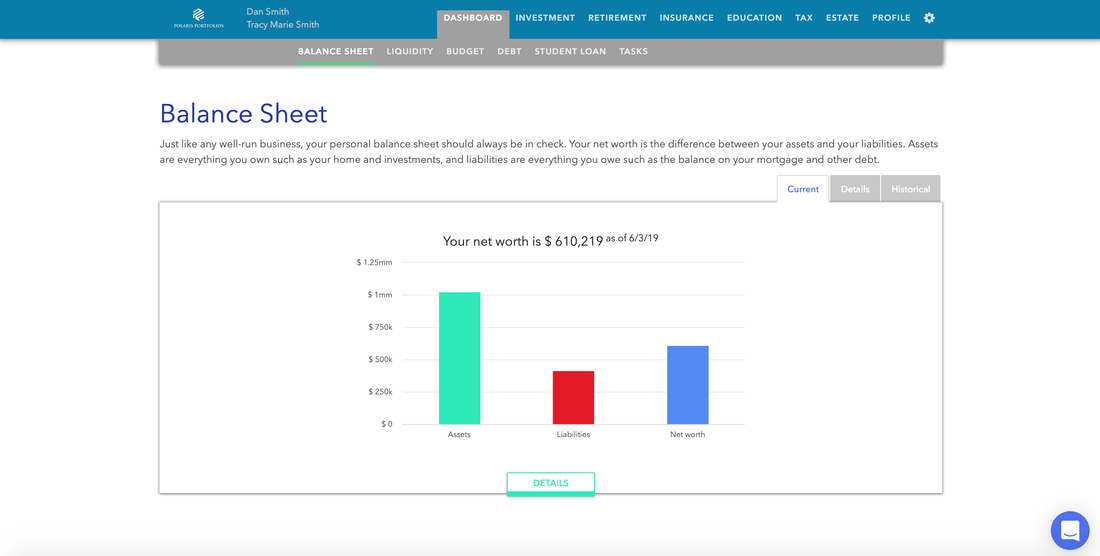

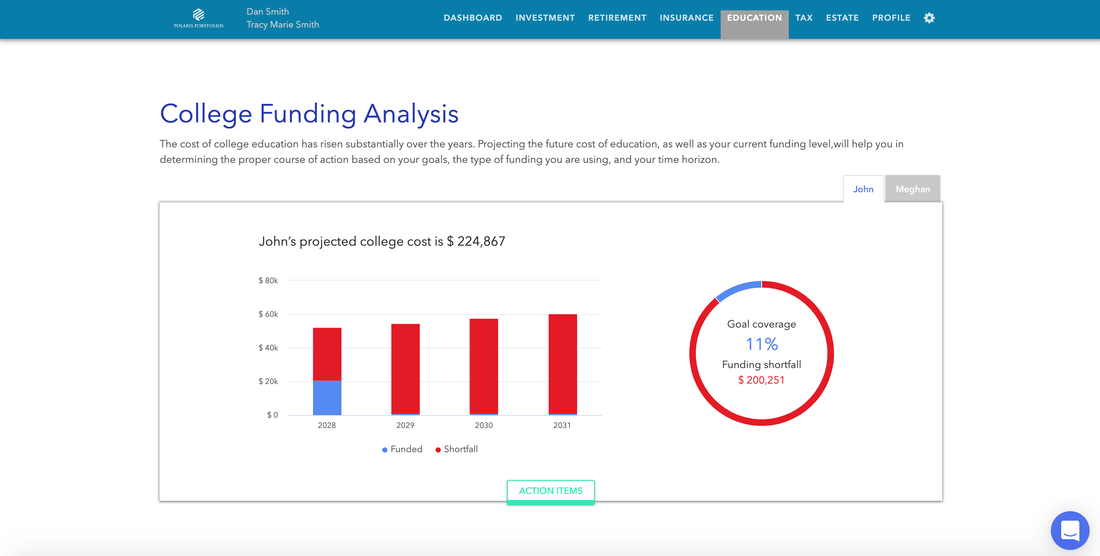

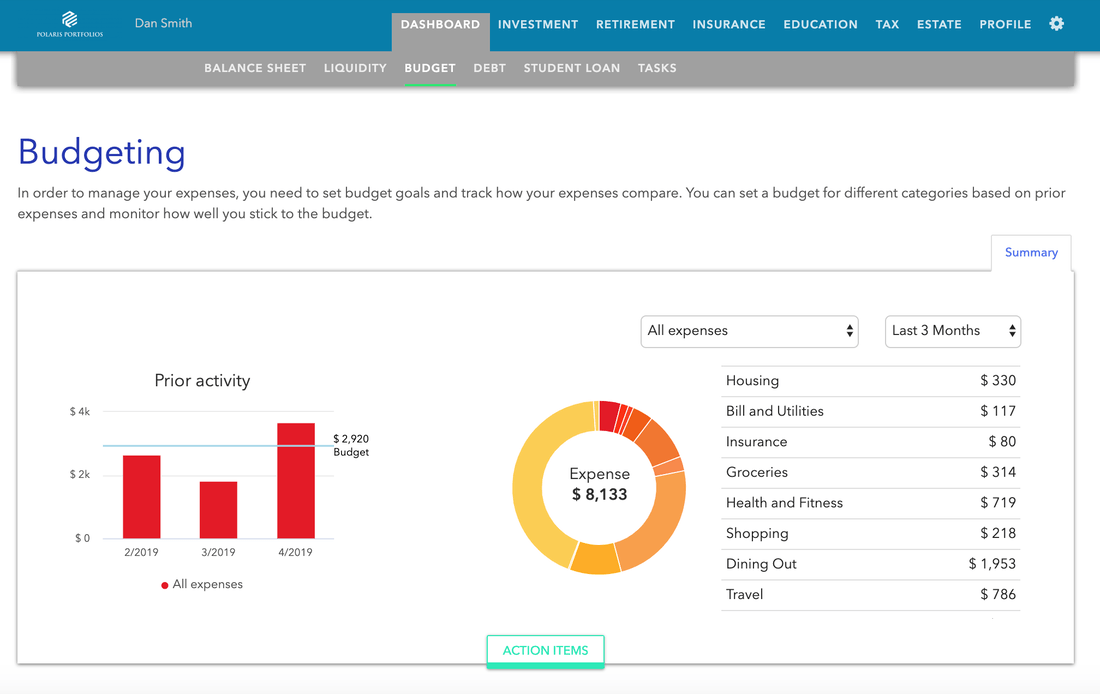

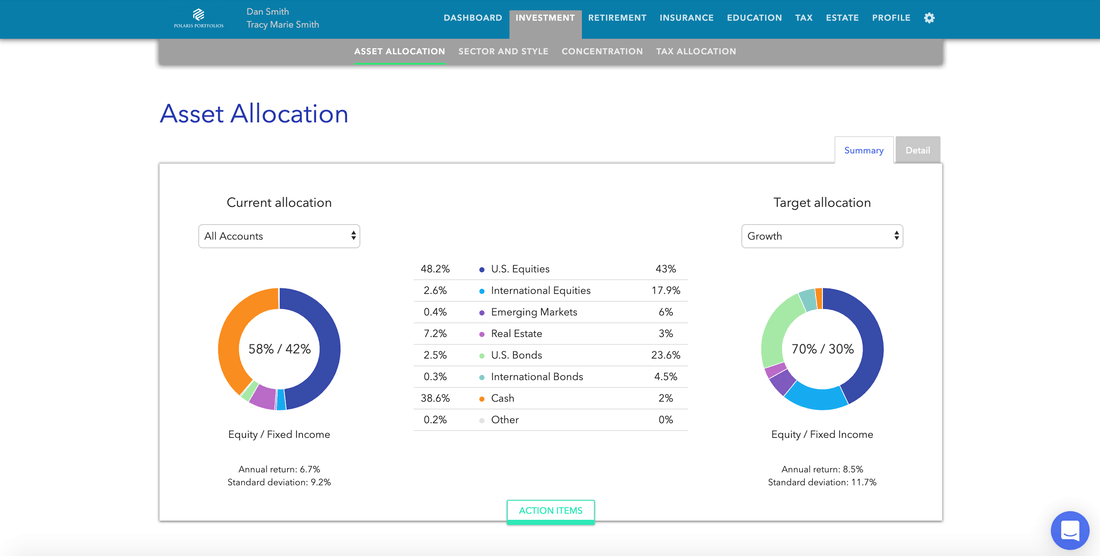

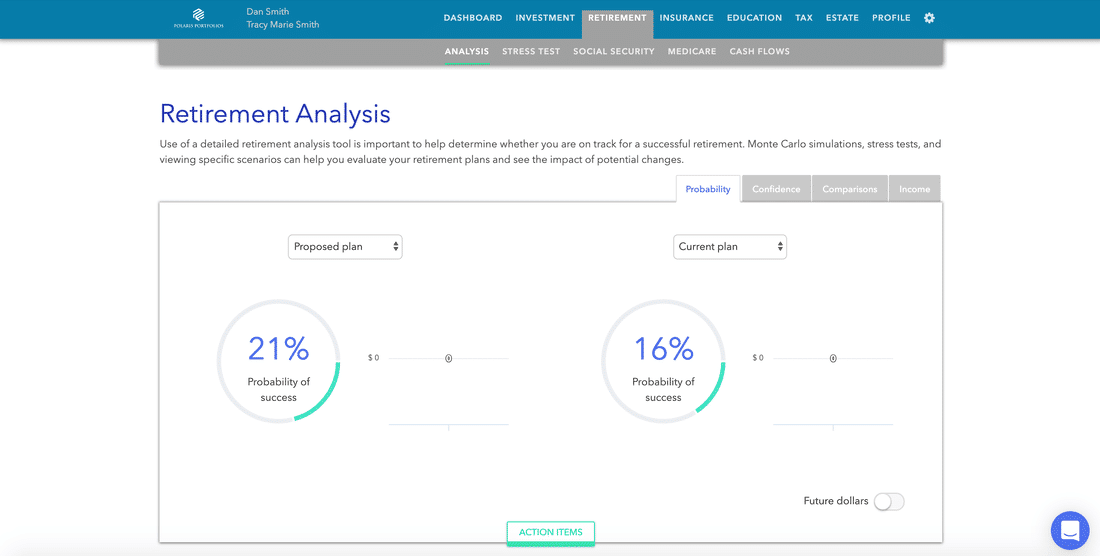

Screenshots

Flexibility

If you’re choosing a Robo Advisor, you should always consider the flexibility of the service. Polaris Portfolios is a fully-automated investment service with a human touch. The service offers unlimited email support. Simply send them an email and an investment representative will answer your query within one business day.

However, the service will not handle outside brokerage accounts. It is also worth noting that this service is only available for permanent residents of the United States with a valid U.S. Social Security number or Tax I.D.

Even though the investment service is fully-automated, Polaris Portfolios offers a personalized approach by allowing you to choose your investment goals. Upon signing up, the system will ask you on what goal you are hoping to achieve. Is it to build wealth? Retirement? Education? Do you want to purchase a car, a house, or save up for your dream vacation in the Bahamas? The system will let you choose the goal that is suitable for your needs.

If you are the type of investor that wants a hands-on approach to investing, Polaris Portfolios is not for you. The system will simply invest your money in a diversified portfolio and will automatically rebalance the portfolio.

With that in mind, we were a bit confused with the flexibility of Polaris Portfolios. The high account minimum is not good for newbie investors while the fully-automated service is not exactly a boon for huge investors who want to get in on the action.

Ease of Use

Similar to fully-automated Robo Advisors, Polaris Portfolios is remarkably easy to use. In this regard, this Robo Advisor gets a high score. The entire sign-up process is fuss-free and begins with choosing your desired financial goal. After that, simply fill out the questionnaire that consists of the targeted amount, the target date, and the initial contribution you wish to make.

The system will also ask for your annual income and your age along with your risk threshold. After all the boxes have been ticked, simply click on the Invest Now button and you’re done. The system will do the rest for you.

If you are new to this type of investing service, it is easy to get dazzled by all the figures and graphs on the interface. But when you get used to it, it is easy to find the information you want.

Account and Investment Types and Services

Polaris Portfolios supports both taxable and non-taxable accounts. The service is good for individual and joint accounts including IRAs.

The system is designed to sustain long-term outperformance (their word, not ours) by utilizing what the company calls Strategy Performance, which puts a bit more emphasis on better returns.

The system utilizes large-cap strategies (investments in U.S. companies with a market capitalization of $7.5 billion), mid-cap strategies (investments in U.S. companies with a market capitalization between $1.5 and $7.5 billion), and small cap strategies (investments in companies with a capitalization between $250 million and $1.5 billion) along with values based investments in stocks.

The unique thing about Polaris Portfolios is the service will give you the option to practice socially-responsible investing. This means the service will give you the option to only invest in companies with positive social and environmental characteristics. This is what the company calls a Values-Based portfolio. This is good news for investors who only want to invest their money in companies with a high level of ethical and sustainable standards.

Suitability for Different Investment Budgets

Although the $0 minimum deposit is attractive for anyone, Polaris Portfolios is mainly targeted at medium to large investors who are used to having a human financial advisor take care of all of their financial needs. Polaris isn’t a simple set-it-and-forget-it option. Although it can be used as such, they’re more meant for those with more complex financial needs and planning for retirement and college.

Their 0.95% fee is definitely higher than average since you can get a robo advisor such as Wealthfront or Betterment for as low as 0.25%, Polaris banks on their $0 fees and more full-featured financial planning features to make the service worth it, especially for client with more complex needs

Overall Summary

We believe that Polaris Portfolios deserve to be on the final list of the best Robo Advisors for 2021. However, it would be better if the service had lower fees. If you are a mid- to high-level investor and would like to only invest in companies with a high environmental or moral standard, look no further than Polaris Portfolios.