We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Are you tired of manually managing your investment portfolio? Discover the benefits of automatic portfolio rebalancing with our ultimate guide. Learn how it works and how to implement it in your portfolio for a stress-free and financially secure future.

What is Automatic Portfolio Rebalancing?

Automatic portfolio rebalancing is a process that automatically adjusts an investment portfolio to maintain a target asset allocation. This helps ensure the portfolio stays aligned with financial goals and reduces the risk of straying from the investment strategy.

Automatic rebalancing can help ensure that an investor’s portfolio stays aligned with their financial objectives and reduces the risk of straying from their investment strategy.

But before we dive into how this works, let’s look a little deeper into what Portfolio Rebalancing is as a general concept and how it’s done.

What is Portfolio Rebalancing?

Portfolio Rebalancing is the process of moving funds between different investments to maintain the right balance for achieving financial goals.

No two investors are the same. For example, some investors may be:

- Interested in acquiring funds to purchase a home

- Interested in saving enough money for their retirement

- Have a high or low risk tolerance

- Interested in accumulating wealth for future generations

No matter the investor’s age or intent, they all have one thing in common: they have to decide on an investment strategy before deciding where to place their funds. This is referred to as asset allocation.

If they’re young or have a high risk tolerance, they may invest a large percentage of their portfolio into stocks and a lower amount into bonds. For someone closer to retirement or who can’t handle the market fluctuations, they might place 90% of their portfolio into safer bonds.

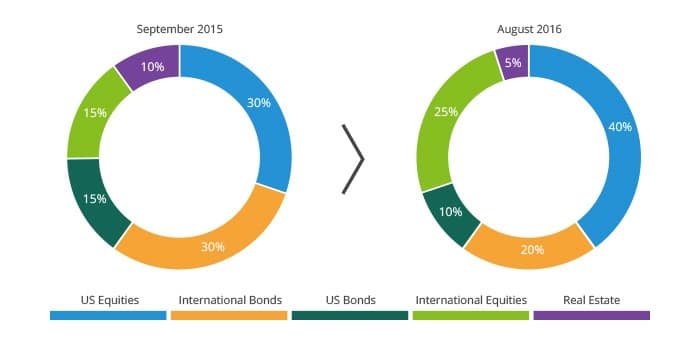

As time moves on, an essential part of asset allocation becomes maintenance. This means that the original balance of stocks vs. bonds during the initial purchase of a portfolio may not be suitable for the investor anymore. So then, they must change the asset allocation based on their current needs. This is known as portfolio rebalancing.

Rebalancing a portfolio is something every investor should do during the time they are making investments. Some rebalancing is necessary to ensure the original allocation is adequately maintained. This type of rebalancing often occurs because the goals of the investor change as time passes. The average investor becomes more conservative with their funds as they approach retirement.

The portfolio rebalancing algorithm will change along with the investor. Investors must also decide whether to maintain their portfolio manually or consider automatic portfolio rebalancing. One of the most significant benefits of rebalancing a portfolio is controlling the risk factor, and maintaining the desired risk level may require the investor to take action.

A good example is an investor interested in investing 35 percent of his portfolio in Canadian stocks and an additional 40 percent in conservative Canadian bonds. The value of these assets can change as time passes. If one year later, fifty percent of his funds are no longer in Canada and just thirty percent are still in Canadian bonds, he must rebalance his portfolio.

The only way for the investor to maintain his desired level of risk is to do some rebalancing. This type of rebalancing will remove some of the emotions from the process. It can be challenging to sell a portfolio when it rises, and it is also hard to buy once it has fallen.

Rebalancing the portfolio becomes nearly emotionless when the investor is forced to either buy or sell at a predetermined time. There are faults in rebalancing a portfolio. If the investor hates math, it is challenging to calculate percentages, adjust balances, and get the correct reflection of the ratios. This individual should consider investing in robo advisors.

When an investor has a small portfolio, it can quickly become expensive to purchase and sell bonds and stocks yearly. If the investor varies from their allotted target by even a tiny percentage, it may not be worth the cost or trouble rebalancing the portfolio. A difference of even one percent can significantly raise the expense.

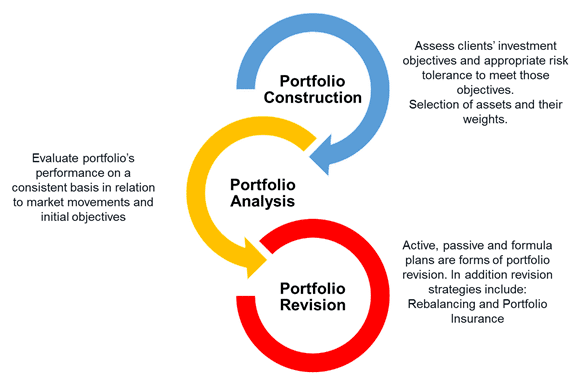

The Process of Rebalancing

There are many different types of rebalancing because there are different kinds of investors. Automated rebalancing is not the same as rebalancing automation and is often referred to as robo rebalancing. This is the rebalancing of actionable and auto-generated trades. Rebalancing automation refers to the tools that make the process more efficient.

Rebalancing automation helps with the process, but automated rebalancing reinvents the process and makes efficient fundamental changes possible for value proposition and scalability. This type of rebalancing is not always fully automatic. Sometimes, the robot will need help, usually for entirely different challenges than humans require.

The most challenging tasks for humans can be automated relatively easily. These tasks include:

- Trade-offs

- Tax management

- Social screens

- Product customization

- Transitions

- Substitutions

- Asset class customization

The most common issues for the robots include:

- Insufficient data – unknown securities

- File transfer failures

- Late-processing of corporate actions

The analytics quality will not make a difference if the data is not useful. This means any automated workflow must have a process for handling issues with the integrity of the data. This generally means the affected accounts must be suspended until the problems with the data are resolved. This requires using the traditional process to generate the trades manually.

There are also certain situations where a manual override becomes necessary. The robot can take care of any complex combinations of constraints, transitions, and tax management. An excellent example of a unique situation is when a client calls and wants $1 million transferred the following week. This means the trading of the stock must be suspended. Temporary suspensions cause the most common overrides.

Robo Advisors Offering Automatic Rebalancing

There is a wide selection of robo advisors offering automated portfolio rebalancing, each with pros and cons. Some of our favorites are listed below.

Wealthfront

Wealthfront is one of the earliest and most well-known robo advisors on the market, and they’re also one of our favorite robos overall. They have excellent service, an intuitive dashboard, a low $500 minimum investment, and a low annual fee of only 0.25%.

Pros

- The first $5,000 is managed for free if you use our link to sign up

- Daily tax-loss harvesting

- Low ETF expense ratios

- Direct indexing for accounts over $100,000

- Rebalancing provided automatically

Cons

- No discounts for large balances

- No fractional shares

Betterment

There is a reason Betterment has maintained its status as the biggest independent robo advisor. They offer a powerful combination of affordable management fees, goal-based tools, and no account minimum. The pros and cons include the following:

Pros

- No account minimum

- Robust goal-based tools

- Low fees from 0.25%-0.40%

- Automated rebalancing

Cons

- Fractional shares limit un-invested cash

- No direct indexing

Ellevest

Ellevest directs its marketing towards women. Their approach focuses on goals, longer lifespans, lifetime earnings, and the lower income of most women. The competitive advisory fees, zero-dollar account minimum, and unlimited financial advisor access make this company a good choice for all investors, regardless of gender. The pros and cons include the following:

Pros

- Low fees and account minimum

- A portfolio mix to suit the needs of women

- Goal-focused investing approach

Cons

- No tax-loss harvesting

- Few accounts are supported

SoFi Invest

SoFi Invest offers excellent features such as free access to certified financial planners, automatic rebalancing, low-cost investments, and zero fees. Customers may also become eligible for bonuses for SoFi’s other products. The pros and cons include the following:

Pros

- A broad range of low-cost investments

- Automatic Rebalancing

- Zero management fees

- Access to certified financial planners

- Customer support

Cons

- No tax-loss harvesting

- Short track record

- Limited account types

Schwab Intelligent Advisory

Charles Schwab turned up the heat with their Schwab Intelligent Advisory. This hybrid service was created as a middle ground between Schwab Intelligent Portfolios, their existing robo advisor, and financial consultants for the online broker. The pros and cons include the following:

Pros

- Access to financial advisors

- Automatic Rebalancing

- Wide ETF selection

- Zero advisor fees

Cons

- High cash allocation

- $5,000 account minimum

- A minimum balance of $50,000 is required for tax-loss harvesting

Conclusion

In conclusion, automatic portfolio rebalancing is a valuable tool for maintaining a target asset allocation and staying aligned with financial goals.

Wealthfront, with its reputation for reliability and focus on passive investing strategies, is a strong choice for a robo advisor that offers this service. Automatic rebalancing can be useful for streamlining portfolio management and achieving long-term financial objectives.

Frequently Asked Questions

Why is automatic portfolio rebalancing important?

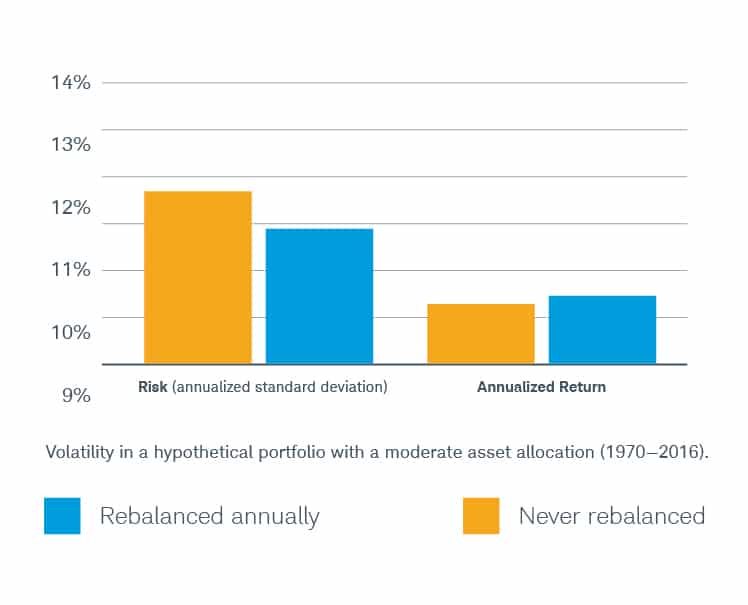

Automatic portfolio rebalancing can be vital because it helps ensure that an investor’s portfolio stays aligned with their financial goals and risk tolerance. Without rebalancing, a portfolio can drift away from its target allocation due to market movements or other factors, potentially increasing risk or reducing potential returns.

How often should a portfolio be rebalanced?

The frequency of rebalancing will depend on the investor’s specific goals and risk tolerance, as well as the portfolio’s characteristics. Some investors may rebalance their portfolio quarterly, while others may do it annually or even less frequently.

Are there any drawbacks to automatic portfolio rebalancing?

One potential drawback of automatic portfolio rebalancing is that it can generate trading costs, such as commissions and fees, which can eat into returns. Additionally, rebalancing too frequently can be inefficient and may not be necessary depending on the investor’s goals and risk tolerance. It is essential to carefully consider the costs and benefits of automatic rebalancing before implementing it in a portfolio.