Reviews

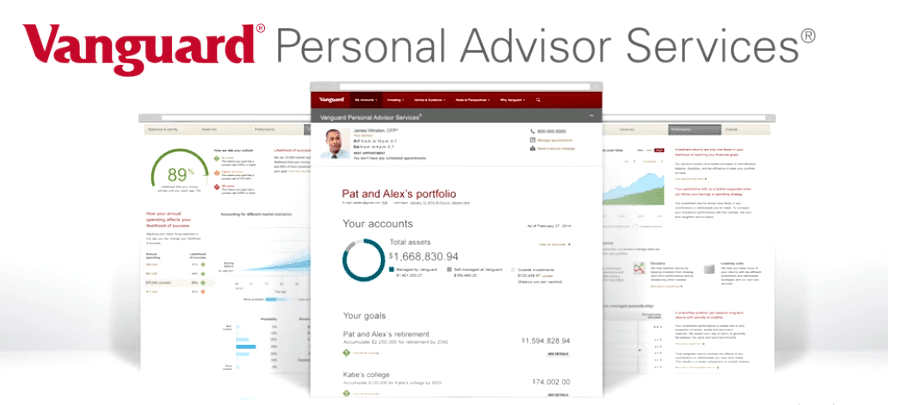

With new robo advisors and automated investment tools cropping up each day, you’ll want to make sure you’re making the best choice when you decide which service to choose.

We take a deep dive into each service and highlight its strengths and weaknesses so you know what the best choices are for your financial needs.