We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Wealthsimple Financial Inc. was established by Michael Katchen in Toronto, Canada, in September 2014. The firm has over $30 Billion CAD in assets under management (AUM) and over 1.5 million clients as of November 2021.

Wealthsimple is the largest Robo Advisor in Canada. That is no easy feat since Canada has a good collection of robo advisors such as Nest Wealth, Justwealth, and CI Direct Investing.

This Wealthsimple review will determine how the service fares regarding low fees and deposit limits, account and investment types, flexibility, and ease of use. We will also find out if they score high enough to become one of the best robo advisors regarding affordability and ease of use.

| Annual Fee | 0.40% – 0.50% |

| Promotion | First C$10,000 Managed Free |

| Minimum Investment | $1 |

| AUM (Assets Under Management) | $30 Billion CAD |

| Headquarters | 80 Spadina Avenue, 4th Floor Toronto, ON M5V 2J4 |

| Desktop App | Yes |

| Mobile App | Yes |

| Socially-Responsible Investing | Yes |

| Cash Management Account | Yes, 4-5% APY |

| Customer Service | Live support via email, phone and social media |

| [email protected] | |

| Phone | 855-782-3559 |

Wealthsimple Invest Pricing & Fees

Wealthsimple Managed Investing has a 0.50% management fee on account balances up to C$100,000, and a 0.40% fee on accounts worth more than $100,000.

Wealthsimple Managed Investing comes with a $1 minimum investment and free dividend reinvestment, automatic rebalancing, tax-loss harvesting, and automatic deposits.

They charge zero fees on trading and transfers, saving you money on hidden fees.

Accounts with over C$500,000 to invest qualify for Wealthsimple Generation. This plan includes all Black features, much more in-depth and personal financial planning, individualized portfolios, a dedicated team of advisors, and half off a Medcan health plan. Generation has the same 0.40% management fee as Black but includes many more features and personal financial planning.

If you sign up using our link, Wealthsimple will manage your first C$10,000 investment for free for the first year. There are no hidden charges, and you don’t need to do anything special.

In terms of management fees alone, Nest Wealth might be a better choice if you’re investing over C$150,000 and don’t need any of the extra services Wealthsimple offers. Due to its fee structure and lower overall Management Expense Ratio (MER), Nest Wealth becomes increasingly less expensive to invest with.

Are you paying higher fees elsewhere on your RRSP, TFSA, or other accounts? You don’t have to. Transfer any accounts worth $5,000 or more to a Wealthsimple account, and they’ll cover any transfer fees your bank charges you.

Your Wealthsimple account offers many features, such as a high-interest Cash account with 4-5% APY, Microinvesting, and extended portfolio options that many other services don’t offer.

We like the tiered structure – if you have over C$100,000 to invest, they reduce the management fees to 0.40% and offer extra features. We think more robo-advisors should do this.

Wealthsimple Performance & Returns

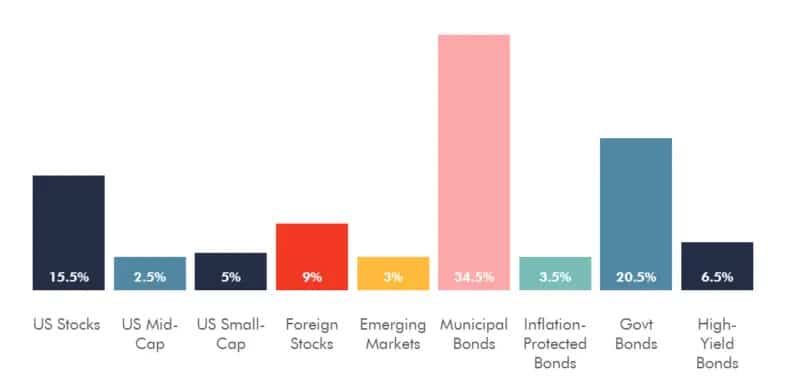

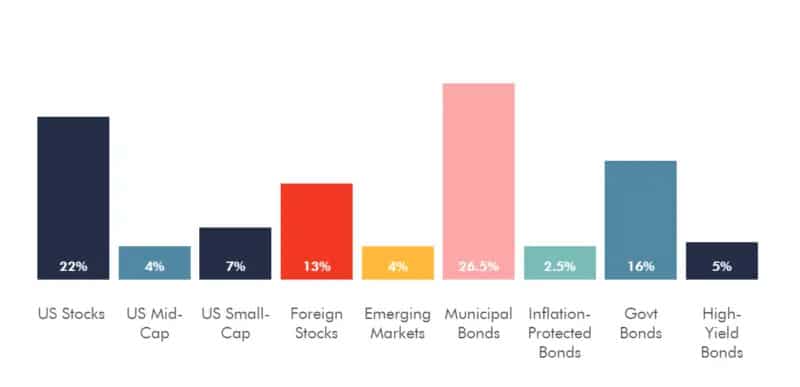

There are three risk tolerance levels, Conservative, Balanced, and Growth, for the standard account, socially responsible investing, and Halal investments. You can see Wealthsimple’s historical performance reviews for various portfolios on their website here.

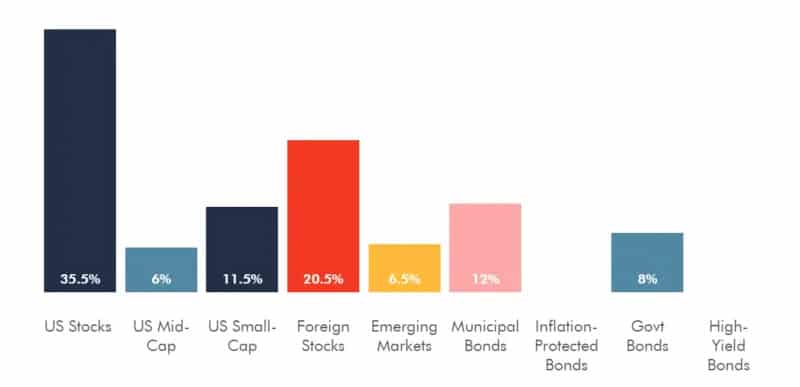

There is a chart of how the investment portfolio performed over the past month, three months, six months, and previous years for each portfolio. You will also see a breakdown of the funds that each portfolio will be investing in.

While past performance can’t determine future success, this data can give you an idea of the different portfolios’ average returns over the past few years.

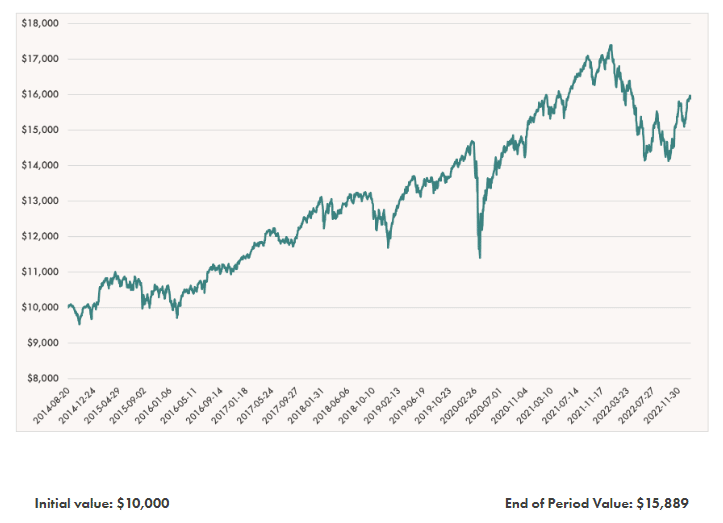

Here’s an example of the performance of a simulated 80% equity portfolio from August 20, 2014, to January 31, 2023, after fees:

Flexibility

Wealthsimple Managed Investing is a fully-automated robo advisor. Although the service comes with automatic rebalancing and dividend reinvestment, this is not the type of service that is ideal for hands-on investors.

Wealthsimple puts all your investments on autopilot by utilizing the Modern Portfolio Theory. While you can choose from eco-friendly ESG options with their SRI portfolios and halal-friendly investment options, Wealthsimple’s portfolios are meant to be set-and-forget, aimed at investors who don’t have the investing knowledge or don’t want to bother managing their own portfolios.

If you’re a more hands-on type of investor, you may find that Wealthsimple Trade better suits your needs. It includes commission-free stock and ETF trading, no fees on Canadian trades, fractional shares, no account minimums, and auto-investing.

The basic trading plan is free and lets you invest up to $1,500. For $10/month, you can upgrade to Plus, giving you no FX (foreign exchange) fees on buying USD stocks, and it lets you trade up to $5,000. Plus is best if you plan to trade $550 USD or more per month.

Ease of Use

Signing up consists of a simple process that involves completing an online application on their website, entering your email address, giving your E-signature on the required Investment Management Agreements, and entering your account information, including your bank account, to make a transfer. After this, your new Wealthsimple account will be ready in a few days so you can begin investing.

Wealthsimple offers free 401(k) assistance, tax-loss harvesting, portfolio rebalancing, automatic weekly, bi-weekly, and monthly deposits, and socially responsible investing in a fully automated account. It might not be as flexible as some services, but Wealthsimple shines when it comes to ease of use.

Account Types and Services

Managed Investing

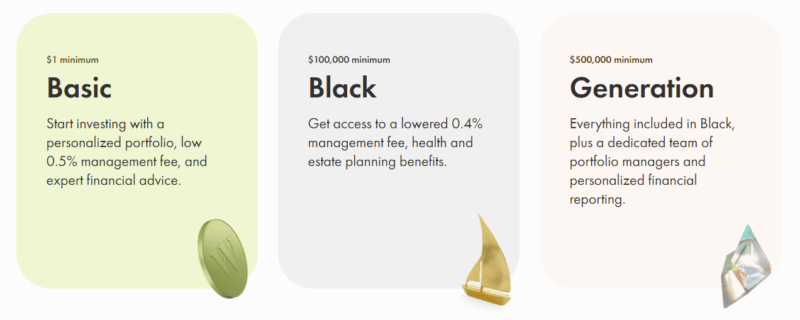

Wealthsimple Managed Investing (their robo advisor) consists of three types of accounts: Wealthsimple Basic, Black, and Generation. The Basic account is the – you guessed it – basic plan everyone qualifies for. This plan has a fee of 0.50% and gets you unlimited access to human financial advice (qualifying them as a hybrid robo advisor), and all the extra features and benefits we covered above.

Once your investment accounts reach C$100,000, you get upgraded to Wealthsimple Black, which comes with a lower 0.40% management fee and health and estate planning benefits.

If you have a balance of C$500,000 or higher, you get Wealthsimple Generation, with the same 0.40% fee as Black, but now you have access to a dedicated team of financial advisors, comprehensive financial planning, individualized portfolios, and personalized financial reporting.

Remember, the first C$10,000 in your account is managed for free for the first year if you use our link.

Wealthsimple Invest offers taxable, traditional IRA, and SEP IRA accounts. It also provides joint, trusts, Roth IRA, and Rollover IRA accounts.

Your Wealthsimple portfolio will consist of ETFs from 16 asset classes. You also get access to socially-responsible SRI portfolios and halal investing products. If you are a socially responsible investor or seeking halal investment choices, you will love your investment options with Wealthsimple.

Your Wealthsimple Invest account is insured under the Canadian Investor Protection Fund (CIPF) for up to C$1 million per account type (general accounts combined, retirement accounts combined, and RESP accounts combined.) Wealthsimple is a member of the Investment Industry Regulatory Organization (IIRO).

Wealthsimple Trade

If you’re the type of investor who likes to be more hands-on, then you might find Wealthsimple Trade’s active trading features pretty cool. You can trade stocks and ETFs without paying commission, there are no fees on Canadian trades, you can buy fractional shares, and there’s no minimum amount you need to have in your account.

The basic trading plan is free and lets you invest up to $1,500. But you can upgrade to Plus for $10/month if you’re an active trader. This lets you buy USD stocks without foreign exchange fees and trade up to $5,000. It’s best if you’re planning to trade $550 USD or more per month.

Wealthsimple Crypto

Wealthsimple also offers Canada’s first regulated cryptocurrency platform. You can trade Bitcoin, Solana, Ethereum, and over 50 other coins with no commission, and the interface is user-friendly and straightforward. There are no account minimums, so you can start with any amount you want.

When you buy cryptocurrency through Wealthsimple, most of the coins are stored in offline cold storage, which means it’s not connected to the internet and therefore less vulnerable to hacking. They also have insurance to cover potential losses in case of theft or hacks. The fees are transparent and easy to understand, with a 1.5% – 2% fee for buying or selling crypto.

Overall, Wealthsimple’s cryptocurrency trading feature is an excellent option for beginners looking for a user-friendly and secure platform to start trading crypto.

Wealthsimple Cash & Save

A fully-featured robo advisor for the masses should be a one-stop-shop for all things financial, and Wealthsimple does not disappoint.

When you spend money from your Wealthsimple Cash account, you earn 1.0% cashback, which can be automatically reinvested into stocks or crypto, or given back as cash. We suggest reinvesting that 1%; the amount you’ll see your balance grow over time will surprise you.

When you have money sitting in the account, you’ll be earning 4-5%% APY on it through Wealthsimple Save.

The savings account has no fees and no account minimums and is insured for up to $100,000 Canada Deposit Insurance Corporation (CDIC) protection. You can easily move money between your Cash savings account and Wealthsimple Invest account.

Wealthsimple Tax

In keeping with the all-in-one personal financial suite mindset, Wealthsimple Tax gives Canadians a free, simple way to file their taxes.

Wealthsimple promises to find all available deductions and optimizations, declare cryptocurrency, import info from CRA and Revenu Québec, and even handle more complex tax situations. Humans are there to help out if you need it.

Investing Master Class

Wealthsimple also launched its free Investing Master Class in 2019 to help new investors get a handle on their personal finances and investments in a jargon-free, easy-to-understand way.

The Master Class consists of 10 short videos covering the Stock Market, Investing 101, Saving vs. Investing, Automating Your Finances, and more. The videos will get you from zero to investor, and they’ll only take 45 minutes.

We highly recommend watching these videos.

Suitability for Different Investment Budgets

Even though the account minimum is $1 for the Wealthsimple Basic service and will charge 0% for the first year if your account balance is under C$10,000, the service has a 0.50% fee for anything above that, up to $100,000.

The $1 account minimum is excellent, but the 0.50% management fee is a bit high, depending on your needs. The good news is Wealthsimple will only charge 0.40% of your account balance above $100,000, and you get a lot of extra features.

The automated investment service is excellent for investors with both high and low budgets.

Overall Summary

Wealthsimple is among the best Canadian robo advisors for beginners, socially responsible investing, and high-net-worth investors. The service is easy to use, and offers many premium features and access to human financial advisors.

If you’re a values-based investor, want a hands-off automated investing experience, or value having one place for spending and saving, investing in crypto, stocks, and ETFs, and a free place to file your taxes, Wealthsimple is a good choice for you.

Wealthsimple FAQs

Who can use Wealthsimple?

Wealthsimple is only available to residents of Canada.

Where is Wealthsimple Located?

Wealthsimple is headquartered in Toronto, Canada, at 80 Spadina Avenue, 4th Floor, Toronto, ON M5V 2J4.

Which Crypto is Available on Wealthsimple?

Wealthsimple’s available cryptocurrency is:

0x (ZRX)

1 inch (1INCH)

Aave (AAVE)

Ankr (ANKR)

Avalanche (AVAX)

Axie Infinity (AXS)

Balancer (BAL)

Bancor (BNT)

Basic Attention Token (BAT)

Bitcoin (BTC)

Bitcoin Cash (BCH)

Chainlink (LINK)

Chromia (CHR)

Compound (COMP)

Curve (CRV)

Dai (DAI)

Decentraland (MANA)

Dogecoin (DOGE)

dYdX (DYDX)

Enjin (ENJ)

Ethereum (ETH)

Fantom (FTM)

Gala (GALA)

The Graph (GRT)

Kyber Network (KNC)

Litecoin (LTC)

Loopring (LRC)

Maker (MKR)

Polygon (MATIC)

Ren (REN)

Sandbox (SAND)

Shiba Inu (SHIB)

Skale (SKL)

Solana (SOL)

Storj (STORJ)

SushiSwap (SUSHI)

Synthetix (SNX)

Uma (UMA)

Uniswap (UNI)

USD Coin (USDC)

Yearn Finance (YFI)

Who Owns Wealthsimple?

Power Corporation of Canada owns Wealthsimple.

Does Wealthsimple Offer Dividend Reinvestment?

Yes, with Wealthsimple Managed Investing (the standard robo advisor), you can have dividends automatically reinvested into your portfolio. Their self-directed trading plans, however, do not offer this.