We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

M1 Borrow is a low-cost portfolio line of credit or margin loan from M1 Finance. A portfolio line of credit is a loan that uses your investment portfolio as collateral. The borrowed money can be used for a short-term need such as a downpayment, paying off high-interest debts, or to use as a margin account—more on this below.

M1 Borrow is flexible, convenient, and a great option if you need extra cash or want a margin loan to invest. This article will discuss the costs, benefits, and what to expect from M1 Borrow.

How Does M1 Borrow Work?

M1 Finance has various money management tools. Their most popular feature is their investment platform, and users can invest in various stocks and ETFs while taking advantage of robo-advising features like automatic investing and portfolio rebalancing. Read our full M1 Finance review here.

M1 Borrow allows investors to borrow money on margin and pay it back on their schedule. Because investors use their portfolio as collateral for the loan, there isn’t a credit check or lengthy application process.

Once you apply for the margin loan, you can typically get the money in 1 to 2 business days. There is only one requirement for approval: having a minimum of $2,000 in your M1 Finance Invest account, and IRAs are not currently qualified to meet the minimum, so your $2,000 will need to be in a taxable account.

Once your Invest account reaches $2,000 or more, you will have access to the line of credit. That doesn’t mean you need to use it, and you’ll only pay for what you do use.

You can borrow up to 40% of your portfolio balance, so if you have $10,000, you can borrow $4,000. And if you have $25,000, you can borrow up to $10,000. The cash balance in your M1 Checking account isn’t included, so you can only borrow 40% of your Invest account balance.

Paying Back Your Loan

One of the best perks of M1 Borrow is that there is no minimum monthly payment, and you can borrow the money for as long as you need it and stay within the 40% limit.

There is a 7.25% to 8.25% interest rate that will be calculated and billed to you at the end of each month. You can pay this interest back using an outside bank, using cash in your M1 Checking account, or adding it to the amount you’re borrowing. M1 will sell some of your securities if those options aren’t available.

You can also set up a recurring transfer to pay the principal amount.

Current Loan Rates

The current base M1 Borrow interest rate is 8.25% APY. M1 Plus users can take advantage of 7.25% interest, which can be significant, depending on your loan. M1 Plus costs $3/month per year, so you may want to consider it if you’re planning to use M1 Borrow.

According to Federal Reserve data, the average interest rate for a personal loan is 10.6%, and credit card interest is a whopping 18.43%.

M1 Borrow can save you a significant amount of money, making it a great alternative to a personal loan and an opportunity to consolidate your other loans and credit cards. There is a chance that the borrow rates for M1 Finance can increase, and when the Federal Funds Rate goes up or down, the M1 Borrow base rate will also fluctuate.

The good (or bad, depending on how you view it) news is that when M1 Borrow’s rates go up (or down), so will your other loans. So, as long as the base rates are lower than the loan you’re using it for, you’ll be saving money.

When Should You Use M1 Borrow?

M1 Borrow is an excellent option for many different people. Remember that you don’t want to take out a loan for no reason; it’s not free.

If you need cash for a downpayment for a car or home, M1 Borrow offers a low-cost option. And if you want to reinvest your loan, there is potential to earn money. Keep in mind there is a risk, and we recommend having a positive track record before doing this.

How to Get Started

There’s no need to sign up for M1 Borrow. Your line of credit will be available as long as you already have an M1 Finance account and you’ve reached the $2,000 minimum account balance.

Getting started is simple; M1 Finance says you can get a loan in just three clicks. There is no lengthy paperwork, credit check, or approval process. As long as you meet the minimum balance, you can start borrowing money.

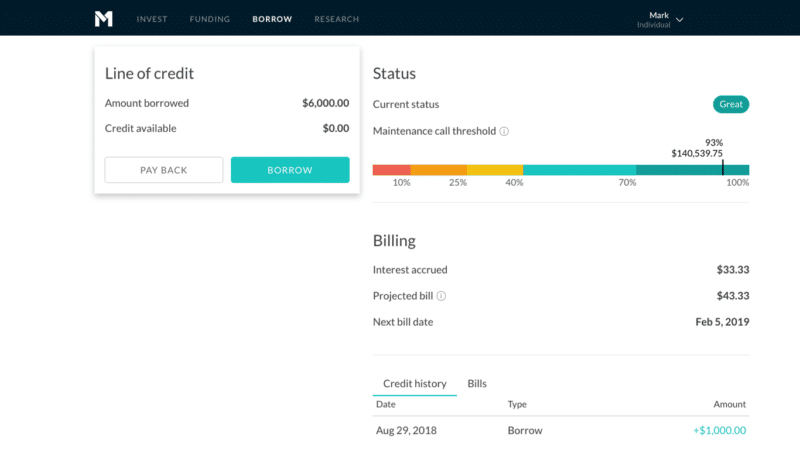

To start, click on the Borrow tab. You can view your loan limit (40% of your account value) and transfer any amount of cash to your outside bank, your M1 Spend account or your Invest account.

Transfers are usually made the following business day.

Once your loan is active, you can navigate to the billing dashboard. Here you will see how much interest you’ve incurred, the expected total loan amount, and the next payment due date.

You can pay back your loan at any time. You can also request more funds if you haven’t reached the 40% limit.

Is M1 Borrow Worth it?

With most financial decisions, we can’t answer for everyone. There are some significant benefits and risks of taking out a loan.

M1 Borrow is an excellent option if you need to borrow money. The interest rate is low, and it’s easy to get started. M1 Borrow can be a viable option for those needing a downpayment for a car, or a house, paying for education expenses, or consolidating other loans or credit cards.

Should you get an M1 Plus account to take advantage of the lower interest rate? The M1 Plus account costs $3/month. If you’re borrowing $8,400 for one year, you will save $126 on interest, which would pay for the M1 Plus cost. There are additional M1 Plus benefits you can find here.

If you’re looking to pay off a high-interest credit card or personal loan, M1 Borrow is an excellent choice. There are no minimum monthly payments, which can help keep you up if you’re struggling. We still suggest setting up a recurring transfer to pay off your loans promptly.

M1 Borrow offers very low interest rates, but it’s not free.

| Loan | Average APY |

|---|---|

| M1 Borrow | 8.25% |

| M1 Borrow (Plus) | 7.25% |

| Credit card debt | 19.59% |

| Federal student loan | 4.99 – 7.54% |

| HELOC | 7.62% |

| New car loan | 6.26% |

| 30-Year Mortgage | 6.52% |

Is Investing Your Borrowed Money Safe?

One investment strategy is to borrow money and invest it in your M1 Finance portfolio to earn more than the loan interest. This is called a margin account. In theory, this makes sense; however, there is a risk that can’t be ignored.

There is a risk that the money you invest can be lost, and you will need to determine if the risk is worth the reward. If you have an M1 Plus account, as long as the investments earn more than 7.25% APY, this can be a good strategy.

M1 Borrow FAQ

Does M1 Borrow affect your credit score?

No, M1 Finance doesn’t run a credit check, and the loan won’t appear on your credit report. Because borrowers need to maintain collateral in their M1 account, there is no risk of non-payment.

Do other robo-advisors offer loans?

Yes, some other robo-advisors offer lines of credit. Another popular robo-advisor that provides a line of credit similar to M1 Borrow is Wealthfront’s Portfolio Line of Credit, which offers loans of up to 30% of your portfolio value for 7.25% – 8.75% APR (depending on your account size) for any portfolio over $25,000.

What are the risks?

There are always risks when it comes to borrowing money. M1 Finance is safe and guarantees that your information will be secure. If you’re investing borrowed funds, there is always a risk of loss. And the loan interest rates are subject to increase.

What else does M1 Finance offer?

M1’s most popular service is its investment management. This is free and allows you to create custom portfolios investing in ETFs and partial stock shares. M1 also offers a cash account called M1 Spend. You can read our full M1 Finance review here.

Where do I sign up?

You can read more about M1 Borrow on their website here, and to sign up for a free M1 Finance account, head over here.