Best Robo Advisors in 2024

We reviewed the best robo advisors for 2024, and here are our top picks.

Best Overall

9.7

- Low Annual Fee (0.25%)

- $5,000 Managed Free

- Socially-Responsible Portfolios

- Very Easy to Use

- Excellent Financial Planning Tools

- Individual Stock Investing

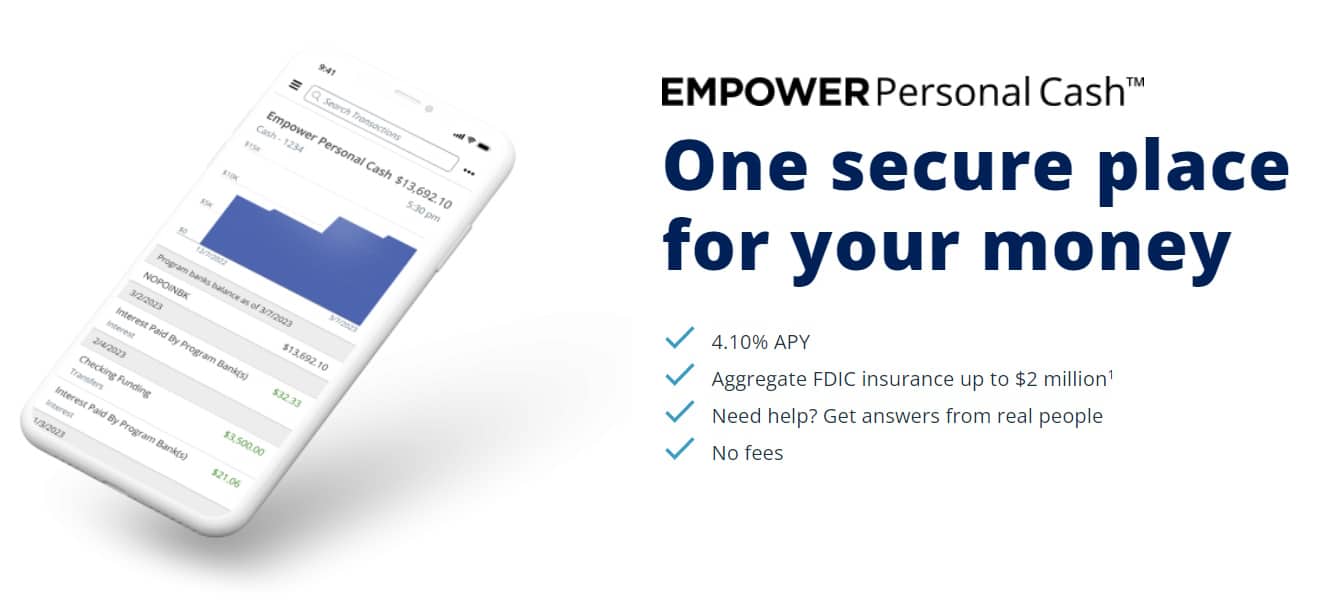

Runner-Up

8.9

- $4/month or 0.25% - 0.40% Annual Fee

- No Minimum Investment

- Access to Human Financial Advisors

- Excellent Banking Features

- Socially-Responsible Options

We may earn a small commission from sales generated from these links.

Best Real Estate Investing Sites in 2024

We reviewed the best passive real estate investing platforms for 2024, and here are our top picks.

Best Overall

9.8

- Excellent Historical Returns

- High Relative Liquidity

- Low ($10) Minimum Investment

- Tons of Investment Options

- Low Management Fees

Runner-Up

8.8

- Open to non-accredited investors

- Low minimum investment ($500)

- No management fees

- Completely Automated

- Free $50 Amazon gift card (with our link)

We may earn a small commission from sales generated from these links.