On This Page:What is a Crypto Robo Advisor?Best Crypto Robo AdvisorsCrypto Robo Advisor AlternativesWhy Use a Crypto Robo Advisor?Should You...

Investing

Invest in the best robo advisors for automated investing. Compare top platforms, fees, and features. Make informed investment decisions with ease.

On This Page:An Overview of Fidelity GoAccount Types and Investment OptionsFee Structure and PricingPortfolio ManagementCustomer Support and ResourcesTax Efficiency and...

On This Page:HighlightsOverviewIs Wells Fargo Intuitive Investor Right for You?Wells Fargo Intuitive Investor Fees & PricingInvestment StrategiesFeatures & Account ServicesConclusionWells...

Investing your hard-earned money can be daunting, especially if you’re new to the world of investments. A wide range of...

Are you looking to start your investment journey in ? A robo advisor is an excellent option for those who...

M1 Finance and Wealthfront are two of the most popular robo advisors on the market. Both offer a range of...

On This Page:Empower Pricing & FeesFree Financial ToolsEmpower Personal CashScreenshotsWealth ManagementPrivate Client FeesEase of UseSocially Responsible Personal StrategyConclusionFrequently Asked Questions...

On This Page:What is a Robo Advisor?Advantages of Using a Robo AdvisorDisadvantages of Using a Robo AdvisorWho Should Use a...

On This Page:How Does Fundrise Work?Who Can Invest in Fundrise?Fundrise Fees & PricingIs Fundrise Legit? Fundrise Historical Returns & PerformanceThe Biggest...

Back in 2020, retirement services provider Empower bought robo-advisor and personal financial tech provider Personal Capital for around $1 billion....

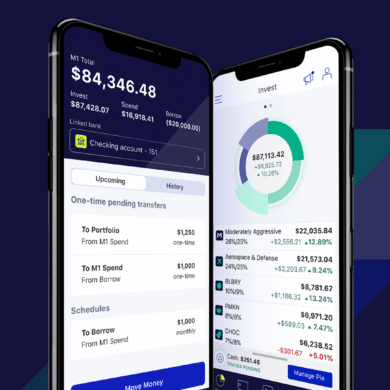

On This Page:Transfer BonusM1 Finance Fees & Minimum BalanceM1 Finance Performance & ReturnsAccount Types and ServicesM1 BorrowM1 CheckingM1 Owner’s Rewards...

Investing can be daunting, especially for high-net-worth individuals with a lot of money at stake. With a fluctuating market and...