We may earn a small commission if you sign up for a service or product from this page. This does not affect our rankings and it does not cost you anything. Learn more about how we make money and our review process on our advertising disclosure page.

On This Page:

Tax Loss Harvesting 101

As robo-advisors and other automated investing tools increase in popularity, more and more competitive features become available to help manage and optimize your investment portfolio. One more popular (and beneficial) feature that many robo advisors offer is tax loss harvesting – an automated strategy to help decrease your tax liability.

Want to know how this feature will help you manage your taxable accounts and keep more money in your pocket? Read on where we discuss:

- What is tax loss harvesting?

- Which robo advisors offer the service?

- How widely available is it?

What is Tax Loss Harvesting?

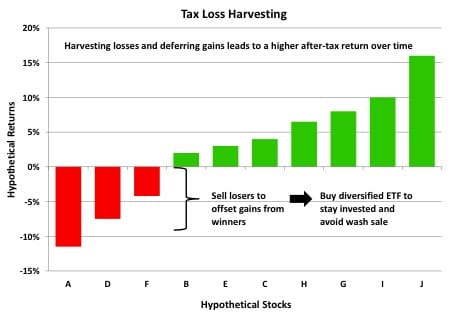

Tax loss harvesting is the process of selling a security at a loss to offset a capital gains tax liability. This liability is usually associated with a different security (that has increased in value), producing a short-term capital gain (taxed at a higher federal tax rate than long-term gains).

Watch the video below to get a better idea of what this process is all about:

In the world of Robo Advisors, the service recognizes the best time to sell your investment (which has decreased in value) to offset the tax liability of a different investment (which has risen in value).

Once the investment is sold, it is automatically replaced by a similar investment to harvest the tax loss, while retaining the original asset allocation of your investment account. The Robo Advisor previously calculated this allocation to determine the most profitable route.

The Best Robo Advisors for Tax Loss Harvesting

Although tax loss harvesting is a common feature among Robo Advisors, the following are two examples that make the service readily available to most investors:

The Best Robo Advisors for Tax Loss Harvesting

Although tax loss harvesting is a common feature among Robo Advisors, the following are two examples that make the service readily available to most investors:

Wealthfront

Wealthfront includes tax loss harvesting as part of its service for all accounts that meet the minimum balance of $500. The service also offers a more optimized version called ‘Direct Indexing’, which is offered to accounts worth more than $100,000. This feature lets Wealthfront buy and sell individual securities (rather than indexes) to further optimize your investments’ tax efficiency.

Betterment

Betterment includes what they call “Tax Loss Harvesting+” as a standard service on all of their accounts. The “+” part of it is just signaling to customers that it’s all a tech-driven, automated approach, similar to the way any robo advisor approaches the tax strategy, avoiding wash sales and rebalancing and reinvesting the harvest.

How Widely Available is Tax Loss Harvesting?

Although there are a lot of discussions on the benefits of tax loss harvesting, we believe this service makes a real difference to most investors.

This is why many Robo Advisors offer it on the market. But remember that you may need to be over a certain investment threshold for the feature to activate on your account.

In many cases, the tax planning feature of the Robo Advisor will only come into action for balances that reach a certain threshold. This particular threshold will differ from one service to the next. Other robo-advisors may activate it only on paid accounts if they offer a free service.

We don’t generally see a problem with this, since low balances aren’t going to benefit from it as much as accounts with larger balances.

The service is impressive, but you should remember that tax loss harvesting benefits investors with taxable accounts, not IRAs or other tax-exempt investments.

Tax Loss Harvesting FAQs

What is tax loss harvesting?

Tax loss harvesting is a strategy used to offset capital gains taxes by selling securities that have decreased in value, known as “losses,” and using those losses to offset any capital gains realized during the same tax year.

What are the benefits of tax loss harvesting?

Tax loss harvesting can help reduce your overall tax liability by offsetting capital gains and potentially lowering your tax bill. It can also help re-balance your investment portfolio.

Can I use tax loss harvesting for all investments?

Tax loss harvesting can only be used for taxable investment accounts, not for tax-deferred accounts such as 401(k)s or IRAs. Additionally, the wash-sale rule applies to tax-loss harvesting, which means you cannot buy a substantially identical security within 30 days before or after selling the security at a loss.

How long do I have to wait to repurchase a security after selling it at a loss?

The wash-sale rule states that you cannot buy a substantially identical security within 30 days before or after selling the security at a loss. However, you can buy a similar, but not substantially identical, security.

Can I harvest losses on investments held in a trust?

Yes, tax loss harvesting can be used for investments held in trusts, but the rules and regulations may differ from individual accounts. It’s best to consult a tax professional for trust-specific tax loss harvesting strategies.

What is the wash-sale rule?

The wash-sale rule is a tax rule that states that if an investor sells a security at a loss and then buys that same security or a “substantially identical” security within 30 days before or after the sale, the loss cannot be used to offset taxes on capital gains.

How does the wash-sale rule apply to robo-advisors?

The wash-sale rule applies to robo-advisors the same way it applies to individual investors. If a robo-advisor sells a security at a loss and then buys that same security or a “substantially identical” security within 30 days before or after the sale, the loss cannot be used to offset taxes on capital gains. Robo-advisors will take this rule into account when performing tax loss harvesting.

Can I opt out of tax loss harvesting with my robo-advisor?

Yes, you can opt out of tax loss harvesting with your robo-advisor. However, you will miss out on the potential tax savings that tax loss harvesting can provide.

How does my robo-advisor determine which securities to sell for tax loss harvesting?

The specific algorithm used by the robo-advisor to determine which securities to sell for tax loss harvesting can vary. Some robo-advisors may prioritize selling securities that are most likely to generate a loss, while others may focus on selling securities that will have the greatest impact on your tax bill. You can always check with your robo-advisor on how they determine which securities to sell.