We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Zacks Advantage is one of the newer robo advisors on the market, but its parent company Zacks Investment Research has been around since 1978.

The platform offers low minimums and over 45 years of experience in the field of investing, although its fees are high for lower investment amounts.

Zacks Advantage is primarily geared towards investors with high net worth, specifically those who prefer active management over full automation. But the platform will also satisfy the needs of newbie investors with $25,000 to invest, although it comes at a price.

Zacks Investment Management (ZIM) has more than $11.7 billion of assets under management (AUM). The company has adopted the same platform developed by Charles Schwab for Zacks Advantage, but that’s where the similarities end. Wherein the Schwab Robo Advisor is perfect for beginners (and free), Zacks is for high net-worth individuals (HNWI).

Screenshots

Zacks Advantage Fees

We will start our Zacks Advantage review by discussing the fees and deposit limits.

For accounts starting from $25,000 to $99,999, the platform charges management fees of 0.70%. If you invest $100,000 to $249,999, the fees drop to 0.50%. If you have $250,000 or more to invest, the fees are only 0.35%:

0.70%

$25,000 to $99,999

0.50%

$100,000 – $249,999

0.35%

$250,000+

The good news is that with the Zacks Advantage Pledge, you can receive a 100% refund of the management fees in the first year if you are unhappy with the investment services of the platform.

The minimum deposit is $25,000, which is very high compared to other automated online advisors. But this isn’t bad either, considering the fact that Zacks Advantage is primarily for investors with more than $100,000 to invest.

Flexibility

Zacks Advantage is a full-service Robo Advisor. Although the platform is designed to simplify wealth management with its automated service, the difference is in the active management format of your portfolio.

The portfolio allocations for equity, commodities, and fixed income are automatically adjusted monthly in accordance with the Zacks Investment Management team’s risk analysis and risk projections. If you are a high-net-worth investor, you will love the flexibility of Zacks Advantage, since it combines automated ETF-based investment options and wealth management in one easy-to-use platform.

Zacks Advantage Video

Check out this video for an overview of how Zacks Advantage works:

Ease of Use

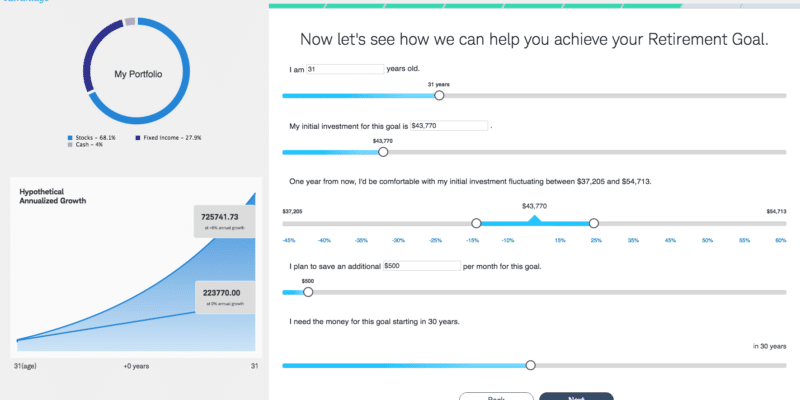

When it comes to ease of use, Zacks Advantage gets a high score. The process starts with signing up for the service and answering a few basic questions to define your investment goals and preferences.

The platform will then create a tailored investment portfolio, and fund your account with diversified ETFs. After this, Zacks’ unique ‘active management approach will regularly adjust or rebalance the investments in your portfolio, in accordance with your risk tolerance and investment goals.

Account Types and Services

We are happy to say that Zacks Advantage is undoubtedly a great Robo Advisor in terms of diversified portfolios. The service offers an extensive array of investment categories, including growth and income, inflation and defensive assets.

In each category, you will also find asset classes that you wouldn’t normally expect from an online investment tool, such as preferred stocks, international bonds, and floating-rate notes.

All accounts will enjoy continuous rebalancing with active management, and automatic tax loss harvesting is also offered for accounts worth more than $50,000.

Suitability for Different Investment Budgets

Although we stated at the beginning that Zacks Advantage is best suited for high-value investors, even those with small budgets can get a glimpse of what this platform can bring to the table. The minimum deposit of $25,000 is high, but we love the fact that the service will only charge 0.35% for accounts worth $250,000 and above, considering the fact that the service offers active management with continuous rebalancing and tax loss harvesting (for accounts worth $50,000 and above).

For accounts under $250,000, we do think that there are far better solutions available, namely Wealthfront, Betterment, or Vanguard PAS. Or, if you want the Schwab Intelligent Portfolios investment methodology, their robo is free for the basic version.

Overall Summary

Seasoned investors with a high net worth will have plenty to like about Zacks Advantage. We don’t think it’s a good solution for lower net worth investors, as there are much better solutions available to them.

With an actively managed and performance-driven platform that automatically builds, monitors, and rebalances your portfolio, combined with a low-cost and tax-efficient automated investment service, Zacks Advantage offers a unique and diverse investment opportunity for high-net-worth investors.